Intraday Market Thoughts Archives

Displaying results for week of Jan 25, 2015Back-to-back January declines in stocks meant this

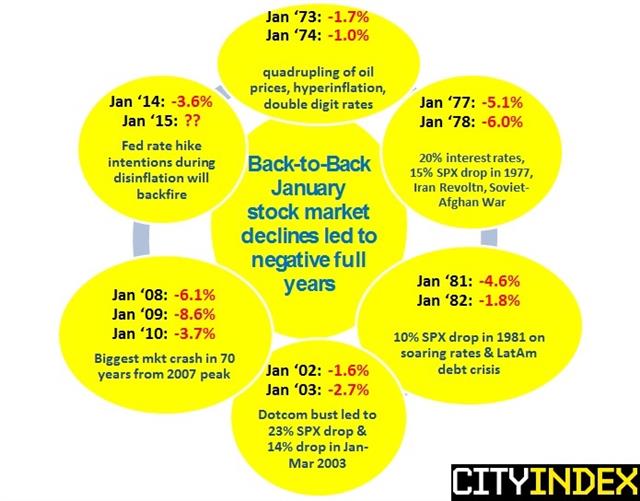

January will most likely be negative for US stock indices (S&P500), and will be the 2nd consecutive year of negative January performance. back-to-back- declines in January have not only been less frequent, but have had more ominous implications for the general market, prevailing during some of the worst of geopolitical events & periods of economic disarray –as seen in the chart & analysis below.

Dollar in the Driver’s Seat, Japan Data Next

The US dollar reasserted itself Thursday as it cruised to gains against the yen and pound while beating up on commodity FX. The euro kept pace and was the top performer while CHF lagged. A full slate of tier 1 Japanese data is due next.. After the last of our 2 AUDJPY shorts hit its final target of 91.40, totalling +230 pips, we issue 1 trade on USDJPY with 3 charts. Full detail found in the latest Premium Insights.

The Fed didn't send any particularly strong signals yesterday but the US dollar proved that the status quo continues to be enough. Initial jobless claims fell to 265K compared to 300K expected and even though it was probably skewed by a US holiday it added to the USD bid.

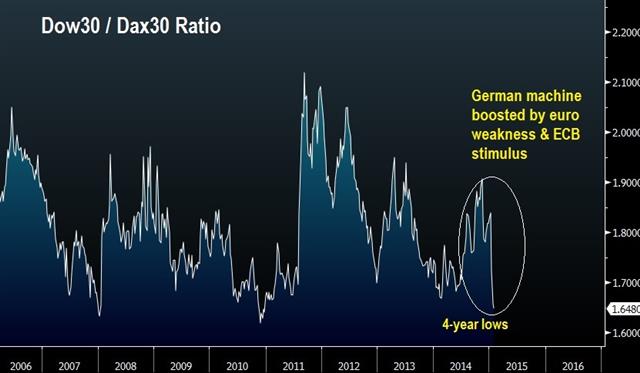

USD/JPY pushed toward the topside of the recent range, hitting 118.48 in a half-cent rise that was aided by a better mood in stocks. The euro may have benefitted from some long-term position squaring. The German inflation data was very soft and it couldn't prompt more selling. It's getting tougher to see a near-term catalyst for EUR/USD weakness and that may have been the catalyst for profit taking, maybe even more so in EUR/GBP shorts.

The real losers on the day were the commodity currencies. An early dip in oil was all USD/CAD needed to break a big figure for the second day as it cruised through 1.26 and then ripped to 1.2670.

The Australian dollar has completely cast aside the CPI data. Terry McCrann, the RBA watcher at the Herald-Sun wrote that a cut is 'almost certain' on Tuesday and that added to the drop but McCrann's record is dismal and traders may be too focused on central bank surprises elsewhere.

