Intraday Market Thoughts Archives

Displaying results for week of Jan 04, 2015US Wages overshadow jobs growth

Both US dollar and bond yields head lower as stocks extend losses following a mixed US jobs report, which is ultimately supporting the disinflation theme, further alleviating expectations of a 2015 rate hike (which remains our view). Full charts & analysis.

Cable Gets a Pulse, Big Day Ahead

The biggest movers so far in 2015 have been the pound to the downside and kiwi to the upside, we look at why and also break down the final trading day of the week along with the many events on the calendar. We issued 2 new trades with 2 charts ahead of Canada's jobs report tomorrow, which follows a disappointing November report. There are also 2 AUD trades ahead of tonight's Aussie retail sales (see below).

The story on Thursday was the large rallies in US and European stocks. There was a significant element of FOMO – fear of missing out – after slumps in Oct and December were wiped out in days. Economic data was a non-factor with initial jobless claims very close to expectations at 294K.

US dollar strength for the day peaked in European trading as the euro carved out a new cycle low at 1.1754. It later bounced to 1.1820 but it was a similar bounce in sterling that grabbed our attention. Cable is down more than 3% since the start of the year but is showing signs of life ahead of 1.5000.

Cable has declined for 5 consecutive days; the headlines behind the weakness were the manufacturing and services PMIs but both are still on expansionary territory. With new year flows dying down, cable could easily correct.

On the flipside, the kiwi was the top performer for the third day on Thursday. In a near-zero yielding world, the +3.5% yields in New Zealand are tantilizing. It's most interesting that NZD has been able to rally in risk-off and risk-on environments this week. It bodes well for the year ahead.

But in the day ahead, all the focus will be on data:

Aussie Nov retail sales are due at 0:30, expected +0.2% from +0.4%.

Chinese CPI/PPI at 0130 GMT. The consensus is 1.5% y/y but a smaller number could benefit AUD on speculation about Chinese rate cuts or stimulus. The risk is that China accepts lower growth. The Chinese Securities News reports that some provinces are doing just that, as they plan to announce lower growth targets.

From there, German data on industrial production and trade is due, Swiss CPI, UK industrial production and then Canadian and US jobs reports. Headline risk is tantamount on all fronts and it will be Monday before the dust settles.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (NOV) (m/m) | |||

| 0.2% | 0.4% | Jan 09 0:30 | |

| Eurozone Retail Sales (NOV) (m/m) | |||

| 0.6% | 0.1% | 0.6% | Jan 08 10:00 |

| Eurozone Retail Sales (NOV) (y/y) | |||

| 1.5% | 1.6% | Jan 08 10:00 | |

| CPI (DEC) (m/m) | |||

| 0% | Jan 09 8:15 | ||

| CPI (DEC) (y/y) | |||

| -0.1% | Jan 09 8:15 | ||

| Eurozone PPI (NOV) (m/m) | |||

| -0.3% | -0.3% | Jan 08 10:00 | |

| Eurozone PPI (NOV) (y/y) | |||

| -1.6% | -1.3% | Jan 08 10:00 | |

| Industrial Production (NOV) (m/m) | |||

| 0.2% | -0.1% | Jan 09 9:30 | |

| Industrial Production (NOV) (y/y) | |||

| 1.6% | 1.1% | Jan 09 9:30 | |

| Challenger Job Cuts (DEC) (y/y) | |||

| 32.64K | 35.94K | Jan 08 12:30 | |

| Initial Jobless Claims (JAN 3) | |||

| 294K | 290K | 298K | Jan 08 13:30 |

| Continuing Jobless Claims (DEC 27) | |||

| 2452K | 2360K | 2351K | Jan 08 13:30 |

| Germany Industrial Production s.a. (NOV) (m/m) | |||

| 0.4% | 0.2% | Jan 09 7:00 | |

| Germany Industrial Production n.s.a. w.d.a. (NOV) (y/y) | |||

| 0.8% | Jan 09 7:00 | ||

Fed Brushes Off 3 Main Concerns

The FOMC minutes led to a small round of US dollar selling on hints about a slow pace of rate hikes but overall they were a reminder that the Fed is interpreting news and markets selectively. On the day, the kiwi was the top performer for the second day while the yen lagged. Asia-Pacific trading features data on Australian housing. In today's Premium trades, we sent 2 new CAD-related trades in addition to yesterday's AUDUSD trades. Full access obtained in the Premium Insights.

