Intraday Market Thoughts Archives

Displaying results for week of Feb 23, 2020نفتح فيديو المشتركين للكل

نفتح فيديو المشتركين للكل إثر التقلبات التاريخية في أسواق البورصة و العملات قبل ما نفتح الخيار لصفقة نهاية الأسبوع. الفيديو الكامل

Where to Hide

As I write this, Fed Chair Powell releases a statement, assuring the Fed will do what it takes to stave off the impact of the Corona virus. Market had a late-session bounce. Ashraf said yesterday he expected some sort of action before the weekend. Powell's stmt is enough of an action to send markets in the green. The endless drip of new worrisome cases led market participants to unload everything on Thursday in what's now one of the worst weeks ever in US equities. It's an understandable reaction to the extreme uncertainty from the coronavirus. Yet, almost all wealth needs to be held in some currency or some place; we look at the places that stand to benefit. As I write this, Ashraf has just released a trade that is backed by 3 charts & relevant notes, making the case why it's the only go-to trade into the weekend and the rest of the quarter.

كيفية التداول إثر تصاعد المخاوف

On Thursday, WHO leader Tedros said we're at the decisive point in containing coronavirus. The market has already decided it's much more likely to be a global pandemic. Let's assume it is. If so, it may be a global catastrophe unlike anything in generations. Let's set that aside for a moment and look at the financial/econ side and, specifically, where is the best place to preserve wealth.

First, consider how the pandemic will spread. Sooner or later, there will be another country with a coronavirus breakout. Right now authorities are scrambling in South Korea, Iran and Italy. The rising number of cases in several countries is ominous. Confirmed cases worldwide pass 83,000; deaths top 2,800. Banks are rushing to limit business travel.

Given that it started in China, two of those three countries were not at all where you would have expected it to land next. Scarier is that Indonesia -- which is a top destination for Chinese travelers -- still has zero confirmed cases. US diplomats are increasingly critical of the testing and preparations in the country.

So what if the next big outbreak is in Indonesia? Or what if it's South Africa? Or Canada?

If that happens, expect the market to sell those currencies. Market reactions are imperfect and that's an understandable response. At the same time, there is a certain point where the market comes to realize that the virus is unstoppable. It could be 5 countries or 25. Given that the market is already leaning towards a pandemic, the number will probably be low.

Once the number of countries is "high enough", the trade will be less about the current locations of outbreaks and more about global growth, not where the individual breakouts are. Will growth-sensitive currencies such commodity FX and and EM be hit the hardest? Oil-sensitive currencies are particularly vulnerable.

Crude is down almost $20 from the January high and falling every day. What's the clearing price for crude when no one is driving or flying? There's no storage for 5 million extra barrels per day. The lows could be harrowing and we're already past the point where many oil producers can hedge in a profit. In the next week or two, expect curbs on investment spending, followed by dividend cuts and outright shutdowns. That will at least take some production offline, but if there is no demand, there's still no bottom.

One thing about Powell's assuring statement earlier before the Friday close: Markets will most likely descend on a fresh downward spiral to make sure the Fed delivers at least 25-bp cut on March 18th. If Corona virus cases spread further, markets may reach a point where anything less than 50-bps may not be acceptable.

Ultimately, it's ominous for the Canadian dollar. Expect the Bank of Canada to cut rates all the way to zero in a pandemic, similar to other central banks but the BOC is one of the few with a bit of rope so that will also erode any yield advantage and cut down the loonie. The way it's set up, there could be a series of cascading stops that take it through all the lows of last year and to the 2016 extremes.

In the early part of a pandemic, the traditional safe haven currencies will lead the way – the US dollar, yen and franc. They will likely be joined by the euro as carry trades unwind.

Part 2 of the market reaction: Who can cope

The next thing the market will look at is which countries can cope. This is where some of the commodity currencies could bottom out. Australia, New Zealand, Canada and Norway have relatively solid public finances, robust health care systems and political stability. Moreover, the burden of care is going to fall on the government. That could mean enormous costs but it's evenly spread.Compare that to the mess of health insurance in the US. The costs are born by consumers and health insurers. The financial cost will cripple millions and bankrupt insurers. That creates some systemic risks. Moreover, a pandemic will destabilize and already-broken political system and probably assures a Bernie Sanders presidency and a Democratic sweep, perhaps even helped by his free health care plan?

As that comes into focus, do you still want to own US dollars? After an initial burst higher in the US dollar, it may not hold up. That would make for a classic blow-off top after a multi-year run.

