Intraday Market Thoughts Archives

Displaying results for week of Oct 24, 2021From ECB Market Rebuff to PCE

Like market participants, central banks are now dividing themselves into separate camps regarding inflation. Christine Lagarde championed Team Transitory once again on Thursday after holding rates steady. She said the central bank did some 'soul searching' but is confident in the transitory view.

"Our analysis certainty does not support that the conditions of our forward guidance are satisfied at the time of liftoff as expected by markets, nor any time soon thereafter,” she said.

Contrast that with the Bank of Canada, which hiked its 2022 inflation forecast by a full point to 3.4% on Wednesday and market pricing that showing an ECB hike around this time next year and much more for other central banks.

The broader market is showing some of the same tensions as long-dated yields fell this week but there have been blowouts on the short end, including in Australia where 2s are now yielding 0.5%, much higher than the RBA's 0.10% yield curve control target.

Next week's Fed decision looms increasingly large with a hike now 90% priced in for June. The troubling part is that the $15B/monthly taper suggested in the FOMC minutes wouldn't end until July, which goes beyond the Fed's latest guidance. Pay close attention to the size and pace of the taper.

The advance Q3 GDP was on the soft side at 2.0% compared to 2.7% expected but not as weak as feared. Notably, stripping out all the auto-related drops – which were largely due to chip shortages – and GDP grew 7.2%. That's a signal that supply is the problem, not demand.

The question that continues to plague market participants is inflation and we get the latest numbers for the US on Friday. The consensus is for a 4.3% y/y inflation rise and 3.6% on the core. It's tough to see it altering the Fed's view, it could light another fire under the bond market.

BoC Done, ECB Dithers, Fed Tinkers

Yesterday we flagged the risk that the BOC could skip the second-to-last step in its taper progression and wrap up the program early. That's what happened as the pace of purchases was dropped to zero from $2B/week.

In addition, the BOC moved up its timeline for the closure of the output gap to the 'middle quarters' of 2022 from H2. That's when rate hikes will be firmly on the table.

What may be most important is what wasn't said. The BOC would surely know that the market is pricing in four hikes in 2022 and Macklem did nothing to push back on that timeline. Silence isn't a full endorsement but it's a step in that direction.

With that, USD/CAD fell 125 pips on the news to 1.2300. It later retraced 65 pips on a broad USD bid that was wrapped up in some large bond moves and some late risk aversion. It all bears close watching but could be a symptom of month end.

Next up is the advance look at Q3 US GDP. The consensus is 2.7% q/q annualized and estimates range from +0.7% to +5.0% as economists struggle to forecast the impacts of bottlenecks and delta. Adding a downside risk was a surprisingly large US trade deficit in September. One forecast that got some extra attention was the Atlanta Fed tracker, which put growth at just 0.2%. That's dangerously close to contraction.

The inclination is to fade any moves on a soft report because Q4 is looking much better but a negative reading could complicate FOMC messaging after a taper next week. The baseline is $15B per month but Powell may indicate that it's flexible, adding in a quirk.Yen Gains on Yields Drop, BoC Next

The first look at US Q3 GDP will be released on Thursday and it's likely to be a dud but the market is now focused on the strength of the rebound in Q4 and beyond. Data on Tuesday was encouraging with US consumer confidence rising to 113.8 from 108.3. The Richmond Fed climbed to +12 from +3 expected. Housing is also growing into a tailwind once again with new home sales at 800K versus 760K expected.

The mood in markets overall continues to improve and we're headed toward the risk-positive seasonal period through year end. Commodities continue to attract a solid bid despite mixed messages from China.

Looking ahead, the tone for central banks in the coming months might be set by the Bank of Canada on Wednesday. A taper to $1B per week from $2B per week is priced in, but there's a small chance the BOC skips right to zero, limiting QE only to reinvestment. Pay close attention to press conference, as it will magnify the sharp moves.

Recent Canadian data has been strong and the BOC is undoubtedly tuned into the global inflation debate along with the Canadian tailwind from commodities and the potential risks around housing. The OIS market is pricing in nearly four rate hikes in 2022 and the BOC will have to either acknowledge it or push back. Given the inflationary winds, it will be tough to push back and that could boost the loonie. Alternatively, the 1.2420 trendline resistance from the September high has capped USD/CAD despite multiple attempts to break it. If the BOC pushes the 'transitory' narrative, stops above there could be run.The Technology Currency

The handful of megacap technology equities are in a class of their own. The 12% rise in Tesla on Monday was one of the single largest market cap gains in any stock, ever. It's now larger than all other car companies combined. Apple, Facebook, Microsoft, Google and Amazon are in a similar class.

What they all have in common is that they're American and act like magnets for capital, particularly when they began to run. We've talked about it before but an underrated factor driving US dollar gains is financial flows into equities and derivatives. The stock market casino operates primarily in US dollars.

The Nasdaq is now less than 2% away from breaking the August record highs and we're nearing the positive Nov-Dec seasonal period. It's tough for the dollar to make gains against commodity currencies and EM in a growth-positive environment but it can continues to make gains against the euro and yen.

The rally in tech also points to the steadily improving mood. That's something that both reflects and will feedback into the real economy. Look for improving US consumer confidence on Tuesday.ندوة أوربكس مساء اليوم مع أشرف العايدي

ندوة أوربكس مساء الثلاثاء مع أشرف العايدي

China Covid Outbreak, & Bitcoin Correlated Stock

As bad as supply chain bottlenecks are, they could be much worse if covid had hit China as hard as the rest of the world. Or maybe it's only a matter of time because while China is making vaccine progress, it's jab is less effective than MRNA technology so they may eventually need to let it run.

While we're optimistic on covid receding further, the recent lockdown in Russia and rising cases in the UK, along with this news bear watching.

Otherwise, markets are consumed with rates and inflation talk. Powell on Friday struck a different tone in nothing the high prices will likely last well into next year. He also emphasized that they need to consider a full range of plausible outcomes.

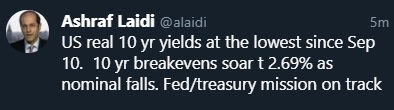

While he still argued for patience, the confident 'transitory' talk from Jackson Hole is long gone. The Fed doves are seeing the pressure on jobs and supply chains and increasingly worrisome that higher prices will become embedded. Interestingly though, as the dollar rallied on this and short-dated rates pushed up, long dated rates pulled in, suggesting the risk of tightening prematurely and tee-ing up another decade of sub-2% inflation.

Economic data will be more lively in the week ahead with the US week starting with the Chicago Fed index, Richmond Fed and new home sales.