Intraday Market Thoughts Archives

Displaying results for week of May 03, 2015USD shrugs NFP, GBP fears referenda

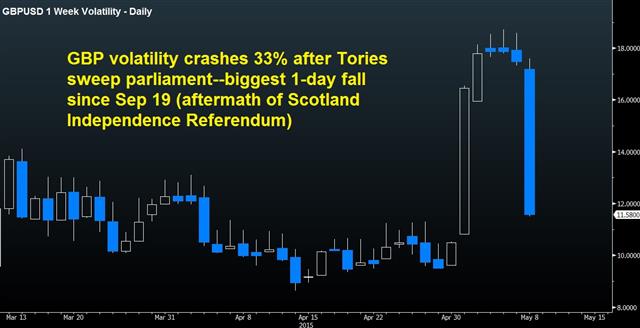

The US April jobs report encapsulated the ongoing divergence between sustainable employment trend and inadequate wage growth. Reaction in USD and yields further reduces the probability of a summer Fed hike. Sterling loses a 1/3 of its post-election rally as the questions of EU Referendum and SNP's expansion cast a shadow over the future of Britain's Union and UK's role in the European Union. Full charts & analysis

Pound Jumps, RBA. Payrolls Next

The impact of the UK election came into clear focus after the pound rallied two cents on the release of the exit poll. Earlier on Thursday, the US dollar was the top performer while the loonie lagged. Along with the election, the minutes of the JPM and RBA Statement on Monetary Policy are next. The biggest mover in our Premium Insights is the GBPAUD long, while EURGBP long has pared its gains significantly.

Cable instantly jumped to 1.5425 after the results of the only exit poll from the UK election showed the Conservatives far ahead with 316 seats compared to Labour at 239. That result would put Cameron's Conservatives just 5 seats short of a majority and with enough seats to continue the coalition with the Liberal-Democrats.

Polling had shown a much closer race and the possibility of Labour and other parties with the seats to form a coalition of their own. Even the pollsters themselves warned that the exit poll could be wrong but for now, it's all the markets have to go on. Traders will be looking for every clue in the coming hours but given the initial reaction, expect more GBP strength if the Conservative vote is confirmed.

The market will have much to digest in the hours ahead of non-farm payrolls. Economists have largely brushed aside the soft ADP reading but markets are likely to be priced below the +228K consensus. Up first are the minutes of the April 7/8 BOJ meeting. Another meeting was held after this one so don't expect much.

A larger event comes at 0130 GMT with the RBA Statement on Monetary Policy. The impression from Stevens was that rates would be on hold for a period after the latest cut but the Statement will add for more clarity and that could mean big moves for the Aussie, especially after the soft jobs report on Thursday.

We also keep a close eye on bond and oil markets. Both reversed in the past day or so and that turnaround could be a signal of a broader US dollar turnaround, especially if non-farm payrolls are strong.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Monetary Policy Statement | |||

| May 08 1:30 | |||

| Nonfarm Payrolls (APR) | |||

| 213 | 126 | May 08 12:30 | |

How to Spot the End of the Great Euro Squeeze

The euro climbed another 160 pips against the US dollar on Wednesday after a disappointing ADP report. It was easily the best performer while the US dollar lagged. The Australian jobs report is up next. Our Premium EURUSD long entry at 1.1210 is over 150 pips in the money. EURGBP and AUDNZD longs are also well in the money, while AUDUSD is at a loss.

The rally in the euro hit a fresh high since Feb 25. It's risen in 12 of the past 17 sessions in what has become a painful squeeze.

We warned for weeks about the overly crowded nature of euro shorts, citing the buildup in the CFTC COT report. But a market can remain crowded for extended periods and there is no telling when a squeeze will come. There is also no easy way to tell when it will end.

A few things to look for:

Signs of capitulation. Look for an outsized move on relatively mild news. Today it was ADP at 169K compared to 200K expected along with some positive murmurs on Greece. That's almost qualifies.

Wait for analysts to capitulate. We haven't heard Wall Street strategists give up on calls for a 95-cent euro yet. Also look for predictions about extreme levels on the other side, like 1.20 or 1.25.

Let the market flatten out before picking a top. Markets sometimes have 'V-shaped' turnarounds but they're hard to sniff out and there will be plenty of time for shorts once a reversal back lower is confirmed.

Finally, keep in mind that this move is as much about the US dollar as it is the euro. It hasn't been a 'euro-short' trade as much as it's been a 'EUR/USD-short' trade. The EUR/USD rally won't stop until US data begins to improve.

Watch the bond market. Another rout took place on Wednesday. That was where the reversal began and that's where it will end.

Overall, EUR/USD is back to the level where it traded before the ECB announced a sovereign QE program on Jan 22. One of the things that gives us confidence that the downtrend will eventually resume is that German Bunds yields can't continue to rise with the ECB buying 60 billion euros of bonds a month. But squeezes can last longer than many expect, especially in trade as crowded as EUR/USD.

