Intraday Market Thoughts Archives

Displaying results for week of Apr 26, 2015هل ارتداد اليورو لم يتنهي بعد؟

تصريح لجنة السوق الفيدرالية المفتوحة أتم الصورة الحمائمية الفورية لها باعترافها بالتباطؤ الشتوي، مع تعزيز وضعية الدولار الأمريكي بتخليها عن تقويمها الاسترشادي واستبداله بالتعويل على البيانات. ارتفاع كبير في الدولار الأمريكي أمام كل العملات الرئيسية بعد بيان الاحتياطي الفيدرالي مباشرةً، فيما تراجع بمقدار سنتين أمام اليورو والإسترليني والدولار الأسترالي. المزيد هنا

The Best UK Election Scenario for Gilts is:

The most preferred UK Election scenario for the pound and gilts would be a Conservative-led minority government. Here is why.

Fed Rips Calendar, Dax Buyers Close Hedge, Euro Soars

The FOMC's decision to abandon all time-based guidance temporarily boosted, but here is why the euro rally is not yet finished. Full charts & analysis

Euro Jumps as Hedgers Let go

A weak US GDP report crushed the dollar but the Fed continues to look toward a brighter future. The dollar was near the bottom of the FX rankings but bounced on the Fed to finish ahead of JPY and NZD. The kiwi was hurt by the RBNZ and the yen is in focus with the BOJ later. Yesterday's EURUSD trade came close to its final target and remains in the green. EURAUD deepens, while NZDUSD, GBPAUD, and EURGBP premium trades remain in progress. AUDNZD long was opened minutes prior to the RBNZ announcement and remaisn well in the green.

At this point, most of what can be said about Q1 GDP (dismal) and the Fed (optimistic) has already been said. Instead, we take a look at the intermarket dynamics that illustrate the squeeze that's taking place in the euro, which posted its best day in six months. Knowing whether it's a squeeze or a fundamental trade helps us decide what to do next.

Looking only at FX, we know that euro shorts are a crowded trade. The CFTC futures positioning data shows net shorts near a record. That alone left EUR/USD shorts vulnerable to a squeeze but earlier this year they held strong in tests of 1.10.

How do we know this time was different?

We know because the euro trade wasn't only in FX. Many traders focus only on the market in front of them but taking a broader view shows us that long-term trades are clearly being unwound. One major trade has been the ECB QE bond trade with many funds outside the Eurozone taking part. They bought German Bunds, helping to drive yields below 0.10% but a large portion of those traders hedged the FX portion of the trade because, naturally, they were worried about euro weakness.

In the bond market today, there was clearly a rush to the exits in German Bunds. Yields moved up 12 basis points to 0.285%. As those traders exited the trade, they also unwound those hedges, which meant buying euros and selling dollars.

The same trade took place in the German DAX. The main stock index was down 3.2%.

In summary, today's trade had all the hallmarks of institutional, real money traders bailing out on what had been a very successful trade. That kind of thing can feed on itself for days. Keep a very close eye on Bunds and the DAX in the days ahead for clues about whether strong hands step back in or if more cash out.

In the near term, the focus moves to the BOJ. Expectations of any action should have fallen to nil after a report today in Nikkei that Kuroda is set to maintain a forecast for a gradual rise in inflation. Question about more action has moved toward October.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Price Index (1Q) [P] | |||

| -0.1% | 0.5% | 0.1% | Apr 29 12:30 |

Dollar Faceplants Ahead of Fed Decision

The pound shook off a weak GDP reading and the Aussie soared as the US dollar dropped yet again. On the day, AUD was easily the best performer while the US dollar lagged. Japan is off today for the Showa holiday as markets settle in ahead of the FOMC and US GDP. Today's EURUSD trade is in progress, EURAUD deepens in the money, AUDCAD was stopped out, while NZDUSD, GBPAUD, and EURGBP premium trades remain in progress.

Another day, another soft US data point. On Tuesday it was consumer confidence falling to 95.2 compared to 101.3 previously and 102.2 expected. The dollar had already been sagging ahead of the data but the numbers kicked off another half-cent of selling.

Cable was particularly impressive, now gaining in 11 of the past 12 sessions, touching a six-week high of 1.5336 and closing near the highs. All that came after a weak Q1 GDP report that immediately caused a 100 pip decline. The pound erased that drop within an hour and then rallied another full cent.

The Australian dollar also held a relentless bid. Yesterday Stevens said he didn't want to talk about monetary policy so close to the May 5 decision and that market took that as a sign of a lack of conviction, sending AUD/USD to 0.8030 from 0.7875. We question the wisdom of that analysis and the bond market still prices it close to a 50/50 decision but it's been impossible to fight the dollar trend recently.

That might change on Wednesday. Q1 GDP may be softer than the 1.0% consensus but it may also allow the traders to refocus on the future and the US economy isn't likely to be as soft as recent data indicates.

