Intraday Market Thoughts Archives

Displaying results for week of Nov 02, 2014NFP good enough for dollar uptrend

Any disappointment in today's NFP figure is offset by further declines in the US unemployment rate, reaching fresh six-year lows. The uptick in labour participation and the fall in the in the underemployment rate, as well as the longest creation of manufacturing jobs in 18 years maintains USD uptrend. Both of today's Premium trades in USDJPY are filled and in progress. Full charts & analysis here.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Unemployment Rate (OCT) | |||

| 5.8% | 5.9% | 5.9% | Nov 07 13:30 |

Dovish Draghi Dunks Euro

Rumors of Draghi's downfall were greatly exaggerated. He was as strong as ever in Thursday's press conference and sent the euro to a fresh 27-month low. The pound and CHF also lagged badly while the US dollar easily led the way. The RBA statement on monetary policy is due later. 24 hours after our Aussie short hit its final target with 340 pips, both of our USDCHF longs hit their final targets at 0.9690 and 0.9720 for a total of +350 pips. New Premium Insights will be issued tomorrow ahead of the US jobs report. Ahead of the ECB decision there was a report about discontent with Draghi's leadership and some speculation he could be replaced with a less-dovish leader but he challenged those reports head-on and preached a message of unanimity.

He also didn't back down from the dovish comments that supposedly got him in trouble. He reiterated that the ECB is moving toward the size of its 2012 balance sheet, said the ECB was unanimous in its commitment to act again if needed and that forecasts could be lowered again.

The euro dropped to 1.2375 from 1.2533 and finished at the lows of the day.

But the story wasn't just euro weakness. The pound fell hard to a one-year low of 1.5828 and the yen continued its descent after a brief bounce in early European trading.

The focus now shifts to the US with non-farm payrolls due on Friday. The chance of an upside surprise continued to build after jobless claims fell to 278K compared to 285K expected. Ashraf wrote about the chance for a strong number and we also note that economist estimates from today and yesterday average 245K compared to the 235K consensus.

The risks to the downside for the US dollar aren't in the number but, rather, in the avg hours and wages data. Q3 productivity data released Thursday showed softer unit labor costs and a large downward revision.

Up next, at 0030 GMT it's the RBA's statement on monetary policy. It's a quarterly report that sets out the assessment of economic conditions. There's scope for the RBA to cut its inflation projections and that would give the market a reason to look for more dovish commentary and AUD weakness.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Mester speech | |||

| Nov 07 0:05 | |||

| Fed's Yellen Speech | |||

| Nov 07 15:15 | |||

| Fed's Evans Speech | |||

| Nov 07 18:00 | |||

| Fed's Tarullo speech | |||

| Nov 07 19:30 | |||

| RBA Monetary Policy Statement | |||

| Nov 07 0:30 | |||

| Nonfarm Payrolls (OCT) | |||

| 231K | 248K | Nov 07 13:30 | |

| Unit Labor Costs (q/q) [P] | |||

| 0.3% | 0.5% | -0.5% | Nov 06 13:30 |

| Challenger Job Cuts (OCT) (y/y) | |||

| 51.183K | 30.477K | Nov 06 12:30 | |

| Challenger Job Cuts (Oct) | |||

| 51.2K | 30.5K | Nov 06 13:30 | |

NFP 350K?

ECB president Draghi weighs on the euro after stating the duration of the next round of asset purchases. EURCHF nears the all-important 1.2000 level and US jobs could deliver a 350,000 rise in non-farm payrolls. Full charts & analysis here.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nonfarm Payrolls (OCT) | |||

| 231K | 248K | Nov 07 13:30 | |

Dollar Days Continue, Australian Jobs Next

Republicans winning control of the US Senate was listed as at least an 8-to-1 likelihood on betting sites and yet it sparked an across-the-board USD rally Wednesday. USD/JPY ran to 114.80 from 113.60 with most of the USD gains coming before New York traders arrived.

The market then turned to the ADP employment report. It showed 230K jobs compared to 220K expected; the prior report was also bumped up by 12K jobs. That wasn't strong enough to keep the momentum going and the dollar edged back.

Later, the ISM non-manufacturing index slipped to a four-month low of 57.1 compared to 58.0 expected. Within the report, however, the employment component rose to a 9-year high and that kept US dollar selling to a minimum.

Oil was volatile. It sank in early trading but rumors of a Saudi pipeline explosion caused a violent round of short covering to $79 in WTI. That lowered USD/CAD to 1.1392 from as high as 1.1466.

The pound was volatile and fell to 1.5969 after the soft UK services PMI but talk of M&A related boosted it all the way back to 1.5998. We emphasize, once again, the strong performance of sterling ex-USD over the past month.

