Intraday Market Thoughts Archives

Displaying results for week of Jan 03, 2016China's Yuan Holds Markets Hostage

Whether this week's violent moves in global equities are the main reason markets and the US dollar failed to garner any meaningful gains despite another solid 292K increase in US nonfarm payrolls is a question that will be asked several times this year. The US jobs report did show a disappointing 2.5% y/y in average earnings –a reflection of lasting slack in the pool of available workers—a widely prevalent phenomenon in both sides of the Atlantic—if not the Pacific.

Some economists claim that a recovery in average hourly earnings is just a matter of time as long as labour markets tighten further and the unemployment rate remains low. They may be disregarding the quality of these jobs (retail, hospitality and leisure), which are not exactly known for their high pay…neither the fact that employees with two part-time jobs may be helpful to personal consumption, but no to the extent of stoking inflation.

You want a free currency? Careful

This week, every trader learned a new reality in intermarket dynamics: The PBOC announces a lower CNY value at its 1:15 GMT fixing, causing Asian equities and US futures to fall on worries of a lower Chinese purchasing power, prompting the safe haven JPY higher across the board –including against the US dollar. The process has been especially striking as Chinese markets shut for the 2nd day in the first 4 days of the year.The West had long demanded China to free its currency from artificial weakness, until the day has finally come. The yuan's SDR era is coinciding with broadening weakness in the world's 2nd biggest economy, and speculators can't get enough out of shorting its currency. Last month's decline of more than $100bn in China's FX reserves is a sign of Beijing's attempts to stabilize its currency (buying by selling USDs) to stem excessive capital outflows. Beijing is really trying, but free markets is also synonymous to further CNY pain.

More interest rate cuts in China are inevitable, and additional CNY weakness is now a question of 5% or 10%. The Fed could always flex its muscle and deliver a cosmetic hike in the Fed Funds rate of 0.25%, which is meaningless for monetary policy as long as not a single cent of the +$4.4 trillion in bonds is sold. So think twice before you go on about policy divergence.

There are currently 6 Premium trades in progress (5 in the green 1 in the red), addressing the above situation. This week, we closed GBPJPY and DAX shorts for a cumulative total of 1,005 pips (points), while the GBPAUD short was stopped out for a 500-pip loss.

مقابلتي على سي أن بي سي بعد بيان الوظائف الأميركي

ماذا قلت عن الصين، الدولار، الين، النفط، أرامكو والبورصات لحسين السيد

It’s China, and more

What's hurting markets now is the lack of a firm guiding hand in China but it's not the only thing weighing on sentiment. The euro and Swiss franc led the way while Aussie lagged Thursday as the early-year fright continues. Aussie retail sales slowed to 0.4% in Nov from 0.6%. In the Premium Insights, 4 out of the 5 Premium trades are in the green, while the GBPAUD trade was stopped out.

Oftentimes, the only thing worse than poor leadership is flip-flopping leadership. China is renowned for long-term vision and planning but monetary officials in the country have badly tarnished the image over the past six months and it took another hit today.

Securities regulators introduced circuit breakers in July to halt trading when markets move more than 7%. That was a reactionary move. Now with panicky stock traders now blaming the circuit breakers for two declines this week, they've removed them.

Similar flip-flops took place with stock sale bans that were brought in, ready to expire and then renewed at the last minute. Reforms designed to curb debt and housing speculation have similarly been introduced and then watered down.

Investors like a clear set of rules and when regulators have the ability to close markets, ban selling and halt cross-border flows, it's no surprise that markets are jittery.

At the same time, the problems aren't only China. We highlighted worries about central banks yesterday, including fear that the Fed is dead-set on hiking despite an economy, grinding along at 2% without any inflation.

It's not only the Fed. On Thursday BOC Governor Poloz offered near-absurd levels of optimism in forecasting that non-commodity export businesses in Canada are about to boom. He outlined how 10,000 Canadian export businesses had shuttered in the past decade because of the strong Canadian dollar. He said it would take time but he thinks they're coming back.

They're not. And the Canadian economy is in the grips of a once-in-a-generation commodity bust. Once they realize it, the Canadian dollar will have even further to fall.

In the short term, the overwhelming focus is on China and what happens to Shanghai stocks and the yuan is crucial. Panicky PBOC officials likely can't stand the thought of another drop in Chinese stocks into the weekend but there are also rumors of a 10% one-off yuan devaluation because they have been rattled by the constant political criticism of the slow yuan devaluation.

If fragile market sentiment can somehow survive through Asia, then it's onto nonfarm payrolls.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nonfarm Payrolls (DEC) | |||

| 211K | Jan 08 13:30 | ||

Ashraf on BNN Earlier Today

Ashraf's earlier hit on BNN discussing Saudi Black Swans and Chinese Yuans - Full interview.

What’s the Worry?

We look at the myriad of reasons that sentiment has deteriorated and whether it's justified. Oil fell 6% on Wednesday and commodity currencies were beaten up again while the yen led the way. Australian building approvals are due later. There are currently six Premium trades in progress, three in profit and three at a loss.

The magnitude of negativity caught virtually everyone off guard to begin the year as aggressive selling roils markets.