The focus will be on the yen in the hours ahead as the monthly data highlights hit with jobs and CPI due at 2330 GMT, followed by industrial production 20 minutes later. By far, the Dec CPI report is the most important and it's expected up 2.1% y/y ex-food and energy. Tokyo CPI for Jan is expected up 1.8% ex-food and energy. A miss might not cause a large reaction but a soft reading could start up the BOJ conversation once again, especially chatter about negative rates.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| National CPI (DEC) (y/y) | |||

| 2.4% | Jan 29 23:30 | ||

| National CPI Ex Food, Energy (DEC) (y/y) | |||

| 2.1% | Jan 29 23:30 | ||

| National CPI Ex-Fresh Food (DEC) (y/y) | |||

| 2.6% | 2.7% | Jan 29 23:30 | |

| Tokyo CPI (JAN) (y/y) | |||

| 2.1% | Jan 29 23:30 | ||

| Tokyo CPI ex Food, Energy (JAN) (y/y) | |||

| 1.8% | Jan 29 23:30 | ||

| Tokyo CPI ex Fresh Food (JAN) (y/y) | |||

| 2.2% | 2.3% | Jan 29 23:30 | |

| Eurozone CPI (JAN) (y/y) [P] | |||

| -0.5% | -0.2% | Jan 30 10:00 | |

| Eurozone CPI - Core (JAN) (y/y) [P] | |||

| 0.6% | 0.7% | Jan 30 10:00 | |

| Germany CPI (JAN) (y/y) [P] | |||

| -0.3% | -0.1% | 0.2% | Jan 29 13:00 |

| Germany CPI - EU Harmonised (JAN) (y/y) [P] | |||

| -0.5% | -0.2% | 0.1% | Jan 29 13:00 |

| Germany CPI (JAN) (m/m) [P] | |||

| -1.0% | -0.8% | 0.0% | Jan 29 13:00 |

| Germany CPI - EU Harmonised (JAN) (m/m) [P] | |||

| -1.3% | -1.0% | 0.1% | Jan 29 13:00 |

| Industrial Production (DEC) (m/m) [P] | |||

| 1.3% | -0.5% | Jan 29 23:50 | |

| Industrial Production (DEC) (y/y) [P] | |||

| -3.7% | Jan 29 23:50 | ||

| Initial Jobless Claims (JAN 24) | |||

| 265K | 300K | 308K | Jan 29 13:30 |

| Continuing Jobless Claims (JAN 17) | |||

| 2385K | 2405K | 2456K | Jan 29 13:30 |

Fed Waits, RBNZ Shifts

The Fed touched on softer short-term inflation but better growth in a statement that had something for everything but nothing definitive or surprising. On the day, the Australian dollar was the top performer while the loonie lagged to a fresh 5-year low. The RBNZ followed up the Fed decision by shifting to neutral and flexing its jawbone. Our Premium subscribers who got on those 2 Premium shorts in AUDJPY, issued on Monday are realizing 200 pips on the 1st trade and 130 pips on the 2nd trade, which was filled after last night's release of higher than expected Aussie CPI temporary lifted the pair.

The Fed upgraded its economic assessment to 'solid' from 'moderate' but lowered its view on inflation, saying it has declined and may decline further. The key caveat was that officials remain confident in medium-term inflation which is a signal they believe low inflation is a one-off effect due to oil and that stronger inflation pressures are in the pipeline because of jobs growth.

The market wavered after the release. In general, the US dollar climbed against the commodity currencies while slipping against the yen and holding against EUR and GBP. The Fed is in 'wait and see' mode so we will await economic data and Fed comments in the coming weeks to see if the 'patient' view on liftoff will remain.

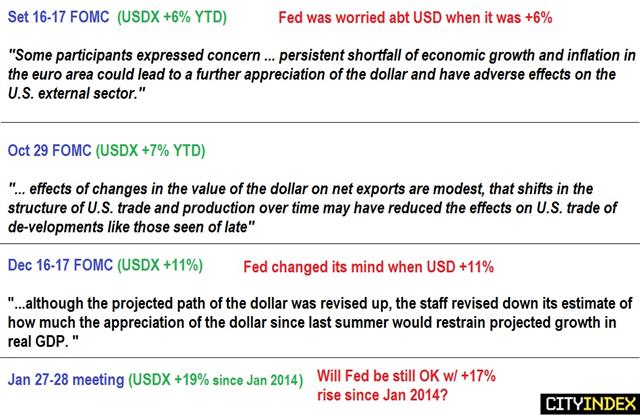

The Fed refrained from mentioning the US dollar as a source of downward pressure on inflation but if corporations continue to refer to FX headwinds, that may change in March. It's also something we'll look for in the FOMC minutes.

