Intraday Market Thoughts Archives

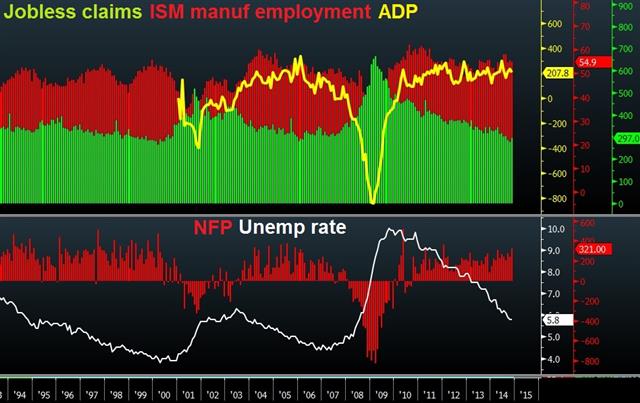

Displaying results for week of Nov 30, 2014Another NFP spurs USD bulls

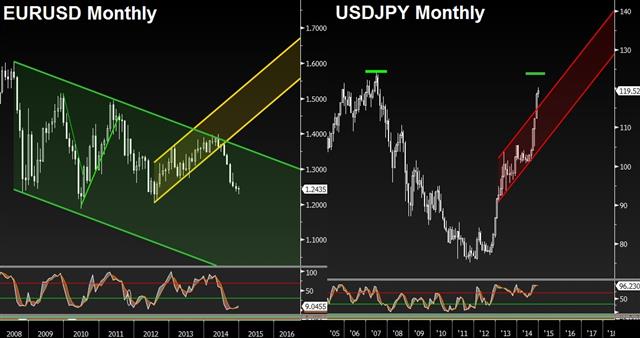

USDX hit a fresh five-year high and USD/JPY hit fresh seven-year highs at 121.69 as the US jobs market shifted to a higher gear of improvement, bolstering chances of a 2015 Fed rate hike. +321K NFP was the biggest monthly gain since January 2012. With USD/JPY rallying to its highest level since July 2007, the pair draws clear parallels with the heights in global equity markets of seven years ago, but strongly contrasting in terms of global inflation, when oil and the rest of commodities levitated at record highs. Full charts & analysis

Recording of last night's webinar

Here is the link to the recording of last night's Post-ECB, Pre-ECB webinar. Click on the link and scroll down for Market Timing webinar #36. Ashraf's part starts 1 hour into the webinar. http://www.hamzeianalytics.com/Educational_Webinars.asp

Draghi Has a Fight on His Hands

Draghi did what he could to push sovereign QE forward but it's clear that ECB hawks have some clout. The euro jumped and was the best performer along with CHF while the Aussie lagged. Markets will have time to digest and get ready for non-farm payrolls because the Asia-Pacific calendar is light. As USDJPY broke above 120, it brought our long closer to the final target, alongside AUDCAD and USDCAD. USDCHF also remains open.

Draghi was careful not to promise QE and said the governing council will reassess the outlook early next year but warned that early 2015 doesn't mean January. He also hinted it was a contentious meeting saying the ECB doesn't need unanimity to act.

The lack of a commitment to do more came despite a dramatic cut in 2015 GDP and inflation forecasts. Growth was slashed to 1.0% from 1.6% and inflation to 0.7% from 1.3% in the Sept forecast – and that's without fully taking into account the latest fall in oil prices.

For almost any central bank, that kind of deterioration in the outlook would prompt some kind of response but the ECB, as usual, wants to wait and see. At this point it's a tough call whether QE will come in Q1.

After the press conference, leaks suggested half the 6-member Executive Board is against QE and several national central bank leaders also surely oppose. That contrasted with a report saying the ECB will prepare measures that could be voted on in January.

The euro was extremely volatile and turned around on at least a half-dozen headlines. The range was 1.2281 to 1.2456 and EUR/USD finished at 1.2378. The days ahead will feature more leaks and conjecture so headline-watching will be critical.

In all the ECB excitement, USD/JPY broke the 120 level for the first time in 7 years. The pair squeezed up to 120.26 but then tumbled to 119.36 in volatile trading. Part of the fall was on apprehension ahead of NFP. Long-term bulls may also have been ringing the register.