China

The most-widely cited problem is China and the worries kicked off with a 6.8% opening day decline in the Shanghai Composite. Officials have spent the past three days shoring up markets with various interventions and selling bans and Chinese shares have risen modestly. Concerns about yuan weakness are prevalent but it's not a shock to see it softer.China scares come and go. The past two episodes have shown that the rest of global markets are increasingly affected. That's a scary thought for the future because big swings in Chinese equities are the norm.

In the near-term, there is no reason for sustained risk aversion. The PBOC and government both have plenty of firepower to shore up the economy and it could be unleashed any time.

Broader emerging markets

This is a genuine worry. The World Bank released its semi-annual report Wednesday and downgraded global growth in 2016 and 2017 with a softer trajectory for the US, Japan and China envisioned. None of that is a big surprise but what caught our attention was a forecast for a 2.5% contraction in Brazil. Other commodity-producing emerging markets are taking heavy hits as well and if there is crisis in 2016, they're a good bet.The Fed

The FOMC minutes were a tad on the dovish side Wednesday but they're old news. In the past two weeks several influential Fed members have been talking about 3-5 rate hikes in 2016. The market has been largely humoring the Fed's tough talk and doesn't believe it's coming but Yellen has now proved she can hike. The market could probably swallow 2-3 hikes but any more would show the Fed is needlessly dominated by hawks.Geopolitics

Tension in the Middle East and exaggerated military claims from North Korea are nothing new. Perhaps the headlines have added to the sour mood but until the bullets start flying (and that won't be any time soon) then any fears are overblown.Overall

We're through three days of trading in 2016. Nothing in the global outlook has materially changed. It's the time of year when flows dominate. Like everyone, we've been surprised by the magnitude of worries and we will continue to watch closely but the ADP numbers were strong today and the ISM non-manufacturing index remained healthy.The jury should stay out at least until the second week of the year.

In the short-term, the focus is on the Australian dollar, which is down 4.4% against the yen already. The main releases are at 0030 GMT with Australian trade balance and building approvals. It's tough to envision either number being strong/weak enough to overcome the swings in sentiment at the moment.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Building Approvals (NOV) (m/m) | |||

| 3.9% | Jan 07 0:30 | ||

| Building Approvals (NOV) (y/y) | |||

| 12.3% | Jan 07 0:30 | ||

| Trade Balance (NOV) | |||

| -3,305M | Jan 07 0:30 | ||

China Renews Stock Selling Ban

Chinese authorities arrived to shore up stocks Tuesday after an early slide, we look at their options. The yen was the top performer while the euro lagged. Chinese economic data is due later. The new Video Insights has been posted from Premium subscribers.

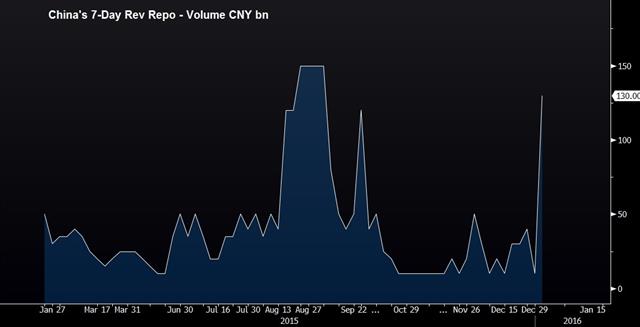

A ban on executive and large shareholder stock sales in China was set to expire on Friday but the latest reports say it will be extended. The PBOC delivered a huge 130B yuan cash injection and there was talk of outright stock buying even though the official policy has been moving away from intervention.

The PBOC doesn't want to seem reactionary with a rate cut so they may simply be looking to stabilize markets for a few days before delivering a rate cut on the weekend or next week. One thing they aren't likely to do is a broad RRR cut recent policy announcements suggest more fined tuned changes in the RRR based on individual banks and sectors rather than across-the-board cuts.

If China can stabilize markets expect the focus to shift to the US economy. The ADP jobs report and FOMC minutes are due Wednesday. Both have their flaws but they start the buildup towards non-farm payrolls on Friday.

Economists have been slashing tracking estimates of Q4 US growth with some now in the +0.5% range. That would leave 2015 annual growth below 2% -- hardly the type of strength to base a series of gradual rate hikes on.

Another spot to watch is USD/CAD. The pair briefly broke 1.40 to a fresh 12-year high on Tuesday. Late in the day, the API announced a large drawdown in crude supplies and if that's reflected in the EIA report, it may underpin crude. However, the inability of oil to hold gains despite the friction in the Middle East is a negative signal.

