Intraday Market Thoughts Archives

Displaying results for week of Jul 28, 2019Trump Hikes after Powell Cut, onto NFP

Trump announced a new round of tariffs on China Thursday in a surprise move that led to a flight to safety. The yen was the top performer while the Australian dollar lagged. The tariff news reverses any progress on trade and should reverberate for weeks. For those of view who entered the DAX trade featured in Tuesday's HotChart, congrats. Meanwhile, each of the existing 3 Premium trades are in the green, including EURNZD at +350 pts.

The market was digesting the Fed news Thursday when Trump tweeted that he was putting 10% tariffs on all $300 billion of Chinese imports that are currently tariff-free. They will go into effect on Sept 1, baring a change of heart. Trump also noted that tariffs could be raised further depending on how talks go.

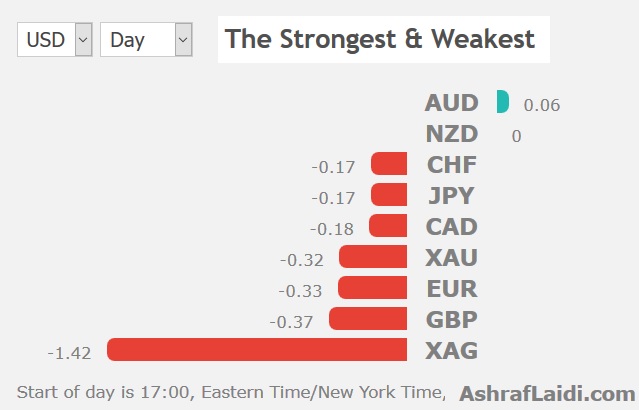

The move damaged through all yen crosses with AUD/JPY closing at the lowest since 2011 in a 1.9% fall. WTI crude was already lower but in total it fell more than 7% in its worst one-day loss since 2015. US equity markets fell 0.9% with some retail stocks down more than 10%. Treasury yields fell 6-14 basis points to fresh 3-year lows, with all maturities touching fresh cycle lows. Gold jumped more than $30.

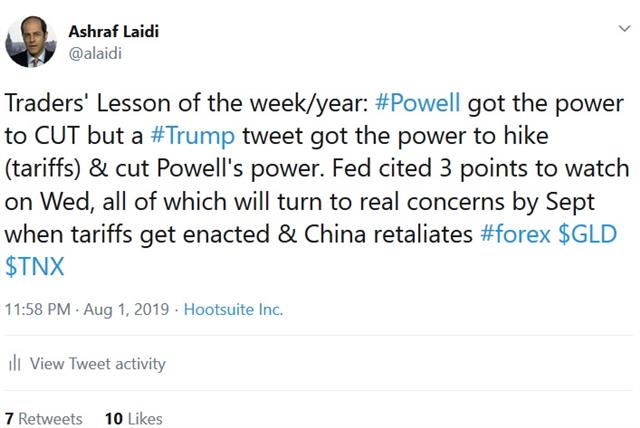

The announcement is a game-changer on almost every front (see Ashraf's tweet above). Powell yesterday specifically highlighted that trade tensions had diminished since May. The fresh escalation means the Fed is now more likely to ease in September. Global growth is also deeper in peril.

The next headline to watch for will be Beijing's response. They had recently pledged to buy more US agricultural goods but that could be reversed and China could retaliate in what would spark a deeper crisis.

One spot to watch is the Chinese currency as the offshore yuan neared 7.00. Allowing the currency to depreciate would signal that China is no longer keen on negotiations.

Not to be lost in all the Fed and tariff talks is that Friday includes the release of non-farm payrolls. The consensus is +165K with unemployment ticking down to 3.6% from 3.7%. Average hourly earnings above the 3.1% y/y expected could put the FOMC in a bind.