The Fed is a major factor as well. The tone of the statement will surely be more downbeat but that's priced in. What the Fed will be reluctant to do is take away the possibility of a hike in June or beyond and that may help the dollar find a bottom.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q1) [P] | |||

| 1.0% | 2.2% | Apr 29 12:30 | |

| GDP Price Index (Q1) [P] | |||

| 0.4% | 0.2% | Apr 29 12:30 | |

USD Can’t Shake That Sinking Feeling

The dollar can't seem to regain its footing. Coming into New York trading, the dollar was at the top of the FX leaderboard but it unravelled to finish near the bottom. There wasn't a clear catalyst but a soft Markit services PMI hurt.

Better news on Greece lent a bid to the euro as it rose more than 100 pips from the lows at the start of US trading to 1.0923. Greek 10-year yields fell a full percentage point after combative finance minister Varoufakis was taken off EU/IMF negotiations in a sign that Tsipras wants a deal. Late on Monday in a TV interview, he said they will reach a deal.

Technical developments were fascinating as cable and AUD/USD rose to one-month highs. Cable faces little immediate resistance but after gains in 10 of the past 11 sessions, it's a tough trade to chase. The AUD/USD highs on Monday fell just short of the 100-day moving avg and that will be pivot point.

At next, RBA Governor Stevens speaks at 2240 GMT. Some jawboning is assured and the market is evenly-divided on a May rate cut so traders will be hanging on his every word for a hint.

At 2350 GMT, Japanese retail sales for March are expected up 0.6% m/m. Talk about fresh BOJ moves later this week has cooled. Only 2 of 34 economists surveyed by Bloomberg expect a move but 23 expect something later this year.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Trade s.a (MAR) (m/m) | |||

| -2.2% | Apr 27 23:50 | ||

| Retail Trade (MAR) (y/y) | |||

| -7.3% | -1.8% | Apr 27 23:50 | |

| RBA's Governor Glenn Stevens Speech | |||

| Apr 27 22:40 | |||

| Markit PMI Composite (APR) | |||

| 57.4 | 59.2 | Apr 27 13:45 | |

| Markit Services PMI (APR) | |||

| 57.8 | 59.0 | 59.2 | Apr 27 13:45 |

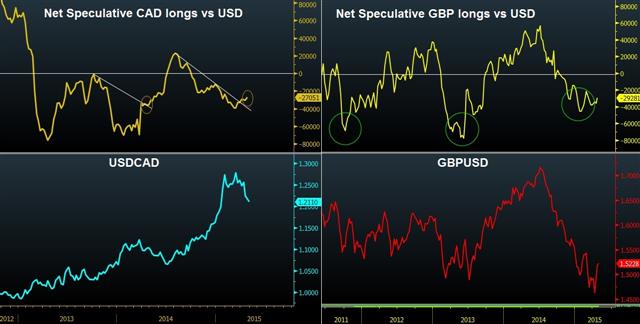

GBP & CAD Speculative Positioning vs USD

We focus on emerging developments in GBP/USD GBPUSD and USDCAD positioning among futures speculators as GBP shorts vs. USD fell to 29,281 contracts last week (from 36,045) -- the least negative in more than seven weeks, while net shorts in CAD vs. USD fell to an 11-week low of 27,051 contracts (from 30,578). Full charts and analysis.

USD Headwinds May Fade, Yen Shorts Shrink Further

The week ahead features Q1 GDP and the FOMC decision, two events widely expected to weigh on the USD dollar but if we look beyond the story begins to improve. Markets open the week relatively unchanged. CFTC positioning showed a small squeeze on dollar longs and a retreat of yen shorts. Our Premium EURUSD long at 1.0605 hit its final 1.0880 target on Friday. Other Premium trades: NZDUSD, GBPAUD, EURGBP and GBPUSD are currently in progress.

Friday's durable goods orders was another black eye for the US dollar and the ninth consecutive soft reading. Weak shipments underscored how soft Q1 GDP will be, with economists downgrading estimates to around 1.0% but many in the market are looking for worse.

In addition, the Fed statement will surely reflect a disappointing quarter, soft housing numbers and dismal capex.

The thing is, that may be completely priced in now. After the numbers, or perhaps even sooner, the market will begin to look ahead and that could give the US dollar a spring. We noted at the start of April that, seasonally, it's the worst month for the US dollar on many crosses but the reverse is true for May. Keep that in mind with just four trading days left in the month.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -215K vs -212K prior JPY -14K vs -23K prior GBP -29K vs -36K prior AUD -35K vs -42K prior CAD -27K vs -31K prior CHF 0K vs 0K prior

Some shorts in GBP, CAD and AUD were squeezed out but euro shorts remain steadfast. A third push to 1.10 (or beyond) would rattle that confidence.

Yen shorts are the least bearish since the week of Oct 10, before the surprise BOJ moves. With the market nearly back in balance, it sets up a nice run in whatever direction USD/JPY eventually breaks.