Non-farm payrolls is the key event to close the week but it will probably be more instructive about how the US dollar reacts to good/bad news than the news itself. We're getting close to year-end and dollar bulls may sell into strength or continue to pile in.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nonfarm Payrolls (NOV) | |||

| 232K | 214K | Dec 05 13:30 | |

| Eurozone GDP s.a. (Q3) (q/q) | |||

| 0.2% | 0.0% | Dec 05 10:00 | |

| Eurozone GDP s.a. (Q3) (y/y) | |||

| 0.8% | 0.8% | Dec 05 10:00 | |

| FOMC's Mester speech | |||

| Dec 05 13:45 | |||

| Fed's Stanley Fischer speech | |||

| Dec 05 19:45 | |||

Euro boosted by ECB status quo, USD awaits NFP

The euro rallied across the board as the ECB stopped short of announcing additional stimulus in the way of purchasing sovereign bonds. It was more a case of markets expecting the ECB would hint at sovereign bonds purchases, rather than the ECB having announced something different. Meanwhile, USD bulls brace for an upside surprise in tomorrow's US jobs report to alleviate today's bruising of the greenback. Full charts & analysis.

BOC in a Bind, More Aussie Data Next

The Bank of Canada hinted a sooner hate hikes and boosted the Canadian dollar to the best performance in the FX market on Wednesday. The euro was the laggard as it and the yen near key levels. The Australian dollar also remains under pressure with trade and retails sales data due next. Our USDCHF and AUDCAD Premium trades are netting +70 pips each, while USDJPY is up more than 100 pips. All the trades will be impacted by the Aussie data and ECB announcement.

The BOC was caught between signs of a stronger economy and falling oil prices but overall they were more optimistic on the economy. There was no change in the official bias but the statement said the output gap is smaller than expected and also applauded better exports and a stronger US.

USD/CAD fell to 1.1350 from 1.1410 on the decision and the Canadian dollar made larger gains elsewhere, including AUD/CAD where shorts are a theme we have been endorsing. Canada is well-positioned to continue benefiting from a stronger US and some of the concerns in the energy sector are overstated.

On Wednesday, the more-general theme was US dollar strength and that pushed USD/JPY to within a shade of 120 and EUR/USD to a low of 1.2301. Those two big figures will be major levels to watch with the ECB decision in the day ahead.

Sterling was able to buck the trend and climb to 1.5720 as Osborne handed out some pre-election goodies that could help growth in 2015 – although slower estimates of growth and inflation make it unlikely the BOE will hike next year.

In the hours ahead, the Australian dollar will remain in focus with trade data and retail sales due at 00:30/London. Exports were surprisingly weak in the Q3 GDP report so a part of the focus will be there but the main event is retail sales, which are expected up 0.1%.

Consumer continue to hold the line under a suddenly-weak Australian economy but if they stumble, talk about RBA cuts could resume just two days after the latest decision.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (OCT) (m/m) | |||

| 0.0% | 1.2% | Dec 04 0:30 | |

| Eurozone Retail Sales (OCT) (m/m) | |||

| 0.4% | 0.6% | -1.2% | Dec 03 10:00 |

| Eurozone Retail Sales (OCT) (y/y) | |||

| 1.4% | 1.4% | 0.5% | Dec 03 10:00 |

| GDP (q/q) | |||

| 0.3% | 0.7% | 0.5% | Dec 03 0:30 |

UK Autumn statement boosts BoE doves

The 2014 UK autumn statement could be dubbed as the statement of downward revisions as forecasts for growth, borrowing, unemployment and inflation were all revised down for 2015 and beyond. The unavoidable implication for currency traders is that the Bank of England will find it nearly impossible to raise rates in 2015. The fiscal-monetary policy mix will not help, and falling government revenues from North Sea will outweigh any windfalls to consumers. Full charts & analysis.

Dollar in Demand, Australian GDP Next

The US dollar pressed to fresh (and nearly fresh) cycle highs on Tuesday as US stocks and yields climbed. The dollar gained at least 0.5% right across the board while the Swiss franc lagged. The Aussie fell after the RBA bounce and is vulnerable with GDP next.

All else being equal, the US dollar climbs. That's been the story day after day for the past four months and although there weren't any fresh reasons to buy on Tuesday, the dollar climbed.