Fed Exits Cautiously, BoE Cautious on Brexit

The US dollar jumped after Powell exited the Fed's tightening cycle and stunted expectations for a rate cutting cycle. The dollar was the top performer while the euro lagged, sending the pair to a two-year low. The Bank of England decision is next and expect it to issue the downward GDP revisions, which were signalled early last month. The EURUSD Premium trade was stopped out, while the DOW30 short hit its final target. Ashraf will publish a video for Premium clients ahead of Friday's jobs report focusing on the central USD view. More on the Fed & this month's Jackson Hole conference below.

The Fed statement was largely unchanged but pointed to global growth and disappointing inflation as the reason for a cut. Rosengren and George, however, dissented in a sign of disunity on the strategy. The larger market moves came in the press conference when Powell said the rate cut was a “mid-cycle adjustment to policy” rather than the start of a more protracted easing cycle. That sent the dollar to fresh highs and cut down the stock market, which sending US 2-year yields as much as 15 basis points above pre-Fed levels.

The market was pricing in a 78% chance of a second cut at the September meeting ahead of the Fed and that has dropped to 64%. It could fall further in the days ahead if other Fed members dial back easing rhetoric. Also, start to watch the US yield curve again. Renewed inversion (as short yields exceed longer term yields) is likely to require fresh easing from the Fed, especially that the fact remains: A neagtive yield curve has always led to rate cuts (but not always to recessions).

If so, the dollar will continue its rally. EUR/USD broke through 1.11 and the ninth consecutive decline in the Australian dollar. AUD/USD came within a fraction of the 0.6956 June low and that's a key spot to watch in the day ahead.

Onto Jackson Hole

In the day ahead, we will probably get statements from Rosengren and George on their dissents. Other Fed officials may also appear on TV and print to manage the message. Watch for comments from Fed doves in particular, if they also hint at a wait-and-see approach then the market will re-price. The Fed's statement was largely expected, but Powell's press conference contained plenty of verbal stumbles, twists and turns (with regards to the length of easing period & otherwise), leaving us to expect fresh market-moving speeches from Powell in the upcoming weeks and certainly at this month's Fed press conference at Jackson Hole.The other focus in the day ahead will be the Bank of England. The BOE has a conditional hiking bias based on a smooth Brexit (or some other positive resolution). The consensus is that it will be maintained but there may be hints of a removal. Even in the case of a soft Brexit, it's tough for the BOE to justify a hike while the rest of the world is easing and with Europe struggling. At the same time, they might be hesitant to offer anything that would further damage the pound.

أربع نقاط رئيسية من القرار الفيدرالي اليوم

في الساعة 9 مساءً بتوقيت مكة المكرمة، تتوقع الأسواق من مجلس الاحتياطي الفيدرالي تخفيض أسعار الفائدة لأول مرة منذ 11 عاماً. وهناك أربعة أجزاء مهمة في قرار هذا المساء من البنك المركزي الأمريكي. التحليل الكامل.

From Shy BoJ to Actionable Fed

The yen edged higher on Tuesday after Kuroda refrained from taking any firm steps toward easing or altering forward guidance. JPY was the top performer on Tuesday while the pound lagged again. The FOMC decision is the big event on Wednesday, but Canadian GDP and US ADP employment are up first. Trade positioning ahead of the Fed decision is covered in the video for Premium susbcribers posted below, titled: "Beyond the Fed's What Ifs" The video includes why Thursday's trade remains valid for the post-Fed playbook.

The BOJ didn't alter its guidance about keep easy policy at least through spring 2020 in what was a mild disappointment for yen bears. Kuroda also avoided any strong hints at action. Instead he emphasized a shift in communication to say the bank now pledges to take action if price momentum is lost, rather than simply considering steps. It's a minor change and especially insignificant compared to the big turns at the Fed, ECB and elsewhere. It led to a modest dip in USD/JPY but was largely ignored as the market dials in on the FOMC. Ashraf expects a retest of 108.90s before a gradual drop towards 107.80s.

