Intraday Market Thoughts Archives

Displaying results for week of May 24, 2015Chicago PMI warns USD bulls ahead of ISM & ADP

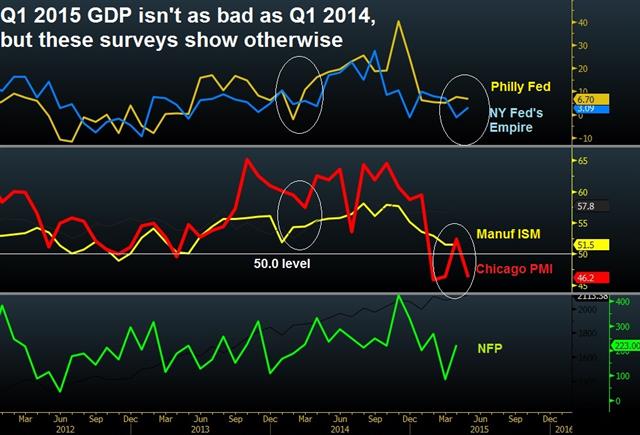

The six-point drop in today's release of the May Chicago PMI to contraction territory at 46.2 doesn't augur well for next week's release of the manufacturing ISM and NFP figures. The situation is different from last February when a similar thing occured. Full charts & anlaysis.

The Focus is on Japan After FX Warning

It's been a generation since markets have had to deal with a strong Japanese economy and at the moment, the reaction is total skepticism if not disbelief. But Japan has strung together a few good months and the consensus for 2015 growth has moved close to 2% from 0.9% at the start of the year.

We don't know if Abenomics is really working but Japanese officials have maintained an upbeat outlook and talk of more QE has fallen to the wayside. If they believe they can achieve solid growth – which is anything close to 2% in Japanese terms – then they might believe USD/JPY at these levels is high enough.

The pair hit an airpocket on Thursday when Aso said recent currency moves were rough and that he will monitor forex moves carefully. USD/JPY quickly fell to 123.63 from 124.10 in the aftermath. We warned yesterday about the possibility of this type of comment and it will continue to be a risk in the pair.

Like the US, the outlook for the yen is data dependant. On the docket next is the jobs report and CPI at 2330 GMT, followed by industrial production 20 minutes later. National CPI is expected up just 0.6% in April so there is no immediate danger of nearing the 2% BOJ target.

April IP is expected up 1.0% m/m.| Act | Exp | Prev | GMT |

|---|---|---|---|

| National CPI (APR) (y/y) | |||

| 2.3% | May 28 23:30 | ||

| National CPI Ex Food, Energy (APR) (y/y) | |||

| 2.2% | May 28 23:30 | ||

| National CPI Ex-Fresh Food (APR) (y/y) | |||

| 0.2% | 2.2% | May 28 23:30 | |

| Tokyo CPI (MAY) (y/y) | |||

| 0.7% | May 28 23:30 | ||

| Tokyo CPI ex Food, Energy (MAY) (y/y) | |||

| 0% | May 28 23:30 | ||

| Tokyo CPI ex Fresh Food (MAY) (y/y) | |||

| 0.1% | 0.4% | May 28 23:30 | |

| Industrial Production (MAY) (m/m) [P] | |||

| 0.8% | -0.8% | May 28 23:50 | |

| Industrial Production (MAY) (y/y) [P] | |||

| -1.7% | May 28 23:50 | ||

China stocks tumble, Aussie capex crumble, oil supported

The 7% plunge in Shanghai Composite forms a weekly gravessone doji as PBOC withdraws liquidity, while Aussie capex crumbles, opening the door for a summer RBA easing. Full chart & analysis.

USD/JPY Flirts With Critical Level

USD/JPY stormed ahead once again on Wednesday before it finally ran into resistance. The late-day high was 124.07, just shy of the 2007 top at 124.14. A break above that would be the best level for the pair since 2002.

Initially at least, that level proved to be solid resistance and some profit-taking pushed the pair back to 123.69. At such a critical long-term level, unless there is a resounding rejection in the next day or two, it points to a break. One space to watch closely is the G7 finance ministers meeting in Germany. If Japanese leaders signal that they don't want further yen weakness, the trade could turn around.

Overall, it was another day of broad gains for the US dollar. In European trading, it looked as though the dollar may sag and consolidate the gains of the past week but instead, it continued to power higher. One exception was against the euro after chatter from Greece that a deal with creditors was close.

Early in Asia, more headlines indicated the sides were nearing agreement and when there is smoke, there is probably fire. But after 6 years of Greek drama, we've learned to never trust a headline and be prepared for anything.

Due up later, it's Japanese retail sales for April at 2350 GMT. The consensus is for a healthy 5.4% y/y raise as we finally get past the skew from the consumption tax increase.

