Intraday Market Thoughts Archives

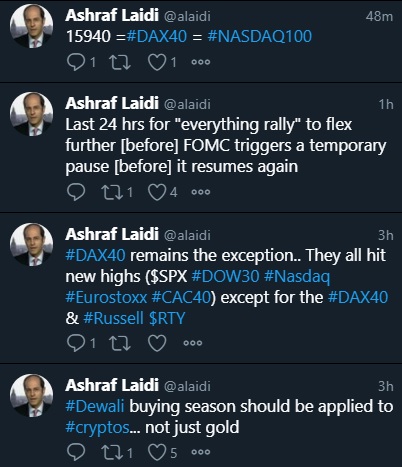

Displaying results for week of Oct 31, 2021Charting more Proactively

Everyone can identify a chart pattern at any time. The key is how to spot a powerful pattern ahead of key economic data in a way that it actually helps predict the market reaction to the report --it's MARKET REACTION/MOVEMENT that counts--NOT the actual report. And that is exactly what we told the WhatsApp Broadcast Group 30 mins prior to Fridays' NFP. We spotted the head-&-shoulder formation in the US 10-year yield, which told us yields would drop after NFP. And although NFP rose, unempRate fell and Avg Hrly earnings rose further, yields ended up falling, boosting gold, hence further powering up our XAUUSD longs for the Group. It's all captured after 2:44 mins of the video.

Rate Hike Re-Think?

Treasury yields fell 6-8 bps at the front end of the curve in the US and 20 basis points in the UK as the market reconsiders the hawkish path of rate hikes that was priced in. That comes after a pushback from both Bailey and Powell.

Bailey argued that the path of rates priced into the UK rates market would push inflation below target at the far end of the projection range. He also attempted to defend the confused signals put out from himself and other BOE members regarding rate hikes.

The GBP market wasn't having it and the pound sank 180 pips against the dollar and 250 versus the yen.

The moves are a reminder that the transitory debate isn't going away soon. Bailey and Powell both highlighted that inflation was in goods and likely due to bottlenecks. They also both argued that the longer prices stay high, the more likely they are to see second-round effects like wage hikes.

Both also cited the jobs market as a key spot to watch. In the US, that shifts attention to Friday's non-farm payrolls report, which is expected to show a rebound to 425K versus 194K in September. One particular spot to watch is labor force participation which is forecast flat at 61.6%. Powell spoke at length about factors that could be keeping it depressed. How it develops with special benefits now gone – especially among prime age workers -- will be a key input for the Fed.No Inflation Panic From Powell

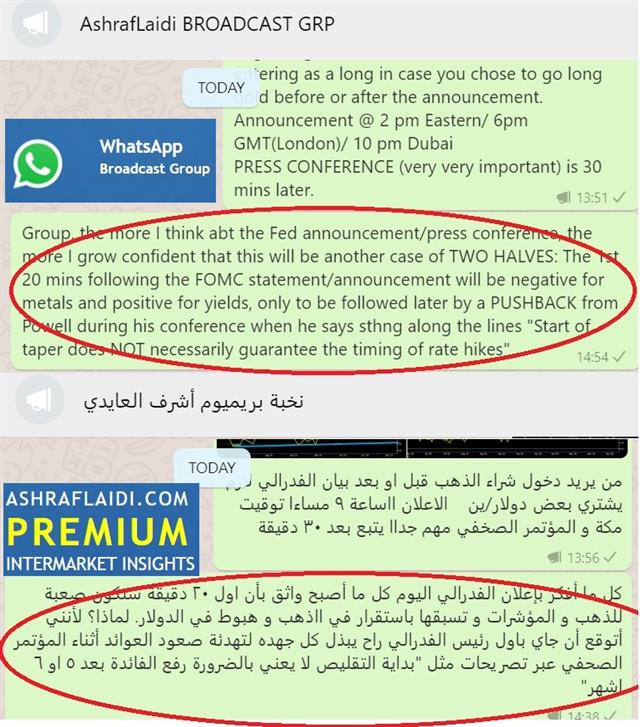

The market has grown increasingly concerned about inflation lately and that led to hawkish shifts at various central banks. In turn, market participants began to think we would get something similar from the Fed.

It didn't happen.

Instead, the FOMC stuck to the plan laid out in the Minutes to taper by $15 billion per month. They gave themselves some flexibility to adjust that pace after the first two months but it was little beyond a token gesture and Powell didn't elaborate.

The statement continued to reference transitory inflation but added some humility saying it was 'expected' to moderate. In the press conference, Powell said they plan to be patient while watching data closely.

Add it all up and the dollar generally declined, though not by a large margin. Long-end rates moved 5-6 bps higher while short end rates were pinned. That steeper yield curve will likely please the Fed, though it's early.

Aside from the Fed, the most-meaningful news on the day was the ISM services index. It showed a booming services economy as the US emerged from the delta wave. The index rose to 66.7 compared to 62.0 expected. New order hit a record.

Evidence is beginning to mount of a strong fourth quarter but that continues to clash with bottlenecks, which Powell said are worsening overall.

Next up is the OPEC+ meeting, which is at noon UK time. There's a strong expectation for another 400k bpd but the intrigue will be at whether OPEC hints at a possible augmentation down the road. Beyond that, the US has made vague threats of action if OPEC doesn't pump more. We will have to wait on that front but news that dates have been set for renewed Iran nuclear talks highlights one path the White House could take to lower crude prices. Crude bulls took some off the table on Wednesday, leading to a nearly $4 decline.What’s Expected From the Fed

The plan was perfectly laid out and communicated over a series of months in an attempt to fight the last war: the taper tantrum. Powell and his deputies laid out the case for a taper of $15 billion month beginning in November and running through June followed by a period of reflation on rates.

The period of reflection has already been scrapped and Fed funds futures are pricing in a rushed taper in order to hike in June.

The main question is whether the Fed opens the door to taper flexibility and how much that's emphasized. In doing so, Powell could add more volatility to future decisions with flexibility or by taking a hard line, reduce it.

In Australia, we saw a slow climb down on prior dovish communication. That's the general trend in central banking and Powell will no doubt be worried about rising inflationary pressures. He will be asked about the transitory narrative and is likely to stick to it, but he will need to be convincing.

Alternatively, the Fed could engineer a tactical retreat by shifting to a $20B/month taper. That would be a hawkish surprise but given the counter-intuitive and volatile moves in FX recently, we hesitate to wade in.Familiar Tune with a Twist

A comment in the ISM manufacturing report summed up everything about the world economy at the moment: "Business is getting stronger, but the supply chain is getting worse every day” a chemical product manufacturer wrote.

The survey itself was a tad stronger than the consensus at 60.4 vs 59.2 expected. Prices paid soared, new orders cooled and customer inventories remain thin.

The Markit manufacturing PMIs for the US and Canada underscored the same themes.

The question from here is what happens next. We're keeping a keen eye on growing covid cases in China and the potential for shutdowns there. At this point, the global supply chain can't survive another blow.

Aside from that, the question is whether bottlenecks are getting worse or better. That's not something easily measured as it's been taken for granted forever. As it limps along we see more reports of companies willing to pass on costs. Perhaps that could unwind later but it's generally something that tends to be sticky. The longer it lasts, the more everyone through the chain will want to be compensated more, including the workers.

That's the question the market continues to struggle with because it's not just a question of rising inflationary pressures – that's obvious – but for how long it will persist and how high rates might need to go to reverse it. What's clear is that markets are losing confidence in central banks and the RBA's hapless attempt at committing to yield curve control and no rate hikes until 2024 underscores that. In some fields, that kind of misstep would prompt a resignation.