Ultimately, there's no 'great' currency to own

That's what makes gold so attractive. The volatility makes for a tougher trade but there's nothing technically stopping it from the crisis highs near $2000. Central banks are going to cut to zero. There will be more QE. Deficits will explode. Politics will be more volatile. A pandemic may even take gold mines offline. Unless there is a decisive turn for the better in the virus, gold will continue to rise. Do not confuse gold's recent decline resulting from defensive margin call funding, with inevitable proactive buying to hedge against tumbling risk assets. The shift can be instantaenous.I just saw Ashraf's Premium trade released moments ago. He presents fairly accurate/exact arguments for taking the trade. Let's see.

Capitulation or Adjustment?

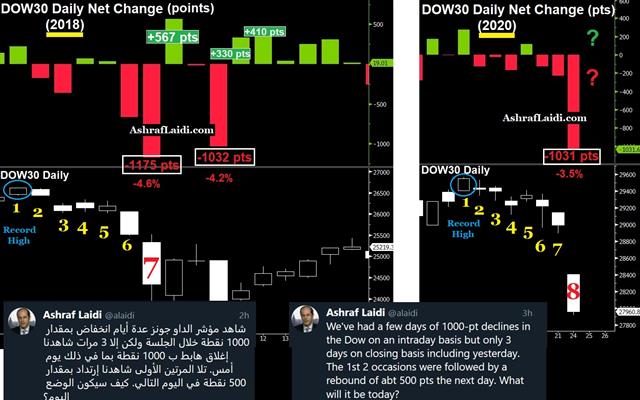

The first signs of capitulation showed emerged in a big way on Thursday as major US major indices plunged 4.4%, posting their biggest 1-day percentage drop since 2011, bringing the week so far to -11%, the worst weekly decline since October 2008. The combination of Microsoft downgrades triggering corporate worries with accelerating tumble in oil shedding 12% in 4 days triggered broadening losses in tech and energy. A new Premium video has been issued below, covering why/how our indices were stopped out by 20 pips before reaching the targets (DAX) and the DOW long after the London close, which targeted 470 pts, only to miss the final target by 35 pts before getting stopped out. I cover my take on FX and indices and the implications for Friday's trades. Will central banks step in before the weekend? My take below.

As for what's next, we could make all sorts of profound arguments about how central bank liquidity injections or rate cuts won't address the economic & market fallout of a virus outbreak in Europe and the US. Alternatively, we could approach the situation by asking “what would happen to the markets if no central bank policy response”. Their job is to safeguard the financial system after all. Some would GDP growth is doing OK and & jobs are solid, while markets are in need of a healthy correction … but 12% in 4 days is the stuff that could easily turn to 30% in two weeks in a world when passive ETFs must find liquidity & anyone can hit the sell button from anywhere not to mention algos. Don't forget that Fed funds futures are currently pricing three rate cuts by year-end.

See you at NY Traders' Expo

I'm delighted to inform you that I'll be a featured speaker at this year's NY Traders' Expo in New York city - March 7-9. This is one of the longest running trading expos around, in which I had the honour to take part numerous times and meet great traders, analysts and programmers. I encourage you to reserve a free seat, and join me at the ultimate educational event for active traders in 2020. Full Program.

للمشاهدين خارج الشرق الأوسط

هل حان وقت الشراء؟

لنتابع مع خبير الأسواق العالمية أشرف العايدي مستويات المؤشرات الرئيسية في ظل توسّع انتشار فيروس كورونا لنكتشف إن حان الآن الوقت المناسب للشراء أم لا! تابعوا هذا الفيديو للتفاصيل

Between Greed & Fear

Markets finally show some green as global indices rally 1%-1.2% after the DAX and DOW reached correction territory—defined as 10% decline from the high. Both indices have also reached their 200-DMA, which is not the case for SPY -- It neither reached its 200-DMA (3046), nor hit the 10% extension (-8.8%). Is this a matter of insignificant detail? Not quite. The most basic of systems trading is based on these landmarks, which denote the difference between a correction and bear market and are usually used to taper in gradual bids or short-covering. Markets sustain some stabilisation thanks to gradual outflows from bonds after the 10-year yields had hit a new low last night. All currencies are trading lower against the US dollar, while gold may sustain further pullback until possibly encountering the next key support at 1615/20. This week's probing long in the DAX was stopped out, so we let the air clear out to get better visibility of technicals balances. A new Premium trade has been sent out, accompanied by charts and the Premium video below.