Afterwards, at 0130 GMT, it's the Australian Q1 capex report. The Q42014 report showed a 2.2% fall compared to 1.6% expected and that marked the top in AUD/USD for the next month. This report is expected to show a further 2.4% q/q decline.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Trade s.a (APR) (m/m) | |||

| -1.9% | May 27 23:50 | ||

| Retail Trade (APR) (y/y) | |||

| 5.4% | -9.7% | May 27 23:50 | |

أسباب الارتفاع الهائل في الدولار الأمريكي أمام الين

بعيدًا عن الأرقام الأمريكية الإيجابية التي فاقت التوقعات، لعل السبب الأهم في الارتفاع الأخير بسعر صرف الدولار الأمريكي أمام الين يعود إلى أحدث تقرير صادر عن صندوق النقد الدولي عن اليابان، مطالبًا فيه اليابان بالمزيد من التيسير الكمي. جاء في تقرير صندوق النقد الدولي ما يلي المزيد:

Three Things May Keep the Dollar Rally Going

The US dollar surged Tuesday on upbeat economic data. USD/JPY was the top performer and the pair broke out to an 8-year high. We take a closer look at three elements that may keep the dollar in demand. The remaining GBPUSD long in the Premium trades was stopped out today. Ashraf is long USDCAD and USDJPY for his personal account.

1) Data dependent

It's all about economic data and it doesn't take much to satiate the dollar bulls. The rally began last week on better housing starts data and more research suggesting the Q1 slowdown was due to various skews. At its core, the foundation of the dollar rally is that US growth is accelerating. Every data point matters.

On Tuesday, as Ashraf detailed, the durable goods orders report was the main catalyst but new home sales, consumer confidence and the Richmond Fed also helped.

2) Hawk talk

The Fed likely breathed a sign of relief over the past two weeks as economic data began to improve. They stuck to the belief that soft economic reports weren't a signal on the underlying economy and stayed patient. The next step will be to ramp up the hawkish rhetoric in order to make the market believe that a hike is possible at any meeting.

3) Bond yields must move

This is the final piece of the puzzle but it's not straight-forward. Treasury yields weren't US dollar supportive on Tuesday but could be a catalyst in the days ahead. There was chatter that month-end buying driving down yields.

In the past month, the retracement in EUR/USD was precipitated by rising yields but it was disorderly and led by Bunds. Ideally, Treasury spreads over Bunds will expand in a more-steady fashion in the coming days and that will underpin the dollar.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Durable Goods Orders (APR) | |||

| -0.5% | -0.5% | 5.1% | May 26 12:30 |

| Durables Ex Transportation (APR) | |||

| 0.5% | 0.3% | 0.6% | May 26 12:30 |

| New Home Sales (APR) (m/m) | |||

| 6.8% | 5.0% | -10.0% | May 26 14:00 |

| New Home Sales (APR) | |||

| 517K | 505K | 484K | May 26 14:00 |

| CB Consumer Confidence (MAY) | |||

| 95.4 | 95.0 | 94.3 | May 26 14:00 |

| Richmond Fed Manufacturing Index (MAY) | |||

| 1 | 0 | -3 | May 26 14:00 |

USD soars on quadruple data surprise

If Friday's release of US April CPI showing core inflation at an unexpected two-year high was an aberration, then today's quadruple upside surprise in US data was no exception. Full charts & analysis here.

Fischer Focused on Inflation, CAD Shorts Flip

The week begins with a holiday and the United States, Hong Kong, South Korea and parts of Europe so trading will be thin. The long weekend may have let Fischer slip some important comments in under the radar at a central banking conference in Portugal.

“It's sort of ironic that at the present we have an output target and we have an inflation target, which are supposed to be conflicting, but we're more or less there on the output target,” he said. “We are not there on the inflation target, so that we have to put in a lot more steam.”

Yellen has generally been concerned with improving employment and gaining confidence in 2% or better growth with a secondary focus on inflation. If Fischer believes the economy is at full capacity on output, it shows he believes hikes could be coming sooner.

For her part, Yellen was moderately upbeat in her speech Friday and brushed aside soft Q1 data once again.

Other news from the central bank forum included more prodding for structural reforms from Draghi while Kuroda reiterated the BOJ would reach its inflation target around the first have of FY 2016.

Looking ahead, today's Asia-Pacific calendar includes April Japanese trade balance at 2350 GMT. A deficit of 351.1B yen is expected.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -168K vs -179K prior

JPY -22K vs -23.5K prior

GBP -23K vs -31K prior

AUD +7K vs +4.5K prior

CAD +4K vs -4K prior

CHF +9K vs +10.5K prior

Given the renewed slump in the euro, that was probably a short term 'bottom' in net shorts. If you're a USD/CAD long, the report is good news. It shows a balanced market before the latest rally in the pair. If oil sinks, the pair could have plenty of upside.| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Mester speech | |||

| May 25 16:00 | |||

| Fed's Stanley Fischer speech | |||

| May 25 16:45 | |||

| Adjusted Merchandise Trade Balance (MAR) | |||

| ¥3.3B | May 24 23:50 | ||

| Merchandise Trade Balance Total (MAR) | |||

| ¥-318.9B | ¥229.3B | May 24 23:50 | |