In the immediate term, the focus shifts back to China. The Caixin services PMI is due at 0145 GMT along with the MNI consumer sentiment index. Neither usually has a market impact but with markets on edge about China, that may not be the case today.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change (DEC) | |||

| 217K | Jan 06 13:15 | ||

| Markit PMI Composite (DEC) | |||

| 53.5 | Jan 06 14:45 | ||

| Markit Services PMI (DEC) | |||

| 53.7 | Jan 06 14:45 | ||

| ISM Non-Manufacturing PMI (DEC) | |||

| 55.9 | Jan 06 15:00 | ||

| PMI (DEC) | |||

| 51.2 | Jan 06 1:45 | ||

| Eurozone Markit PMI Composite (DEC) | |||

| 54 | Jan 06 9:00 | ||

| Eurozone Markit Services PMI (DEC) | |||

| 53.9 | Jan 06 9:00 | ||

| FOMC Minutes | |||

| Jan 06 19:00 | |||

Why China is Snookered for the Moment

A round of risk aversion that started in China went global in a dismal start to the trading year. The yen led the way and commodity currencies lagged in a classic flight to safety. BoJ governor Kuroda speaks later but the focus is on Chinese stock markets. After closing the Premium Insight's GBPJPY short at a 395-pip gain, a new trade in a yen cross was issued, alongside a new note & chart on the existing EURUSD trade.

There isn't a simple explanation for the Monday's 7% plunge in Shanghai stocks that tripped circuit breakers, but a few factors help make sense of it.

Yuan weakness and the softer Caixin PMI were widely cited but the expiration of a stock selling ban might be a clearer culprit. On July 8, Chinese securities regulators banned senior management from selling stocks along with investors who owned more than 5% stakes. That's set to expire on January 8 and the selling now may be in anticipation of selling then.

That could mean more selling to come and the PBOC may not be able to fight it. On Dec 30 the PBOC's chief economist wrote that policymakers should improve guidance. He said officials needed to do a better job of keeping financial stability in mind when changing the RRR or short-term rates.

That may mean the PBOC will want to signal a move before acting. Now the PBOC will look like it's reacting to markets if it cuts. That was the case in August and it was interpreted as a sign that the economy was even worse than markets suggested and it sparked a worse panic.The PBOC wouldn't want to be blamed for a second rout so they may play it safe and stay sidelined.

While China grabbed the main headlines, there were some critical developments in the West. German HICP in December was 0.2% y/y compared to +0.4% expected. That knocked the euro to the lowest since the ECB.

In the US, construction spending was far weaker than expected and the ISM manufacturing index fell to a six-year low. Markets finished 2015 in a complacent mood about the economy but they may have been harshly woken up.

In the short term, the swings in China may come quickly. ETFs suggest more Chinese stock selling early but it will be a minute-to-minute trade. Expect USD/CNY to be fixed around 6.60/63 from 6.50 at 0115 GMT. It's a large move and the market still poorly grasps the mechanics of the fix so there may be an overreaction.

The other event on the calendar is Kuroda at 0710 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (DEC) | |||

| 51.2 | 51.3 | Jan 04 14:45 | |

| ISM Manufacturing PMI (DEC) | |||

| 48.2 | 49.0 | 48.6 | Jan 04 15:00 |

| PMI | |||

| 48.2 | 48.9 | 48.6 | Jan 04 1:45 |

| Eurozone Spanish PMI Manufacturing | |||

| 53.0 | 53.1 | 53.1 | Jan 04 8:15 |

| Germany Markit PMI Manufacturing (DEC) | |||

| 53.2 | 53.0 | 53.0 | Jan 04 8:55 |

| ISM Prices Paid (DEC) | |||

| 33.5 | 35.2 | 35.5 | Jan 04 15:00 |

China Data, MidEast Hit Markets, Yen Fired up

Rising tension bordering on hostility between Iran and Saudi Arabia led to a raucous start to 2016 trading. USD/JPY hit a two-month low in early trading as commodity FX was pelted. The China PMI from Caixin remained in negative territory for a tenth month. There are currently 5 Premium trades in progress.

Simmering tensions between Iran and Saudi Arabia came to a boil after a Shiite cleric was executed Saturday. That set off protests and a war of words that escalated as the Saudi embassy was ransacked. Saudi Arabia retaliated by expelling Iranian diplomats and breaking off diplomatic relations.

Both countries are considered the main heavyweights in the Mideast and oil market. Friction there quickly sent oil 1.5% in early trade. That's a relatively small jump that could grow much larger unless tensions are deescalated.

Despite the rise in oil, commodity currencies were sharply lower and the yen higher on risk aversion. Flows are dominating as the market sorts itself out following the holidays and Asian stocks are sharply lower.

In the bigger picture, slowing emerging markets remain a top theme to start the year. The Caixin PMI fell to 48.2 from 48.6 and 48.9 expected. USD/CNY is also in the spotlight as it was fixed at 6.5032 from 6.4936. The offshore yuan is down 0.5% on the day to 6.6032.

The Australian dollar was down 85 pips on the worries with AUD/JPY down 160 pips on risk aversion. Japanese and Chinese stocks are down 2-3%. USD/JPY fell to the lowest since October as the pair broke 120.00 in a quick fall.

Similarly negative sentiment gripped markets to start the year in 2015. Risk managers are rarely in a rush to allocate funds early in the year so support is light. Last year sentiment stabilized and reversed higher around mid-week.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (DEC) | |||

| 51.3 | Jan 04 14:45 | ||

| ISM Manufacturing PMI (DEC) | |||

| 49.0 | 48.6 | Jan 04 15:00 | |