The Coronavirus Positioning

Markets gets caught in a fresh round of selling after a brief reprive in early Tuesday Asia. VIX pushing to 24.87, DOW30 eyes the Dec 3rd low and SPX nears the 100-DMA of 3164. GBP is the best performer, followed by JPY and CHF. No one wants to see a global pandemic but experts and the market are increasingly worried that it may be inevitable. If it comes, which global assets will suffer and which ones will appreciate? We take a closer look.

تطبيق التوازن بين الخوف و الطمع (فيديو للمشتركين)

On Monday the market got a taste of what the pandemic trade may look like as pictures of empty grocery store shelves in Italy offered a hint of the potential panic. We have repeatedly highlighted the bond market as a spot to watch and it was the breakdown in long-term yields Friday that hinted at what was to come.

It may also be just a taste of what's next with a Fed cut in April now priced at 60%. If a pandemic hits, the Fed will likely cut all the way to zero and pull rates to near that level. In times of trouble, bonds are always a clear winner.

That isn't always the case for gold and precious metals but it will be this time because central banks are already toying with monetary policy experiments and governments are already deeply in debt. Technically, gold has broken out in a big way and there is little resistance until the all-time highs.

In FX, we may have gotten a taste of the trade Monday as the yen led the way and the Canadian dollar lagged. Last week's squeeze on the yen raised some Japan-specific risks and even talk about intervention but in times of trouble, the rush into JPY is an inevitability. The other side of that trade is equally interesting. The loonie has held up well recently compared to AUD and NZD but that may just mean it has further to fall, especially if oil falls into the low $40s.

The latest South Korea business sentiment survey may offer a hint of what's to come if the pandemic were to arrive in the US. It fell on Tuesday to 84.4 from 92.0.

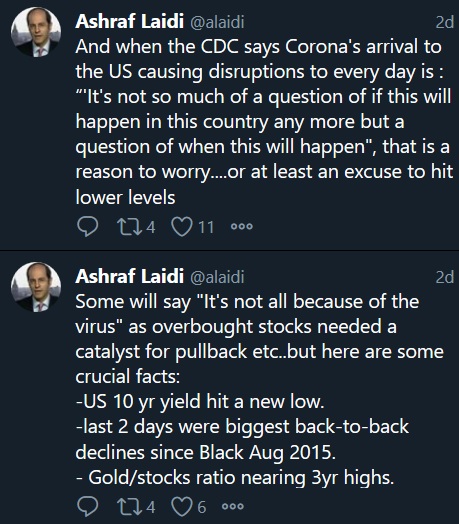

Virus Sends Stocks to 4th Worst Day in Past 9 yrs

Major US indices sustain their 4th biggest percentage daily decline since 2011 as the escalating outbreak of the coronavirus in Italy and rapidly rising numbers in South Korea emphasize the gravity of the situation. 10-year yield hit a fresh 4-year low at 1.35%. The VIX jumped 50% today. JPY is the best performer of the day, followed by EUR (due to unwinding of the euro funding carry trade), while CAD and GBP are the worst performers. The Premium trades in DAX, DOW and Gold have all hit their final targets and a new Premium trade has just been issued, backed by 3 charts & notes. 5 trades are currently open. Ashraf signalled to me earlier today that despite today's focus being largely on equity indices, FX markets should unveil some key developments by mid week.

New coronavirus cases in China continued to sag with only 409 newly announced on Sunday but the market has shifted its attention to other possible outbreaks. The situation in Iran remains murky and could be severe but it's Italy and South Korea that have spooked the market.

Confirmed cases in Italy jumped from only 3 on Friday morning to 155 by Sunday and the country took dramatic action as it seeks to find the source, including banning public events in some areas near Milan. Italy's top football league canceled at least three games and schools have been closed for two weeks.

Similarly, cases in South Korea have jumped to 763 early Monday from just 31 on February 18 and officials have raised the public alert system to its highest level.

The WTO said there was still a chance to contain the virus outside of China but that “the window of opportunity is narrowing”. What's particularly worrisome is the number of cases that have no clear link to China or other clusters of cases.

Many markets have seemingly ignored the risks around the virus until fears kicked up late on Friday. However bonds have been consistent in flagging fears. The biggest losing shares of the day have been American Airlines -9.8%, NorwegianCruiseLines -9.2%, Carnival -8% and RoyalCarribean -8%.

Gold surged $30 to 1689, hitting the 1680 target signalled on Friday here.

With virus fears and outbreaks widespread many market participants are struggling to understand what currencies to buy and avoid, especially in light of the squeeze in the yen last week. The dollar remains a solid bet but is subject to Fed risk. The more straight-forward trade continues to be gold as it breaks out technically and with central banks and fiscal authorities increasingly likely to loosen policy.