Intraday Market Thoughts Archives

Displaying results for week of May 03, 2020VIX at 2 Month Lows, GBP Hit

Global risk appetite improves across the board after US-China officials announced the resumption of trade talks via telephone, aimed at completing phase 1 deal. GBP lost its post-BoE gain to break below 1.23, dragging down all GBP crosses. US weekly jobless claims hit nearly 3.2 mn last week, down from 3.8 million the prior week and the record 6.9 mn seen in late March. Total claims have now reached 33 mn over the past 7 weeks. The VIX is nearing its lowest level in over 2 months, while oil attempts retesting its 55-DMA of 26.00. 4 out of the existing 5 Premium Trades are currently in the green.

The US Treasury's plan to borrow nearly $3 trillion between April and June to finance the govt's response to the coronavirus economic fallout, means the govt deficit will exceed $4 trillion for the year. This may not be an immediate problem as long as the Federal Reserve is ready to buy up the US debt. But the fact that the debt jubilee (debt forgiveness) has been making the rounds and rumblings about the US reconsidering paying its debt obligations to foreign investors, with whom it has political/commercial disagreements, may raise a more serious question for a later time.

Meanwhile, in a sign of stabilisation, US indices have not had a +(-) 3% day in over 2 weeks, while the VIX is nearing 2-month lows. SPX eyes 2920 and DOW30 24180/200.

GBP was temporarily boosted by the BoE's decision to vote unanimously at keeping rates unchanged at 0.10% and bond purchases steady a £645 bn. As cable retests 1.2280s, EURGBP extends gains towards 0.8830s.

Biggest & Least Mentioned FX Development

One of the least mentioned developments in FX is the surge in the Japanese yen. Just as traders are busy discussing the US dollar's unique funding feature, the yen rises above it and the rest. Year-to-date, JPY is the only currency higher against the greenback, up 2.3%. Most interestingly, USDJPY is down for the 6th consecutive month, the longest monthly losing streak since 2010, when the BoJ had to intervene to stabilize its currency.

We also know the yen remains the oldest form of FX carry trades, a development that has been especially propagated since the Fed's efforts to contain bond yields. As the Fed spends trillions to shore up liquidity in FX and the US treasury market, yield-seeking Japanese investors see no point in clinging for US govt coupons.

As JPY net longs vs USD hit 4-year highs, the divergence between USD Index and USDJPY continues to deepen. Some say it is matter of time Japan's that debt bubble explodes and sends USDJPY to 140 (they've been assaying for the past 15 years). One major difference between Japan's debt set-up and that of the US is that Japanese debt is wholly owned by domestic investors, whereas the US has to rely on its exorbitant privilege (ability to issue the world's reserve currency to pay for imports and capital). There is no need to point out that Japan has a current account surplus equal to 3.6% of GDP vs a deficit -2.3% of GDP for the US. Finally, the Premium Insight's trade of shorting USDJPY at 108.60 is more than 250-pips in the green...and remains open.

The Great Re-Opening Debate

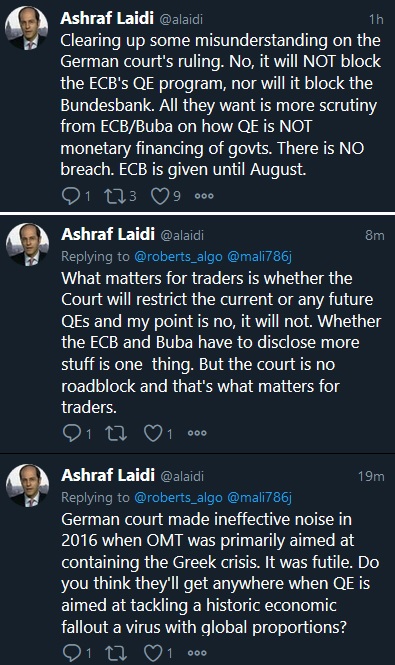

As markets shift attention to the details of reopening global economies, FX trading was dealt a jolt from Germany's constitutional court ruling, ordering the German government to ensure the ECB carried out a “proportionality assessment” of its latest asset purchase programs. More on that below. The market shrugged off the escalation in US-China tensions once again Monday and the focus has now shifted to how economies will reopen and what will happen when they do. The US sevrices ISM is up next.

Economic data Monday showed US factory orders falling 10.3% compared to 9.4% expected. It was the worst report on record, dating back to 1957. Ominously, the decline was almost entirely focused on the transportation sector. The aircraft and auto orders aren't coming back any time soon but it means that other orders still face heavy downward pressure.