Looking ahead, the Australian jobs report is due at 0130 GMT. The retail sales report was close to estimates yesterday and brushed aside but kiwi Q1 jobs were extremely weak. The consensus is for 4.0K new jobs and the unemployment rate rising to 6.2% from 6.1%. The better trade is probably buying AUD; a strong number would confirm that the RBA will remain on the sidelines, while a soft number would be brushed aside as markets wait for the impact of Tuesday's cut.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change (APR) | |||

| 169K | 200K | 175K | May 06 12:15 |

| Retail Sales (MAR) (m/m) | |||

| 0.3% | 0.4% | 0.7% | May 06 1:30 |

| Retail Sales (1Q) (q/q) | |||

| 0.7% | 0.8% | 1.2% | May 06 1:30 |

| Eurozone Retail Sales (MAR) (m/m) | |||

| -0.8% | -0.7% | 0.1% | May 06 9:00 |

| Eurozone Retail Sales (MAR) (y/y) | |||

| 1.6% | 2.4% | 2.8% | May 06 9:00 |

| Unemployment Rate (1Q) | |||

| 5.8% | 5.5% | 5.8% | May 05 22:45 |

| Employment Change (1Q) (q/q) | |||

| 0.7% | 0.8% | 1.2% | May 05 22:45 |

| Employment Change (1Q) (y/y) | |||

| 3.2% | 3.3% | 3.6% | May 05 22:45 |

| Employment Change s.a. (APR) | |||

| 5.0K | 37.7K | May 07 1:30 | |

| Fulltime employment (APR) | |||

| 31.5K | May 07 1:30 | ||

| Part-time employment (APR) | |||

| 6.2K | May 07 1:30 | ||

| Unemployment Rate s.a. (APR) | |||

| 6.2% | 6.1% | May 07 1:30 | |

| Unemployment Rate s.a. (MAR) | |||

| 6.1% | May 07 1:30 | ||

GBP Implied Volatility: 2008, 2010 & Today

The analysis highlight the predominantly inverse relation between GBPUSD and 1-week volatility in each of the recent major episodes of surging volatility. The deepening sell-off in global markets on October 2008 — resulting from the escalation of the housing/subprime crisis, and the uncertainty from the 2010 UK General Election have acted as tremendous triggers for sterling volatility. Most specifically, GBPUSD tended to lead rallies in volatility by 2-4 weeks. Full analysis here

Alberta Vote adds to Busy Calendar

The US dollar ignored a better ISM report and focused on soft trade data but the real story may have been the renewed drop in bonds. The Australian dollar as the top performer and the US dollar lagged. NZD is the bigger loser in Asia after higher than expected Q1 unemployment rate. The highlights on the economic calendar are New Zealand jobs, Australian retail sales and the China services PMI but don't underestimate today's Canadian provincial election. We issued a new Premium trade in EURUSD, while last week's AUDNZD long is over 100-pips in the green. GBPAUD and AUDUSD are currently in the red as is NZDUSD.

The temptation is to blame another slide in the US dollar on Tuesday on the worst trade report in 6 years but the market tends to look forward and not back. The way the FX market was able to overlook good ISM non-manufacturing numbers suggests something else was going on.

Once again we point to the bond market. The rout in Bunds two weeks ago kicked off a squeeze on euro shorts and US dollar longs. That trade appears to be ongoing as Bund yields rose another 6 basis points to 0.51%. The pain was much more dramatic in the periphery as Greek leaders abandoned the pretense of a May 11 deal.

It's concerning that the US dollar was unable to rally on ISM but it's early in an important week of economic data.

The focus shifts to Australia at 0130 GMT for retail sales, which are expected up 0.4% in March. The RBA probably had an advance look at the report so even a soft reading is unlikely to have a lasting effect. The China services PMI from HSBC is due 15 minutes later but it's generally not a significant market mover.

One event that isn't registering on the calendars of many traders is the Canadian election in the oil-rich province of Alberta. The left-wing NDP holds a 20-point lead heading into the polls to threaten the 43-year dynasty of the Progressive Conservative party. The likely winners have promised higher corporate taxes and oil royalties. That may drive investment away from the oil sands and it weighed on CAD Tuesday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (MAR) (m/m) | |||

