Intraday Market Thoughts Archives

Displaying results for week of Mar 22, 2015Net euro shorts hit record high after 3-year wait

Excessive speculative longs and shorts are often used by traders as contrarian sign, but deciding upon what determines “excessive” is debatable. Full charts & analysis.

Major Trends Die Hard, Japan CPI Next

The US dollar stormed back on Thursday minutes after the euro hit a three week high. The dollar was easily the best performer in US trading but CAD and JPY were tops on the day. Japanese CPI, employment and retail sales are due later. A new set of Premium trades will be issued tomorrow morning ahead of the US GDP revision and Yellen's speech after today's wild-fluctuations day, which looked rather similar to last Thursday in terms of FX swings.

The US dollar rally wasn't driven by a single clear factor but a few elements along with a dose of quarter-end led to a sharp rally.

- Initial jobless claims at 282K compared to 290K exp - The Markit March services PMI at 58.6 vs 57.0 exp - The Fed's Lockhart continuing to talk about hikes in June, July or September - A second consecutive soft Treasury auction

Alone, none of those factors should have given the dollar a big lift but as it got some momentum the dollar gains accelerated. EUR/USD touched as high as 1.1052, narrowly breaking the recent highs, and then tumbling as low as 1.0855.

The dollar made similar gains against the pound and also posted a solid rally against JPY and the commodity currencies in New York trading. The dollar rebound after a few days of declines underscores the power of a long-term trend and the danger in trading against it.

Geopolitics are also a focus with the loonie surging on the back of an oil rally as Saudi warplanes bomb Yemen. The kneejerk higher in crude ebbed later, in part because Middle East countries aside from Yemen are showing rare signs of solidarity and that diminishes the chance of any kind of repeat of an Arab Spring.

The Canadian dollar slid slightly on comments from Poloz. He said first quarter growth will be lower than BOC projections but, importantly, he qualified that by saying the January rate cut has bought time for evaluation – a sign that near-term rate cuts are unlikely.

Up next the focus shifts to Japan with February CPI and jobs data due at 2330 GMT. As Ashraf outlined, the BOJ has moved away from rhetoric suggesting a sagging economy and even though inflation is low, policymakers believe it's transitory. CPI is expected up 2.1% y/y ex-food and energy but even a soft reading may be brushed aside. At 2350 GMT, the focus shifts to retail sales which are expected up 0.9% in February. Signs of better inflation or sales could add to tentative arguments for yen longs.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Tokyo CPI Ex-Fresh Food (MAR) (y/y) | |||

| 2.2% | 2.2% | 2.2% | Mar 26 23:30 |

| National CPI Ex Food, Energy (FEB) (y/y) | |||

| 2% | 2.1% | 2.1% | Mar 26 23:30 |

| National CPI Ex-Fresh Food (FEB) (y/y) | |||

| 2.0% | 2.1% | 2.2% | Mar 26 23:30 |

| National CPI (FEB) (y/y) | |||

| 2.2% | 2.3% | 2.4% | Mar 26 23:30 |

| Tokyo CPI (MAR) (y/y) | |||

| 2.3% | 2.3% | 2.3% | Mar 26 23:30 |

| Tokyo CPI Ex Food, Energy (MAR) (y/y) | |||

| 1.7% | 1.7% | 1.7% | Mar 26 23:30 |

| Retail Trade s.a (FEB) (m/m) | |||

| -1.3% | Mar 26 23:50 | ||

| Retail Trade (FEB) (y/y) | |||

| -1.5% | -2.0% | Mar 26 23:50 | |

| GDP Annualized (Q4) | |||

| 2.4% | 5.0% | Mar 27 12:30 | |

| GDP Price Index (Q4) | |||

| 0.1% | 1.4% | Mar 27 12:30 | |

| Fed's Stanley Fischer speech | |||

| Mar 27 10:30 | |||

| Fed's Yellen Speech | |||

| Mar 27 19:45 | |||

| Flash Services PMI | |||

| 58.6 | 57.2 | 57.1 | Mar 26 13:45 |

| Unemployment Claims | |||

| 282K | 291K | 291K | Mar 26 12:30 |

Stocks Shudder on Hike Talk, Tech Downgrade

The only thing the stock market likes less than the prospect of a rate hike is the prospect of a rate hike in a softer economy. The Nasdaq posted its worst day in 11 months Wednesday following a downgrade of semiconductor maker AMD as the euro led and the kiwi lagged. The Asia-Pacific calendar is quiet. EURGBP Premium trade is open ahead of tomorrow's UK retail sales.

Atlanta Fed President Lockhart said it's quite likely that rates will rise in September or sooner. He said the FOMC would need to be “really disappointed” in the economic data to wait longer with something close to an economic shock the only way hikes could be derailed beyond year end.

We mulled the prospect of the Fed waiting beyond year end yesterday but that sounds less likely in light of Lockhart's comments. It seems even with soft economic data, the Fed wants to get away from zero interest rates.

