Intraday Market Thoughts Archives

Displaying results for week of Jun 27, 2021Cardano and gold beyond jobs

Cardano still looks good by several technical measures. The US jobs report came and went with yields extending their plunge, Nasdaq leading indices to new highs, metals holding firm and the US dollar coming off its highs ahead of the July4th Weekend. It was another case of stronger than expected payrolls +850K, unexpected rise in the unemployment rate to 5.9% from 5.8% and average hourly earnings remaining a soft +0.3% m/m. As for Cardano, the 3 charts below highlight it is making the transition from stabilisation to ascent, while Bitcoin remains supported above the 28K/29K H&S target. How about gold? It quietly rose $40 this week, with our WhatsApp Broadcast Group members riding the wave from $1853/55. As long as real yields continue to chart the same pattern shown in last week's video, buyers are here to stay.

Non-Farm Payrolls Are Pivotal

The early consensus on non-farm payrolls is 700K job in June. That should firm up after ADP employment rose 692K compared to 600K expected, though that report has a poor recent track record.

Whatever the employment number is on Friday, there is plenty of evidence that jobs are available. The issue is that workers aren't applying for low paid jobs the way they used to. Part of the reason is that in much of the country, jobless benefits will extend through August.

That's allowing workers to be picky in what work they will accept. In addition, families have an incentive to wait until after the summer when school restarts.

That thinking puts the Fed on a slow path to tapering but it could change if there is a surprisingly strong jobs report. In particular, the wage indications could convince some FOMC members that inflation risks call for more action.

For the dollar, the trade is straightforward around USD/JPY. It's testing the April 2021 highs and not far off the 2020 peak at 112.23. That's followed by a series of annual highs that stretch up to 115.00. Dominos will begin to fall whenever the jobs growth materializes.Eye on Motionless July & Real Yields

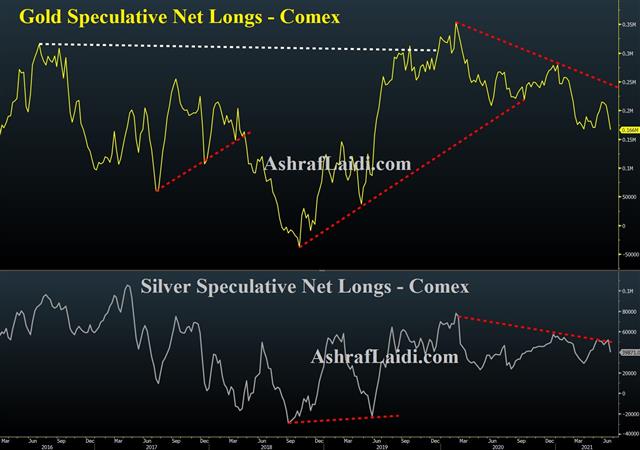

Half the year is done with the Canadian dollar at the top of the leaderboard and the yen at the bottom. Some of that unwound on Tuesday despite a positive risk backdrop in a hint that flows might be overwhelming fundamentals at the moment. We take a closer look at July seasonal patterns. The US June ADP survey is up next, exp 600K from prev 978K, more on this below. 15 mins later, Canada's April GDP follows.The chart below shows gold struggles to hold above the crucial support of 1760/3, as real yields trade in an increasingly narrow range, paving the way for a potential breakout.

Comments from Fed governor Waller yesterday stating his preference for start thinking about tapering helped drive down metals again earlier this session.

We got more evidence of a strong recovery building as we ramp up for a big finish to non-farm payrolls week. The June US consumer confidence report from the Conference Board was at 127.3 compared to 119.1 expected with the 'present situation' component jumping. Deeper down in the report, the 'jobs plentiful' metric also rose to the highest since 2000 in another sign that it's more a matter of 'when' US jobs come back than 'if'.

The Fed's Barkin pointed to Aug and Sept as months when he expects to see strong hiring because of the expiration of jobless benefits and schools reopening.

For July, the risk backdrop continues to improve with the S&P 500 closing higher for five straight days, hitting a new record. In the month ahead, the seasonals continue to be positive. July is the fifth best month on average over the past 20 years but is second best in recent years as its ripped off 6 straight gains in July and 10 in the past 12.

More broadly, there are much fewer seasonal signals in July. In fact, the average move in the Dollar Index in the past 20 years is precisely 0%. There is some fractional strength in the commodity currencies but not as much as equities would indicate.

The day ahead on the economic calendar is a busy one. The ADP jobs report is up at 1215 GMT/13:15 London/16:15 Dubai but note that its recent track record is dismal. Canadian GDP for April will be released at the same time but CAD risks may be skewed upwards on the data because a soft report will be dismissed due to lockdowns.

Comments from Fed governor Waller yesterday stating his preference for start thinking about tapering helped drve down metals again earlier this session.

Gold Tests Support, Inflation Tests Weidmann

Bundesbank leader Weidmann cited a newly found Galapagos turtle in his speech on Monday. The species was thought to be extinct for 100 years but one was found last month in May. He said inflation has also been written off but it's not dead.

He warned that upside risks are now predominant in the eurozone. Most importantly, he said the preconditions for curbing pandemic emergency bond purchases have now been met.

Weidmann and other hawks are increasingly framing pandemic measures against the coming end of the pandemic. They argue that they agreed to measures during the pandemic but not afterwards. Doves want to let the programs run because of fears about repeating premature tightening following the financial crisis.

In the eurozone, the doves will undoubtedly win and that's why the euro was little moved by Weidmann. Globally though, the hawks are finding receptive audiences.

Much is different about this crisis. The financial crisis left scars and a legacy of austerity. This time, governments won't pull back quickly and that changes the calculus for central banks.

In its monthly manufacturing survey, the Dallas Fed had special questions on hiring. In June, 42.5% of companies said workers are looking for more pay than offered, which compares to 33.8% in April. Supply chain complaints have exploded as well with nearly half of companies expecting them to last for at least seven months.

To start the week though, the market was tentative with commodities and commodity currencies lower. Treasury yields also took back Friday's advance. It's month/quarter end so flows could be tricky through Wednesday.PCE Cools the Inflation Narrative

PCE core inflation rose 3.4% in May, as expected. The headline number at 3.9% also matched estimates. The numbers come after CPI data hit 5% in a big surprise. The market eventually digested (and shrugged off) the high CPI reading but there's a limit to how many inflation surprises the Fed will tolerate.

The dollar sold off on the headlines but hours later it recovered, in part to a climb in Treasury yields. The bond market continues to be a key barometer. It's the single-most sensitive asset class to inflation and the Fed. With 10s at 1.52% the message about transitory inflation is clear but it will be tested repeatedly in the months ahead and a major repricing would have enormous implications for virtually every global asset class.

The new week starts with a strong rally in crypto, led by a 10% weekend jump in ethereum. The resolve of the bulls this month despite a battering has been impressive.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +89K vs +118K prior

GBP +18K vs +32K prior

JPY -53K vs -47K prior

CHF +14K vs +9K prior

CAD +43K vs +44K prior

AUD -17K vs -18K prior

NZD +3K vs +3K prior

This is the first look we have at post-Fed positioning and it highlights the likelihood that late-coming longs in EUR and GBP were squeezed out on the big USD rally after the FOMC.