The big loser on the day was the Australian dollar, down 1.5 cents. The moves weren't tied to anything in particular or easily identifiable and came well-after the RBA yesterday.

The Aussie will stay in focus with jobs data due at 0030 GMT. The market is ultra-skeptical of Australian employment data at this point but the consensus is +20K with the unemployment rate ticking to 6.2% from 6.1%. As always, watch the full-time/part-time breakdown.| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change (OCT) | |||

| 230K | 220K | 225K | Nov 05 13:15 |

| ISM Services (OCT) | |||

| 57.1 | 58.0 | 58.6 | Nov 05 15:00 |

| Markit Services PMI (OCT) | |||

| 56.2 | 58.5 | 58.7 | Nov 05 9:30 |

| Markit PMI Composite (OCT) | |||

| 57.2 | 59.0 | Nov 05 14:45 | |

| Markit Services PMI (OCT) | |||

| 57.1 | 58.9 | Nov 05 14:45 | |

| Employment Change s.a. (OCT) | |||

| 10K | -29,700 | Nov 06 0:30 | |

| Fulltime employment (OCT) | |||

| 21,600 | Nov 06 0:30 | ||

| Part-time employment (OCT) | |||

| -51,300 | Nov 06 0:30 | ||

| Unemployment Rate s.a. (OCT) | |||

| 6.1% | 6.1% | Nov 06 0:30 | |

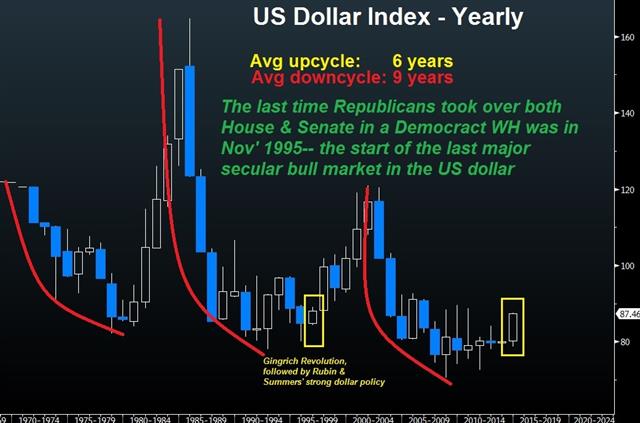

Republicans’ sweep of Congress recalls 1995 dollar secular bull

The the time Republicans swept both chambers of Congress under a Democrat White House in November 1995, the start of the major secular bull market in the US dollar. Full charts & analysis.

ECB Drama, US Elections in Focus

A report about discord with Draghi's leadership at the ECB struck almost out of nowhere on Tuesday. Multiple sources in a Reuters story said other members of the governing council are fed up with unilateral statements from Draghi and will confront him at this week's ECB meeting.

The euro rallied on the report. Draghi is seen as a dovish leader and the main quibbles outlined were that he made dovish promises that weren't vetted by the rest of the ECB. Any change would also likely swing power back toward the Bundesbank and that would severely undermine the case for QE.

Overall, however, it's a tough trade because turmoil at the ECB would hurt growth in the Eurozone. If a shock headline hits that Draghi is stepping down it might be wise to avoid euro trading and look to short Eurozone stocks or periphery bonds instead.

An early economic data highlight in Asia-Pac trading was the New Zealand jobs report and it showed unemployment at 5.4% compared to 5.5% expected and immediately boosted the kiwi to 0.7840 from0.7765. New Zealand jobs data is only released every three months so the report can have an outsized impact. Earlier in the day the kiwi fell 20 pips briefly after Fonterra's milk auction fell 0.3%.

The more intriguing story will be the US midterm election. The entire House is up for election but Republicans are expected to easily maintain a majority. The market will be watching the Senate to see if six seats can change hands and give Republicans a majority.

The kneejerk will be to buy US assets if the Republicans win but that trade may be short-lived because policymaking will essentially remain deadlocked.