And soft data was what came on Wednesday as core Feb durable goods orders fell 1.4% compared to +0.3% expected. It was compounded by a revision in the January reading to -0.1% from +0.6%. It makes six consecutive months of declines in the core capex reading which is a prominent leading indicator.

The stock market groaned and gave up all the post-FOMC gains. The S&P 500 was down 1.5% and Nasdaq down 2.4% in the largest loss since April 10, 2014.

The US dollar generally strengthened although gains against the euro and yen were minimal after the comments and data. One factor that points to repositioning rather than true fear is the upcoming end of the quarter/fiscal year. That bonds sold off alongside stocks and that FX was relatively unshaken argues for calm but there is definitely apprehension about soft Q1 earnings due to the US dollar and that may continue to weigh.

Geopolitics are also back on the agenda. Oil brushed off another high inventory report and instead focused on Yemen where rebels chased the President from the Southern capital of Aden and looters ransacked the Presidential compound. There is talk of an increasing military buildup along the border with Saudi Arabia and oil prices rose more than 3%.

The market will have a chance to digest the latest moves with the schedule quiet in Asian trading.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (FEB) (m/m) | |||

| 0.4% | -0.3% | Mar 26 9:30 | |

| Retail Sales ex-Fuel (FEB) (m/m) | |||

| 0.4% | -0.7% | Mar 26 9:30 | |

| Retail Sales (FEB) (y/y) | |||

| 4.7% | 5.4% | Mar 26 9:30 | |

| Retail Sales ex-Fuel (FEB) (y/y) | |||

| 4.2% | 4.8% | Mar 26 9:30 | |

| Core Durable Goods Orders (m/m) | |||

| -0.4% | 0.3% | 0.0% | Mar 25 12:30 |

USDJPY oiled down

Will the plunge in JPY the last 2 1/2 years help restore Japan's trade balance into surplus? Aside from USDJPY nearing its 55-day moving average for the first time in four weeks, we observe that net long contracts in JPY vs USD have broken above their 3-year down channel. Full charts & analysis.

Datawatch is the Name of the Game

A market is in balance when news is the driver and reports on UK and US inflation point to a healthy state. The pound was the laggard Tuesday while the Swiss franc led the way. Australian housing could be in focus later.

Inflation is probably the biggest long-term question mark in the global economy. In equal numbers there are market participants looking for hyperinflation or long-term deflation and everything in between. It will be months or years before an answer begins to materialize but central banks are watching closer as the QE experiment moves into a second phase.

UK CPI was flat in February and a touch softer than expected while US CPI rose for the first time in months and was a touch stronger than the consensus. The differences in both reports compared to the consensus was a rounding error but the reaction in markets was massive.

Cable dropped 60 pips on the UK CPI data and then fell another 60 on the US numbers. Both data points added some confusion and caveats but the headline was what mattered in the end. Specifically, US weekly earnings were down 0.1% in the month and that caused a momentary plunge in the US dollar but it quickly reversed.

Other data points on the day had less of an impact. New home sales surged to 539K vs 464K expected but it was entirely due to a 153% jump in the Northeast that was almost certainly a seasonal skew from a cold winter a year earlier. Numbers on manufacturing also differed as the Markit PMI rose to 55.3 vs 54.6 expected. The flipside, the Richmond Fed was -8 compared to +3 exp.

The US dollar recovery is a good start but we will be watching closely to see how it reacts to incoming data, especially the durable goods report on Wednesday.

In the near term, the focus is on Australia later with skilled job vacancies data due at 0000 GMT. It's rarely a market mover but the data focus could give it an added lift. The release more likely to move the move the market is the RBA financial stability review at 0030 GMT. Headlines on the housing bubble could cause a scare.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (y/y) | |||

| 0.0% | 0.1% | 0.3% | Mar 24 9:30 |

| New Home Sales (FEB) | |||

| 539K | 465K | 500K | Mar 24 14:00 |

| Markit US Manufacturing PMI (MAR) [P] | |||

| 55.3 | 54.6 | 55.1 | Mar 24 13:45 |

| Durable Goods Orders (FEB) | |||

| 0.2% | 2.8% | Mar 25 12:30 | |

| Durable Goods Orders ex Transportation (FEB) | |||

| 0.4% | 0.3% | Mar 25 12:30 | |

| Richmond Fed Manufacturing Index (MAR) | |||

| -8 | 3 | 0 | Mar 24 14:00 |

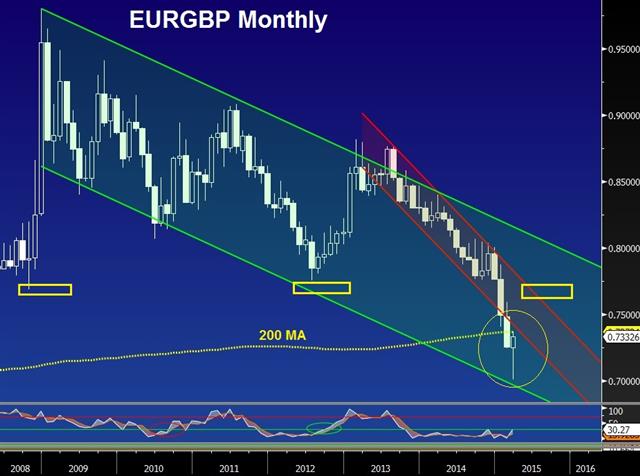

How far EURGBP will rise?

