Intraday Market Thoughts

Gold Eyes 1680 ahead of G20

by

Feb 21, 2020 18:08

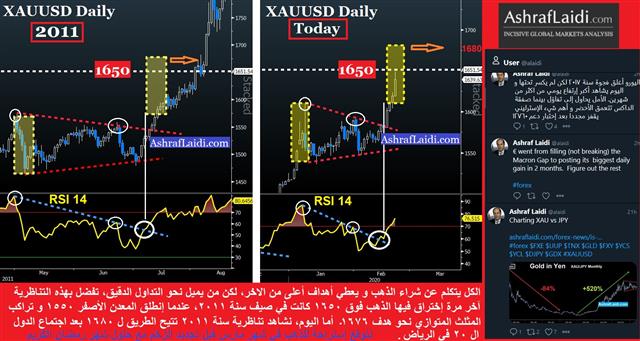

As the excesses of USD-bound safe haven flows hit a wall of data disappointments courtesy of a sub-50 composite PMI, gold extends its rally, picking the yen up along with it at the expense of new record lows in US bond yields. Now that Fed rate cuts are back on the table (they never left) as the US yield curve inversion deepens in 2 out of 4 measures highlighted here, USD traders shift attention from safe haven flows to Fed easing pricing (40% of July rate cut). Add to it the inevitable statements/misinterpretations/clarifications about USD strength at this weekend's G20 meetings of finance ministers and central bankers, and you're likely to see further playing out of gold appreciation a la 2011 analog in the charts below.

Click To Enlarge

Latest IMTs

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35

-

How I Grew the Account 5x

by Ashraf Laidi | Mar 2, 2026 11:54