More importantly, the market shrugged off another data point. If anything, risk trades ticked higher just after the release. Traders have decided that economic data right doesn't matter at present. It will be horrific and we're undoubtedly in the worst quarter of our lifetimes.

Where the debate starts is on the recovery. The baseline right now appears to be that governments and central banks will absorb much of the losses this quarter and then the economy will start to bounce back.

How much is the big question. Morgan Stanley was out with a report Monday drawing parallels to the China experience. In particular they look at the consumer sector, which is a smaller part of China's economy but the bulk of developed countries. Extrapolating from that experience, they forecast that in Aug-Oct, discretionary retail sales will be down just 10-15% year-over-year.

It's hard to say if that's the market's baseline but that is a tough number to believe. There's no doubt that unemployment in that period will still be in double digits and COVID uncertainty isn't going to go away. Moreover, the comparison with China is a stretch. That country has virtually eradicated the virus so the risks around going out shopping there are low. Few other countries will be able to say the same thing in Q3.

In terms of data, expect the market to tune in progressively as countries and regions open, as we try to sort out exactly how demand and spending will evolve.

With regards to the upcoming services ISM, since services have always outperformed their manufacturing counterpart, we expect more suprises to the upside, expecially as the gig ecomomy flex its muscles during the Covid-19 shutdown.

US Claims Conspiracy, Remdisivir Awaited

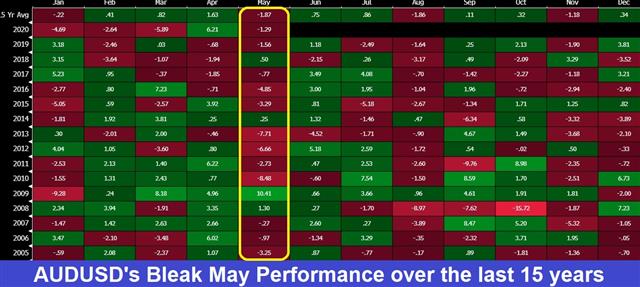

US Indices paring their losses into the final hour of Monday's trade, while the USD recovers after a broadly negative week. Monday began deep in the red in Asia and throughout Europe after the US Secretary of State Pompeo asserted the coronavirus came from a Wuhan lab, while Warren Buffett revealed he dumped airlines stocks. May seasonals point to dollar strength and AUD weakness. Shutdowns relaxed in Italy and Spain. Trump raised the expected US death toll from Covid-19 to 100K and Russia reported over 10K new cases. Gilead's newly approved anti-virus drug remdesivir will be sent to hospitals this week.

A war of words is brewing between the US and China with the source of COVID-19 at the centre of it. On Saturday, Fox Business reported that “there is agreement among most” of the 17 US intelligence agencies that the virus originated in a Wuhan and was inadvertently released.

Secretary of State Pompeo took it a step further on Sunday and told ABC there is “enormous evidence” it came from a lab in the city. However the TV exchange was as confused as it was remarkable as he said “the best experts seem to think it was man-made”. Moments later the interviewer told him that the release from the Director of National Intelligence said it was not man-made, he then said he “has no reason to doubt that.”

To be clear, this is third-highest member of the US executive branch accusing China of a crime against humanity, yet he can't seem to get the story straight.

At best China will brush this off as an election tactic, but more likely it invites a strong rebut that will accelerate the decoupling of the world's two largest economies. A report on Thursday also suggested the US will pursue some kind of punishment or compensation from China for the virus.

Even without the coronavirus, the deterioration in US-China relations would justify the 15% decline in the S&P 500.

Worse still, the Oracle of Omaha was far-from inspiring at Berkshire Hathaway's annual meeting. While he extolled America's ability to overcome challenges and predicted a bright, long-term future, he also repeatedly warned about uncertainties around the virus. His actions spoke even louder as he dumped his entire position in US airlines and didn't invest any of his $137B cash horde.

May Seasonals & Payroll Tax Cuts

Risk assets are soft to start the week and the seasonal trend is for more along those lines. May is the strongest month for the US dollar index and even more so for the Swiss franc in the past 10 years. It's also the worst month for the Australian dollar and the euro over the past decade.Meanwhile, Trump insists he won't pass any further stimulus measures to combat the economic fallout of the virus, unless a payroll tax cut is passed. The measure would be seen as a complementary strimulus to helicopter money, but its impact on widening the deficit remains considerable.