Not only Eurozone deflation is an “older” issue than it is in the UK, but Eurozone CPI may appeared to have bottomed in January at -0.6% before stabilizing to -0.3% in February. The picture is already reflected in the narrowing EU-UK 10- year yield spread. Full charts & analysis

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (y/y) | |||

| 0.0% | 0.1% | 0.3% | Mar 24 9:30 |

Recording of last night's webinar

Here is the link to Ashraf's webinar for City Index, covering trades in USDJPY, EURUSD, AUDUSD, GBPUSD and GBPNZD and more. Access webinar here

Central Bank Moods Matter

The top ECB policymaker and #2 at the Fed spoke on Monday and it underscored the reason for the rebound in EUR/USD. On the day, the Australian dollar was the top performer while the US dollar continues its post-Fed fall. The Aussie remains in focus with the China manufacturing PMI coming up. In our latest Premium Insights, GBPAUD short hits final target for 220 pips, AUDNZD netted more than 280 pips and GBPJPY was stopped out. A new edition of the Premium Insights will be issued on Wednesday.

We first wrote about Draghi talking about green shoots in the Eurozone on Feb 25. The euro continued to decline afterwards but has turned around since ECB QE buying officially began.

What stood out on Monday was how Draghi's optimistic mood contrasted with the wait-and-see tone from Fed vice chair Fischer. Draghi's appearance at European parliament didn't make waves in the market as he continued to say growth was gaining momentum but he also noted that low rates are increasingly being passed through the financial system.

His comments were underscored by a rise in Eurozone consumer confidence to -3.7 compared to -6.0 expected. It was the best reading since 2007.

Fischer, meanwhile, re-emphasized the Fed's data dependence. He also said that a rate hike is likely before year end but the market wants to know just how likely it is. The futures market prices about an 86% chance of a hike but traders are wondering what would have to happen for the remaining 14% to be proven right. One of the factors might be a strong dollar, a risk that Fischer touched on.

Going forward, data will continue to dominate but ECB QE is old news so long as they find the necessary 60 billion euros of bonds to buy each month. What matters next is which economies grow and that will be reflected in central bank comments.

Another key central bank is the PBOC, which suddenly sounds reluctant to keep cutting rates. The market is unsure where the economy stands after skews in February data so today's HSBC manufacturing PMI for March is especially important. It is expected to tick lower to 50.5 from 50.7. A sub-50 reading would stoke fresh fears of a harsher slowdown, something that could quickly reverse AUD gains.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (MAR) [P] | |||

| 54.7 | 55.1 | Mar 24 13:45 | |

| PMI (MAR) [P] | |||

| 50.5 | 50.7 | Mar 24 1:45 | |

| Eurozone Markit PMI Composite (MAR) [P] | |||

| 53.3 | Mar 24 9:00 | ||

| Eurozone Markit PMI Manufacturing (MAR) [P] | |||

| 51.5 | 51.0 | Mar 24 9:00 | |

| Eurozone Markit Services PMI (MAR) [P] | |||

| 53.9 | 53.7 | Mar 24 9:00 | |

| Eurozone Consumer Confidence (MAR) [P] | |||

| -3.7 | -6.0 | -6.7 | Mar 23 15:00 |

Ashraf's webinar starts in 4 hrs from now

Ashraf's webinar on the euro, the Fed, USD cycles and commodity currencies vs. yen starts 16:00 Eastern Time , 20:00 GMT/London. Registration link here

Dollar Slide Continues, AUD Shorts Slashed

Early trading this week continues the trend of USD weakness with the euro up 20 pips. Last week, the Swiss franc was the top performer while the US dollar lagged. The Asia-Pacific calendar is light to start the week but comments from Mester and SNB sight deposits are up later. CFTC data showed a major drop in AUD shorts.

Part of the reason for the early-week rise in the euro was the results of the French departmental elections. The anti-euro National Front was expected to lead the first round but was about 5 points behind Sarkozy's UMP with a second round to be held next Sunday.

Comments from PBOC leader Zhou may have dampened enthusiasm for rate cuts. He said “excessively loose monetary policy” would not be favorable for structural reforms.

Oil will be in focus after a series of headlines on Iran. Obama and Kerry said significant gaps remain before a nuclear deal can be completed but both sides seemed optimistic a deal could eventually be reached. Iranian oil finds its way to market but a deal would make it easier to export to the west and may weigh on Brent and WTI.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

- EUR -194K vs -181K prior

- JPY -48K vs -59K prior

- GBP -38K vs -33K prior

- AUD -29K vs -77K prior

- CAD -33K vs -39K prior

- CHF -2.2K vs -8.4K prior