Fedspeak from a variety of sources was benign or even bland. Perhaps the most notable headline was Vice-Chair Fischer saying the Fed should keep rates near zero if inflation heads lower.

Data was solid with US vehicle says rising to a 17.2m pace in Nov compared to 16.8m expected but that's not generally a market driver.

The commodity currencies came under pressure with oil falling $1.67 and gold down $13 in a retracement of Monday's super-sized gains. Despite some impressive reversal patterns to start the week/month, there was no follow-thru.

One driver of USD strength is the Treasury market. Ten-year yields pushed up to 2.29% from as low as 2.16% Monday. There is talk of rate-lock selling as companies finalize plans for capital raising at low rates.

USD/JPY hit a fresh 7-year high of 119.29. Technically, there isn't much standing in the way of 120.00 but the market was hesitant to press. But not that it was also hesitant to back off and that's a bullish signal. We issued 2 new Premium trades ahead of this week's ECB meeting and the subsequent week's SNB announcement. Existing USDJPY longs are over 90 pips in the money. All details are found in the Premium Insights.

Looking ahead, the Australian dollar will be the major focus, especially with Friday's cycle low of 0.8414 nearby. The main event is at 0030 GMT when Q3 GDP will be released and is expected up 0.7% q/q. Two internal numbers to watch are government spending and exports (for a sense of the AUD boost).

Thirty minutes later, the China non-manufacturing PMI will be released. It was at 53.8 and although the impact is smaller than the manufacturing data, a soft reading could spark fresh China worries and weigh on AUD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (Q3) (q/q) | |||

| 0.3% | 0.0% | Dec 03 6:45 | |

| GDP (Q3) (y/y) | |||

| 1.4% | 0.6% | Dec 03 6:45 | |

| Net Exports of GDP (Q3) | |||

| 0.8% | 0.65 | -0.90 | Dec 02 0:30 |

| Gross Domestic Product (Q3) (q/q) | |||

| 0.7% | 0.5% | Dec 03 0:30 | |

| Gross Domestic Product (Q3) (y/y) | |||

| 3.1% | 3.1% | Dec 03 0:30 | |

| Philadelphia Fed's Plosser speech | |||

| Dec 03 17:30 | |||

| Markit PMI Composite (NOV) | |||

| 57.2 | Dec 03 14:45 | ||

| Markit Services PMI (NOV) | |||

| 57.1 | Dec 03 14:45 | ||

| ISM Non-Manufacturing PMI (NOV) | |||

| 57.5 | 57.1 | Dec 03 15:00 | |

| PMI (NOV) | |||

| 53.8 | Dec 03 1:00 | ||

| PMI (NOV) | |||

| 52.9 | Dec 03 1:45 | ||

Massive Reversal on Manic Monday

A wave of commodity buying splashed some impressive reversals on the charts. The Canadian dollar was the top performer while the US dollar lagged. The Australian dollar was also soft with a key RBA decision just hours away. Ahead of tonight's RBA decision and this week's BoC announcement, Premium trades include USDJPY, USDCAD, AUDCAD and EURGBP. Charts and relevant trade ideas are in the Premium Insights.

The OPEC decision and Swiss referendum sparked a tide of selling in early trading Monday but it was overwhelmed by a later tsunami of buyers. Crude rallied 7% from the intraday lows, gold climbed nearly $80 and silver jumped 17%.

The most compelling chart might be gold. The bullish reversal engulfed the previous 15 days of trading and the close was well-above the November high. The textbook says that's one of the strongest buying signals. Still, it's challenging to envision a compelling reason to buy gold (ECB QE perhaps?).

In FX, US dollar selling was the main theme. USD/CAD also posted an outside reversal with the BOC looming on Wed. Poloz is faced with the conflict of quickly-improving economic data but plunging energy prices.

One thing that's important to keep in mind is that this is the final RBA decision until February so whatever Stevens says will have to last for more than 2 months. That could make officials more dovish as they think about heading on vacation rather than managing a stumbling economy.

The decision is scheduled for 0330 GMT. If the RBA hints at more cuts the key level to watch will be the Asia-Pacific low of 0.8418. That was also the lowest level since 2010.