The Fed was followed by the RBNZ an hour later. Governor Wheeler said rates will be on hold for longer and that the next move could be higher or lower and with that he completely removed the hawkish bias. He called the NZD rate unjustifiably, unsustainably high. It's fresh rhetoric but part of a long jawboning campaign that's been sprinkled with intervention. His comments had the desired effect and sent NZD down 60 pips to a fresh cycle low.

The RBNZ comments helped to drag down the Australian dollar and left it nearly unchanged on the day despite the higher CPI reading. That's a bearish signal.

Up next, the focus shifts to Japan with retail sales data due at 2350 GMT. The market is looking for a 0.9% y/y rise but it's unlikely to move USD/JPY, which is testing the downside of its recent range at 117.40.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| National CPI (DEC) (y/y) | |||

| 2.4% | Jan 29 23:30 | ||

| National CPI Ex Food, Energy (DEC) (y/y) | |||

| 2.1% | Jan 29 23:30 | ||

| National CPI Ex-Fresh Food (DEC) (y/y) | |||

| 2.6% | 2.7% | Jan 29 23:30 | |

| Tokyo CPI (JAN) (y/y) | |||

| 2.1% | Jan 29 23:30 | ||

| Tokyo CPI ex Food, Energy (JAN) (y/y) | |||

| 1.8% | Jan 29 23:30 | ||

| Tokyo CPI ex Fresh Food (JAN) (y/y) | |||

| 2.2% | 2.3% | Jan 29 23:30 | |

| Consumer Price Index (Q4) (q/q) | |||

| 0.2% | 0.3% | 0.5% | Jan 28 0:30 |

| RBA trimmed mean CPI (Q4) (q/q) | |||

| 0.7% | 0.5% | 0.3% | Jan 28 0:30 |

| Consumer Price Index (Q4) (y/y) | |||

| 1.7% | 1.8% | 2.3% | Jan 28 0:30 |

| RBA trimmed mean CPI (Q4) (y/y) | |||

| 2.2% | 2.2% | 2.4% | Jan 28 0:30 |

Fed hawkish on semantics, but yen gets last word

USD rallied against all FX with the exception of the Japanese yen-- the overall winner following today's release of the FOMC statement, which can be best summed up as less dovish than expected, or slightly more hawkish than anticipated. The resulting declines in the stock market – 195 pt loss in the Dow meant a 2.75% decline in two days, which is the biggest back-to back drop since February 2014. Full charts & analysis.

Fed hawkish on semantics, but yen gets last word

USD rallied against all FX with the exception of the Japanese yen-- the overall winner following today's release of the FOMC statement, which can be best summed up as less dovish than expected, or slightly more hawkish than anticipated. The resulting declines in the stock market – 195 pt loss in the Dow meant a 2.75% decline in two days, which is the biggest back-to back drop since February 2014. Full charts & analysis.

Fed Left in a Tough Spot, Aussie CPI Next

Separate economic data points on Tuesday left a wildly different impression of the US economy as we count down to the FOMC. The euro snapped back on short covering and was the top performer while USD lagged. The Australian dollar was also an underperformer ahead of a critical CPI report. 1 of 2 Premium AUDJPY trades from last night has been filled and is in the money, while both NZDCAD remain in progress.

The Fed is highly unlikely to remove a commitment to be patient before raising rates in its decision on Wednesday. Policymakers are looking for clarity on the economy but the picture is growing murkier. Nevermind the divergence between the US and other economies, it's impossible to get a clear idea of the domestic economy.

Dec durable goods orders fell 3.4% in the fifth consecutive flat or negative reading. It was compounded by substantial negative revisions. Details were also weak. Capital goods orders non-defense ex-air fell 0.6% compared to +0.9% expected; also with a big negative revision.

