What’s Expected From the Fed

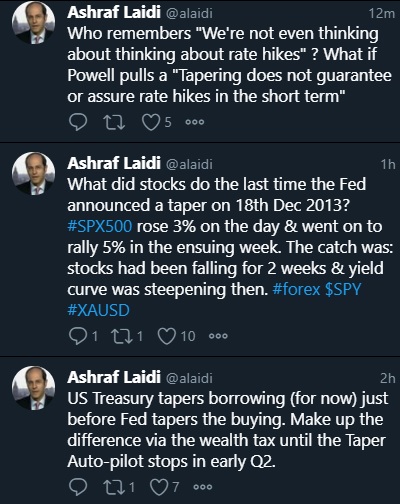

The plan was perfectly laid out and communicated over a series of months in an attempt to fight the last war: the taper tantrum. Powell and his deputies laid out the case for a taper of $15 billion month beginning in November and running through June followed by a period of reflation on rates.

The period of reflection has already been scrapped and Fed funds futures are pricing in a rushed taper in order to hike in June.

The main question is whether the Fed opens the door to taper flexibility and how much that's emphasized. In doing so, Powell could add more volatility to future decisions with flexibility or by taking a hard line, reduce it.

In Australia, we saw a slow climb down on prior dovish communication. That's the general trend in central banking and Powell will no doubt be worried about rising inflationary pressures. He will be asked about the transitory narrative and is likely to stick to it, but he will need to be convincing.

Alternatively, the Fed could engineer a tactical retreat by shifting to a $20B/month taper. That would be a hawkish surprise but given the counter-intuitive and volatile moves in FX recently, we hesitate to wade in.Latest IMTs

-

Is that it for Oil?

by Ashraf Laidi | Mar 9, 2026 13:27

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35