Other data on the calendar includes Australian Q3 current accounts and building approvals but both will be overshadowed by Stevens. A final event to watch is a rate decision from the Reserve Bank of India; there is talk of a rate cut with inflation falling.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Current Account Balance (Q3) | |||

| -13.6B | -13.7B | Dec 02 0:30 | |

| Building Approvals (OCT) (m/m) | |||

| 5% | -11% | Dec 02 0:30 | |

| Building Approvals (OCT) (y/y) | |||

| -13.4% | Dec 02 0:30 | ||

| RBA Interest Rate Decision | |||

| 2.5% | 2.5% | Dec 02 3:30 | |

| RBA Rate Statement | |||

| Dec 02 3:30 | |||

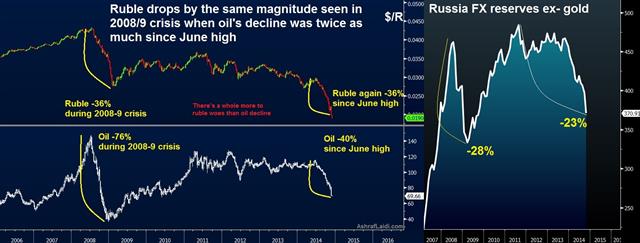

Deflation threatens as German PMI contracts, ISM Prices tumble, ruble wilts

The 2nd contraction in Germany's manufacturing PMI over the last three months, the lowest prices paid index figure in US manufacturing ISM in 23 months and fresh record lows in the Russian ruble, highlights the impending global disinflationary spiral in H1 2015, which would leave central banks, including the Fed, little choice but to continue talking the hawkish talk instead of walking the hawkish course. Full charts & analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit US Manufacturing PMI (NOV) [F] | |||

| 54.8 | 55 | 54.7 | Dec 01 14:45 |

| ISM Manufacturing PMI (NOV) | |||

| 58.7 | 57.8 | 59.0 | Dec 01 15:00 |

| Germany Markit PMI Manufacturing (NOV) | |||

| 49.5 | 50.0 | 51.4 | Dec 01 8:55 |

| ISM Prices Paid (NOV) | |||

| 44.5 | 52.0 | 53.5 | Dec 01 15:00 |

EUR/CHF Higher After Swiss Vote

Swiss voters overwhelmingly rejected a referendum that would have forced the central bank to hold 20% of its reserves in gold. EUR/CHF rose 18 pips to 1.2039 in early trading. Japanese capex and Chinese manufacturing data is due later. The existing Premium Insights include USDJPY, USDCAD, AUDCAD and EURGBP. All charts are in the Premium Insights.

The Swiss gold referendum was rejected by a 77-23% ratio. The large margin of victory can be seen as an endorsement of the SNB, the EUR/CHF peg and post-crisis monetary policy. Gold trading has yet to begin but if the move in EUR/CHF is any indication, the result wasn't fully priced in.

The SNB released a statement to say it was pleased with the result of the referendum and repeated statements about being ready to take immediate action if required.

Gold fell $24 on Friday to $1167 and support is at $1150 and the November low of $1131. Oil also remains in focus after the 10% collapse on Friday. The market may be cautious ahead of US trading because a wave of trading is expected after two days of holidays.

Other headlines circulated about the quality of US holiday weekend shopping but it's very difficult to separate PR from hard data. The shift towards online shopping severely undermines most of the data.

RBNZ Governor Wheeler also speak and said the level of NZD was “unjustified and unsustainable” but also lamented that there is little the central bank can do to alleviate it – a sign that further intervention could be off the table.

Early moves in the market show the euro 20 pip higher and AUD/USD nearly 40 pips lower. The driver for the latter could be a report showing declining property prices in China for the seventh consecutive month.

For the euro, the ECB's Lautnschlaeger said on the weekend she sees little room for further monetary easing. The ECB meeting is on Thursday.

In the near term, the focus shifts to Q3 Japanese data on capital spending. The consensus is for a 2.0% y/y rise but the risk is to the downside after the terrible GDP numbers. The report is due out at 2350 GMT along with company sales and profit data.

At 0100 GMT, China is in the spotlight with Nov manufacturing data expected to slip to 50.5 from 50.8. The latest round of worries about China (and AUD) began after private numbers showed a slide to 50.0.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's William Dudley speech | |||

| Dec 01 17:15 | |||

| Capital Spending (Q3) | |||

| 3% | Nov 30 23:50 | ||