Intraday Market Thoughts Archives

Displaying results for week of Aug 30, 2020Picking Tops or Following Through?

Here is the OPEN-ACCESS link for our Premium video, making the case for a new Premium trade —more importantly, please make sure to focus on the rationale, the analysis and the execution.

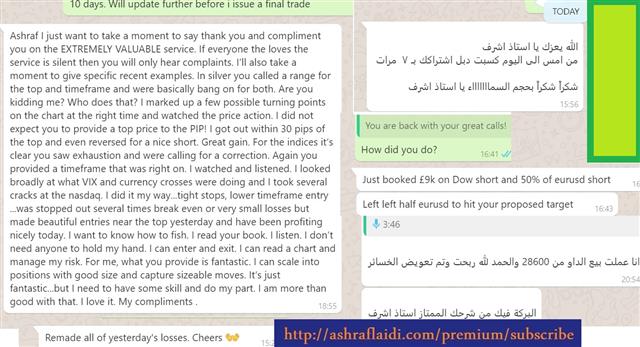

And below are a few comments from members of our WhatsApp Broadcast Group who in addition to receiving the Premium video (like the rest of Premium subscribers), were sent a series of voice and written notes via WhatsApp before and after Friday's NFP, guiding them through Friday's 3% swings (+ and -) in the DOW30.

Risk Rocked Ahead of NFP

We have been highlighting the breakdown in correlations this week as the US dollar reversed alongside Treasury yields. We also highlighted the ugly reversals Wednesday in shares of Apple and Tesla. Ashraf is comparing Wednesday's bearish outside day candle on Apple to the Dax30's candle on Thursday.

Those were crucial signs indicating that trouble was coming. Of course, there are always negative signs in a bull market and the timing of a break is always murky. At best, the risk-reward to the downside this week was increasingly tilted negatively but there was no 'trigger' on Thursday.

Weekly jobless claims at 881K compared to 950K were better than expected, though that was likely due to a new method of seasonal adjustments. Unadjusted claims and total ongoing claims were both higher on the week. The ISM services index had a fractional miss at 56.9 vs 57.0 expected. There was no knee-jerk move on either.

Instead it was a soft open to equities that cascaded as high-flying tech stocks fell. A rush to the exits was compounded by a rush into instruments like SQQQ (ultra-short tech) that traded at extremely high volumes. While the world has been infected by COVID-19, the market has been overcome with speculation and leverage. A pattern of easy money driving up equities followed by swift corrections is becoming increasingly clear.

Outside of stock markets, the price action was much less dramatic and that's an upbeat signal. EUR/USD finished the day flat after an early drop. The commodity currencies fell, but only in the 60-80 pip range. Notably, several risk-sensitive EM currencies like MXN and BRL finished higher on the day.

Outside of FX, the bond market was also well-behaved.

Looking ahead, the US is expected to add 1350K jobs in August. About a fifth of those jobs will be due to temporary census hiring but the seasonal risk is from teachers. Many schools delaying the reopening could compound the usual seasonal adjustment lower. Expect the market to focus on the details.

The Canadian jobs report is also due and forecast to show a +250K net change.Unceasing Enthusiasm, Doubtful Correlations

Profit taking was the likely culprit of the quick turn in the US dollar on Tuesday. EUR/USD touched 1.20 for the first time since May 2018 but that likely kicked off some sell programs due to the crowded nature of the trade and the relatively quick move from 1.08 in late May.

EUR/USD retreated all the way to 1.1845 and the dollar buying spilled over into the rest of the FX market for a time. The turn was another respite for a dollar that continues to rest of the brink of long-term lows.

Comments from Fed Governor Brainard highlighted why. She said the Fed will need to do more in the months ahead and highlighted a playbook that included bond buying, forward guidance and even yield curve control.

The stock market continued to cheer low rates as the new month got underway. Stabilizing or falling cases of COVID in the US are adding to enthusiasm as people increasingly look towards the post-pandemic world where the virus is gone but the legacies of easy central bank and government money continue.

It's tough to imagine a blip in economic data shaking confidence in that trade at this point but there are indicators of extreme greed, like the put-call ratio that are warning signs. This is a time more than ever to watch technicals.