The bigger move was once again in the pound as it hit a new two-year low in Asia before flattening near 1.2150. Meetings between Ireland and the UK solved nothing with Johnson insisting the UK will leave on Oct 31 and Varadkar insisting the withdrawal agreement won't be reopened.

Another trend was the divergence in AUD/CAD as oil prices and the proximity to the relatively-strong US economy aid the loonie. In contrast, the Australian dollar fell for the eighth consecutive day and is now within 50 pips of the June low of 0.6832 – a level that's doubly important because it was also the 2016 low.

The FOMC decision follows next, setting the tone for the remainder of the week, making Friday's US jobs figures appear as a distant event. The Fed recieved further indications that the economy is solid as consumer confidence rose to 135.7 compared to 125.0. That's the third-best reading this century. The PCE report was largely in line with expectations but inflation was a touch on the light side and that should embolden those calling for an insurance cut on Wednesday and an effort to get back to 2%.

There are some risks before the FOMC with the ADP report expected to show 150K new jobs, up from 102K a month ago. Canada's May GDP is also on the agenda with a 0.1% rise expected.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| 0.1% | 0.3% | Jul 31 12:30 | |

| ADP Employment Change | |||

| 150K | 102K | Jul 31 12:15 | |

| CB Consumer Confidence | |||

| 135.7 | 125.1 | 124.3 | Jul 30 14:00 |

DAX HotChart

We have a new chart in the HotChart section, open for everyone. Some may agree, others are not sure. What do you think? Full analysis.

Pound off Lows as Fed, BoE Draw Closer

The pound is off its lows against the US dollar as are all currencies, but the currency was sent to a fresh 2 1/2 year lows after Boris Johnson's plan to force a showdown with the EU on a Brexit deal. Ashraf presents an alternate view below to the pound's decline in his tweet earlier today. Equity indices are down across the board after Trump referred to a "problem with China" in the trade talks. The Premium GBP short was allowed to be stopped out, while Thursday's EUR trade (issued moments before the ECB) is currently in +200 pips in the green. Ashraf will lay out his pre-FOMC strategies and video in the next 20 hours. Look out for key US data on core PCE, home sales and consumer confidence.

Back to the conventional explanation

Johnson's cabinet continues to take a hard line on the potential for a hard Brexit. Gove said the government is now operating on the assumption of a no-deal Brexit and Raab said they are 'turbo-charging' no-deal preparations and that the EU must change its 'stubborn' position. Johnson reiterated that he will take the UK out of the EU on October 31.The FX market is beginning to think he's serious. Cable fell 160 pips on Monday in a free-fall through 1.2300 and to as low as 1.2119 Tuesday morning. Johnson was meeting with the Irish government in the hopes of pushing them towards a solution on the backstop but every public indication from all EU members is that the deal won't be re-opened.

Ultimately, parliament will have the final say and that will stop a no-deal Brexit but fears will be stoked in the meantime. Technically, cable has little support until the post-Brexit vote lows at 1.19 and EUR/GBP broke out to a 23-month high.

Elsewhere on Monday the market was remarkably stable as we await major data and central bank decisions (the most vital of which is Fed on Wednesday and BoE on Thursday). The Bank of Japan --which faced a delicate balancing act as it aimed to sound dovish enough to halt a yen rally while not moving on rates -- kept its policy settings unchanged overnight while cutting its inflation view.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Confidence | |||

| 38.5 | 38.7 | Jul 31 5:00 | |

| CB Consumer Confidence | |||

| 125.1 | 121.5 | Jul 30 14:00 | |

إلى أين ستصل أسعار النفط؟

حان الوقت لتحليل أسعار النفط. منذ بداية العام، ارتفع سعر النفط الخام الأمريكي بنحو ستة وعشرين في المائة، لكنه انخفض بنحو ثمانية وعشرين في المائة عن أعلى المستويات التي شهدها قبل عشرة أشهر. فإلى أين يذهب سعر النفط مع الأخذ بعين الاعتبار العوامل الثلاثة الرئيسية ؟ التحليل الكامل