That data point sent a shudder through the US dollar and market participants are increasingly talking about no Fed hikes this year. Then just 90 minutes later reports on consumer confidence and new home sales both smashed expectations to the highest levels since the crisis.

The Fed won't want to pick sides and that ensures no substantial changes in guidance but other factors could weigh on the dollar. The Fed will have noticed falling corporate earnings due to the strong dollar and low inflation because of commodities. That could lead Yellen to downgrade inflation forecasts and note the dollar – both could cause a squeeze on USD.

But first it's the Australian dollar in focus with the 0030 GMT release of Q4 GDP. This is a major report ahead of the Feb RBA decision. The market is divided about the chance of a rate cut and this will likely cast the deciding vote. Overall CPI is expected up 1.8% y/y but the trimmed mean is key; it's expected up 2.2% y/y.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Price Index (Q4) (q/q) | |||

| 0.3% | 0.5% | Jan 28 0:30 | |

| RBA trimmed mean CPI (Q4) (q/q) | |||

| 0.5% | 0.4% | Jan 28 0:30 | |

| Consumer Price Index (Q4) (y/y) | |||

| 1.8% | 2.3% | Jan 28 0:30 | |

| RBA trimmed mean CPI (Q4) (y/y) | |||

| 2.2% | 2.5% | Jan 28 0:30 | |

| New Home Sales (DEC) (m/m) | |||

| 1.032M | 0.450M | 0.451M | Jan 27 15:00 |

| New Home Sales Change (DEC) (m/m) | |||

| 11.6% | -6.7% | Jan 27 15:00 | |

| Cap Goods Orders Nondef Ex Air (DEC) | |||

| -0.6% | 0.9% | -0.6% | Jan 27 13:30 |

| Cap Goods Ship Nondef Ex Air (DEC) | |||

| -0.2% | 1.0% | -0.6% | Jan 27 13:30 |

| CB Consumer Confidence (JAN) | |||

| 102.9 | 95.1 | 93.1 | Jan 27 15:00 |

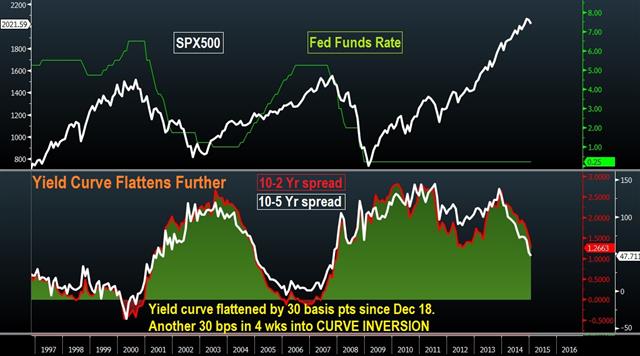

Flattening yield curve unleashes blow to Fed hike hype

US equity markets are gradually confronting the reality that a 2015 Fed hike is out not feasible after US durable goods orders tumbled 3.4% in December after a 2.1%, undershooting expectations of a 0.3% rise. The 11.6% increase in December new home sales was not enough to reverse the market sell-off, which was initiated by disappointing earnings from Caterpillar (-7.1%) and Microsoft (-9.6%) due to slowing global growth and negative impact from the strong US dollar. And what about the sign from the flattening US yield curve?

| Act | Exp | Prev | GMT |

|---|---|---|---|

| New Home Sales (DEC) (m/m) | |||

| 1.032M | 0.450M | 0.451M | Jan 27 15:00 |

| New Home Sales Change (DEC) (m/m) | |||

| 11.6% | -6.7% | Jan 27 15:00 | |

EUR/CHF Squeezes Higher, Euro Rebounds

Markets were active but failed to grab a clear theme to start the week as New York is hit with a massive snowstorm. The pound was the top performer while the Swiss franc lagged badly. Australian business confidence highlights a quiet Asia-Pacific session. 17 days after the last of our Premium AUDJPY shorts hit its final target, has the pair got any more downside left? We answer with 2 new trades and 3 charts in the pair.