Alternatively, one trading chip the President may use if the Republicans win is approving the Keystone XL pipeline so the Canadian dollar could end up being the big winner/loser.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone PPI (SEP) (m/m) | |||

| 0.2% | 0.0% | -0.2% | Nov 04 10:00 |

| Eurozone PPI (SEP) (y/y) | |||

| -1.4% | -1.5% | -1.4% | Nov 04 10:00 |

| Employment Change (Q3) | |||

| 0.8% | 0.6% | 0.4% | Nov 04 21:45 |

| Unemployment Rate (Q3) | |||

| 5.4% | 5.4% | 5.6% | Nov 04 21:45 |

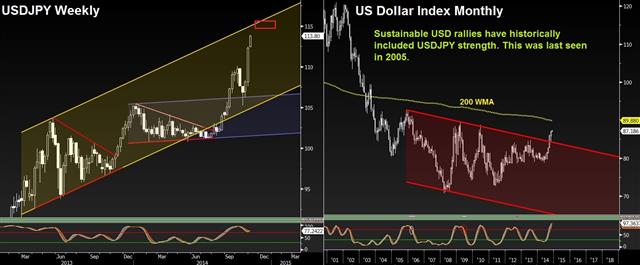

USD Beyond ECB & NFP

As crucial as this week's release of the US October non-farm payrolls report may appear, the combination of last week's double blow from the Federal Reserve's ending of QE3 and the Bank of Japan's expansion of its monetary policy should cement further ascent in USD/JPY. Full charts & analysis.

Why the Australian Dollar is Vulnerable Today

The US dollar rallied to fresh highs after the ISM manufacturing index hit 59.0 compared to 56.2 expected. It led to a broad rally but it later fizzled with USD/JPY slipping back to 113.92.

The bigger moves in US trading were in the commodity currencies. USD/CAD neared the October high as oil broke down below $80 and Poloz indicated the BOC could leave rates low even after the economy is at full capacity and several other dovish comments. Watch for a break 1.1385, which would mark a fresh high since 2009.

But the spotlight should certainly be on AUD/USD. Technically, a death cross hit yesterday with the 100dma falling below the 200dma. The pair is also nearing the October low of 0.8642.

It's a huge day in Australian markets. Most people are focused on the retail sales and trade balance reports along with the RBA decision. Those are all huge events but they could be overshadowed by a special release at 0030 GMT.

Many traders don't know about this because it was just announced yesterday but the Australian Bureau of Statistics will re-release all the employment reports from Dec to Sept at 0030 GMT with a new seasonal adjustment method. They will also explain what happened with the imbroglio in Aug/Sept and the approach to the October report, which will be released tomorrow (Thus in Australia).

This raises a multitude of questions. The RBA announcement is three hours later at 0330 GMT and there is next-to-know talk about a rate cut but if employment is revised dramatically lower, retail sales are soft and along with yesterday's dismal dwelling starts numbers; there might be a case for a surprise cut.

After the BOJ and the wild volatility elsewhere, we'll leave nothing to chance. Like the BOJ, if there is a dovish surprise, get into AUD shorts ASAP and ride them as long as you can.| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Prices Paid (OCT) | |||

| 53.5 | 56.3 | 59.5 | Nov 03 15:00 |

| Retail Sales (SEP) (m/m) | |||

| 0.4% | 0.1% | Nov 04 0:30 | |

| Trade Balance (SEP) | |||

| $-40.0B | $-40.1B | Nov 04 13:30 | |

| Trade Balance (SEP) | |||

| -1,950M | -787M | Nov 04 0:30 | |

| AIG Performance of Manufacturing | |||

| 49.4 | 46.5 | Nov 02 23:30 | |

| ANZ Job Advertisements (OCT) | |||

| 0.2% | 0.8% | Nov 03 0:30 | |

Yen Rout Continues, Specs Missed Out

USD/JPY added another 60 pips early in the week and touched as high as 112.99. The pair has added nearly 500 pips in the past three days.

Before the BOJ decision, we wrote: That if the BOJ announces more QE “would easily send USD/JPY through 110. If those headlines hit, jump on them and ride them for as long as you can.”

It's been difficult to buy dips in USD/JPY and it may continue to be so. In the Oct 2012 to Feb 2013 rally, the pair gained 1700 pips and there were no retracements of more than 200 pips (and only one above 150 pips).

The other move early in the week was a tumble as low as 0.8733 in AUD/USD from 0.8798 at Friday's close. The decline was the result of China's official manufacturing PMI falling to 50.8 from 51.2 – a five month low.

Worries about China are always in the background and the Chinese Economic Information Daily also reported that about 20% of small lending companies in the country are unprofitable.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -166K vs -159K prior

JPY -67K vs -71K prior

GBP -6K vs -4K prior

AUD -34K vs -32K prior

CAD -21K vs -22K prior

CHF -20K vs -18K prior

NZD -4K vs -2K prior

Specs were on the right side of the BOJ trade but not nearly as aggressively as they would have liked to be. At the start of October the net short was -121K and that was nearly halved before the BOJ announcement.| Act | Exp | Prev | GMT |

|---|---|---|---|

| PMI (OCT) | |||

| 54 | Nov 03 1:00 | ||

| PMI (OCT) | |||

| 50.2 | Nov 03 1:45 | ||