| 0.4% | 0.7% | May 06 1:30 | |

| Eurozone Retail Sales (MAR) (m/m) | |||

| -0.3% | -0.2% | May 06 9:00 | |

| Eurozone Retail Sales (MAR) (y/y) | |||

| 3% | May 06 9:00 | ||

| Final Services PMI [F] | |||

| 57.4 | 57.8 | 57.8 | May 05 13:45 |

| ISM Non-Manufacturing PMI | |||

| 57.8 | 56.2 | 56.5 | May 05 14:00 |

| Ivey PMI (APR) | |||

| 56 | May 06 14:00 | ||

| Ivey PMI s.a (APR) | |||

| 50.1 | 47.9 | May 06 14:00 | |

| PMI (APR) | |||

| 53.1 | 52.3 | May 06 1:45 | |

| Eurozone Markit PMI Composite (APR) | |||

| 53.5 | 53.5 | May 06 8:00 | |

| Eurozone Markit Services PMI (APR) | |||

| 53.7 | 53.7 | May 06 8:00 | |

| ISM Non-Manufacutring Composite (APR) | |||

| 57.8 | 56.2 | 56.5 | May 05 14:00 |

| Eurozone Spanish Unemployment Change | |||

| -118.9K | -64.8K | -60.2K | May 05 7:00 |

| Unemployment Rate (1Q) | |||

| 5.8% | 5.5% | 5.8% | May 05 22:45 |

| Employment Change (1Q) (q/q) | |||

| 0.7% | 0.8% | 1.2% | May 05 22:45 |

| Employment Change (1Q) (y/y) | |||

| 3.2% | 3.3% | 3.6% | May 05 22:45 |

What to Expect From The RBA

The US dollar continued to creep higher on Monday as the market braces for a big week of economic news. The Canadian dollar was the top performer on Monday while the euro lagged. The RBA decision will be the focus in the hours ahead. Ashraf's Premium Insights will release an AUD-related Premium trade shorrly before the RBA decision, which is due at 00:30 ET, 4:30 GMT, 5:30 BST.

US trading was slightly lackluster to start the week, in part because the UK was on holiday. In the factory orders report, core durable goods orders were revised to +0.1% from -0.5% in a slightly better signal for business investment.

Most traders are looking ahead to more significant economic news later this week. That begins with the RBA decision at 0430 GMT. Among 29 economists surveyed by Bloomberg, just four anticipate no change.

The futures market has pared expectations of a rate cut compared to yesterday. The latest pricing suggests a 69% chance of a cut compared to 31% of no change.

The Australian dollar tracked slightly higher to 0.7850 ahead of the release as two tests of 0.7800 held. The range over the past three weeks is 0.7533 to 0.8076 and whatever the RBA decides could send AUD/USD to the extremes of that range before the end of the week.

Given economist and market expectations, electing not to cut would be the bigger surprise and almost-certainly test 0.8050. If it breaks could depend on the associated language but it would take some extremely dovish comments for that line to hold if there is not a cut. The market is looking at a 50/50 probability of a second cut in August.

That pricing is also important to keep in mind if Stevens cuts. A cut and then a clear shift to neutral would spark a kneejerk lower but also a tremendous opportunity to buy.

There will almost-certainly be anti-AUD jawboning but the effects will be fleeting.

For more on why a cut is likely, see yesterday's IMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Factory Orders (m/m) | |||

| 2.1% | 2.1% | -0.1% | May 04 14:00 |

Pound Under Pressure, AUD in Focus

Sterling was beaten up on Friday as questions arise about the economy ahead of Thursday's election. The new week starts with a modest moves; the euro led last week while the kiwi and yen lagged. CFTC positions showed yen shorts now nearly back to neutral.

The pound fell more than 2 cents on Friday to form a gravestone doji. A similar bearish pattern was traced out on several crosses as the US dollar roared back.

Up next, the focus will be on Australia with the TD Securities' inflation estimate for April due at 0030 GMT. It's not normally a market-mover but traders will be sensitive to Aussie data with the RBA coming up. At 0145 GMT, it's the final HSBC China manufacturing PMI for April. It's expected to improve to 49.4 from 49.2 and is unlikely to

Australian cash rate futures are pricing only a 74.5% chance of a rate cut on May 5, much higher than the 50/50 proposition a week ago. Adding to the swing was a report from PeterMartin of the Sydney Morning Herald that said “concern about a deteriorating economic outlook and a resurgent Australian dollar will force the Reserve Bank to cut interest rates on Tuesday.

On the weekend, colleague Michael Pascoe questioned Martin about the story: “I asked Peter on the record if the story was a drop. He replied: 'I can't say how I got the story. It is accurate.'”

We also remind readers that markets have moved 20-40 seconds ahead of the past 3 RBA decisions.

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -198K vs -215K prior JPY -6K vs -14K prior GBP -34K vs -29K prior AUD -27K vs -34K prior CAD -21K vs -27K prior CHF +1K vs 0K prior

The still-abundant size of the euro short position underscores just how large of a squeeze is possible in the euro. Yen positioning is nearly neutral. Note that on the weekend Kuroda said the timing of reaching the inflation target will be slightly delayed. He emphasized that stimulus isn't needed but it's the first time he's talked about missing the target.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| PMI (APR) | |||

| 49.2 | May 04 1:45 | ||

| Eurozone Markit PMI Manufacturing (APR) | |||

| 51.9 | 51.9 | May 04 8:00 | |