A rally in EUR/CHF to 1.0170 from 0.9800 in Europe was the highlight of the day. The move started after the SNB reported the largest one-week rise in sight deposits since March 2013. Ostensibly, deposits would count as inflows into Switzerland by there was talk about financial engineering to reverse it via swaps or debt repurchases.

Overall, EUR/CHF is a murky trade because technical limits are loosely defined, fundamentals don't matter in the short term and flows can be enormous. The trade so far has been to ride the momentum but many traders are staying away until the dust settles.

Overall, the euro was generally stronger despite the Syriza win. Compromise from European leaders about maturity extensions and lower yields may allow everyone to escape unscathed and that helped sentiment but it was clear that euro sellers were present at 1.1280 and 1.1300 so rebounds will be hard pressed to extend.

That pattern is also clear in USD/CAD as chatter mounts about a second BOC rate cut. The OIS market now sees a 30% chance of a cut at the March meeting. USD/CAD slides have been short-lived and a dip near 1.2400 was bought aggressively and pushed the pair to a fresh cycle high of 1.2487 late in the day.

Up next, the Australian dollar is in focus with NAB Business Confidence due at 0030 GMT. There is no consensus but the prior reading was +1. Japanese small business confidence is due at 0500 GMT as well. Neither report is likely to impact the market.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| NAB's Business Confidence (DEC) | |||

| 1 | Jan 27 0:30 | ||

Syriza will yield to austerity

Considering that Troika is willing to grant another extension to Greece's bailout plan, and that even Alex Tsipras' fervent supporters are aware that Greece must repay €4.3 billion in March, Syriza will have to play ball and “compromise” shall remain the name of the game. Full chart & analysis.

One more Webinar - Tuesday morning for Asian folks

If you missed my webinar last week, I'm doing one more on Tuesday morning so that Asia/Pacific-based residents can attend. 9:30 am GMT, 5:30 pm Singapore, 10:30 pm Sydney. REGISTER FREE HERE

Euro Below 1.11 after Greek Elections

Greek anti-austerity party Syriza won a decisive election victory and may hold a parliamentary majority. The stronger-than-expected result sent the euro a half cent lower in early Asia-Pacific trading. Japanese trade balance is due later and Australia is on holiday. The 2 AUDUSD Premium sh0rt trades from mid December have hit their final targets for 210 and 230 pips.

Syriza will win 149-151 seats in the 300 seat parliament, according to the Interior Ministry. It may take another 6-8 hours to see if they have achieved the 150 seat threshold but either way, they will have a strong mandate based on rejecting bailouts and austerity.

In his victory speech, Syriza leader Alex Tsipras didn't soften his rhetoric and he said the Troika era is over. The euro was down 48 pips to 1.1156 in early trading and EUR/JPY down 82 pips to 131.12.

Even if Syriza is able to form a slim majority, they may look to form a coalition to strengthen their hold on power. The most-likely partner appears to be the Communists and they openly favor a Eurozone exit. Headline risk in the remainder of the week will be paramount as the balance of power is decided.

Other key weekend news included a renewal of aggression in Ukraine with pro-Russia forces launching an assault on the key port of Mariupol in the deadliest move in months.

At the ECB, the Bundesbank remained defiant with Weidmann saying he has doubts QE will be effective. Overall, however, his comments didn't signal open hostility and that's slightly dovish for the euro because it shows the Germans aren't willing to risk any kind of scorched earth policy to avoid QE.

Looking ahead, Japanese trade balance is due at 2350 GMT and expected to show a healthy 11.2% y/y rise in exports and a 2.0% rise in imports. The minutes of the Dec 19 BOJ meeting are also due.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Merchandise Trade Balance Total (DEC) | |||

| ¥-660.7B | ¥-740.3B | ¥-891.9B | Jan 25 23:50 |

| Adjusted Merchandise Trade Balance (DEC) | |||

| ¥-712.067B | ¥-925.010 | Jan 25 23:50 | |

| Merchandise Trade Exports (DEC) (y/y) | |||

| 12.9% | 11.2% | 4.9% | Jan 25 23:50 |

| Imports (DEC) (y/y) | |||

| 1.9% | 2.3% | -1.7% | Jan 25 23:50 |