A few questions are plaguing the Fed as officials move closer to liftoff but they appear to have answered them.

1. What will be the effect of falling oil prices?

Yellen has hinted at this but the minutes were clear. The boost to consumers is more important than the drag on US energy producers. There was one caveat; that low energy could damage long-term inflation expectations.

2. Why are markets so worried about disinflation

The Fed resolved to study this more but the bulk of the FOMC believes it's not a true reflection of the outlook. Instead, they point to models and survey-based data (largely the U Mich survey) that continue to show stable expectations. With 5-year breakevens now at 1.09% and a poor forecasting track record, the Fed is playing with fire.

3. How will slowdowns in Europe, Japan and China affect the US

The minutes show the Fed took a long look at overseas growth but it didn't damper the upbeat mood. The Fed indicated it expects foreign governments to take action to stimulate growth. Overall, the minutes said the foreign risks balance out. That sounds optimistic.

Despite those worries, the Fed has resolved to watch the data and on Wednesday ADP employment painted a solid picture with 241K jobs created compared to 225K expected. That led to a brief bout of USD strength but it ebbed after hitting fresh highs against the euro, sterling, aussie and CAD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change (DEC) | |||

| 241K | 225K | 227K | Jan 07 13:15 |

Fight the Fed not the Bond Market

The old market cliché of “don't fight the Fed” remains valid in highlighting the Fed's authority to limit violent market instability and prolonged recessions, but do not confuse it with Fed members' hints of rate hike intentions, especially at a time of rampant lack of visibility by Fed researchers with regards to the new equilibrium rate of unemployment at a time of flashing deflationary pressures. Full chart & analysis

Yen still King in Risk Aversion

A second day of risk aversion led to another yen rally after disappointing UK & US economic data. The kiwi narrowly outperformed the yen on a reach for yield and a better dairy auction while sterling continues to lag. Early in Asia-Pacific trading the euro busted through stops to a fresh cycle low. Among the several trading options in yen crosses, we selected a new pair in today's edition of the Premium Insights. After realizing a total of 260 pips in last week's CADJPY shorts, we raise the question as to whether to keep on shorting CADJPY or to move into another pair, which has more downside potential. The 2 trades and 3 relevant charts are in today's Premium Insights.

Sentiment was relatively stable heading into US trading but the lack of any kind of bounce after the rout on Monday should have been a warning sign. When the ISM non-manufacturing index was reported at 56.2 compared to 58.0 the yen began to rally and it didn't stop until late in the day.

USD/JPY skidded all the way to 118.06 while GBP/JPY took a beating for the third day, falling more than 300 pips at the lows and breaking the 61.8% retracement of the rally since October.

Along with the ISM data, factory orders were disappointing. We especially highlight a revision to the Nov core durable goods orders reading to -0.5% from 0.0%. That marks 5 consecutive months of lower or flat orders – something that hardly fits with the widely-believed narrative of a strengthening US recovery.

It's clear some skepticism is setting in and the bond market remains unconvinced. US 10-year yields fell as low as 1.88% and closed at the lows level since 2012. Five year breakevens now imply just 1.07% over that period. Oil is clearly part of the story with prices down another $2 on Tuesday but that's a one-year effect.

In all the focus on JPY and GBP, the euro quietly rallied to 1.1959 in late London trading but a few hours later it slipped back toward the European low of 1.1884. In early Asia-Pacific trading, that level broke and sparked a flurry of selling down to 1.1843, taking out Monday's spike low then bouncing to 1.1870.There is very little support for the euro technically and more chatter about ECB sovereign QE continues to circulate.

Looking ahead, Asia-Pacific trading will remain delicate but there are no important data releases on the calendar.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Factory Orders (NOV) (m/m) | |||

| -0.7% | -0.5% | -0.7% | Jan 06 15:00 |

Choosing the "Right" Yen Cross

Those Premium subscribers who received our S&P500 overlay charts between 2007 and today, sent in late December, were warned of our expectations to the path in the major US indices, highlighting striking divergence in the momentum, trend and magnitude between then and now. Despite minor differences on momentum, the path charted by the S&P500 and its US counterparts displays a high level of convergence. Among the several options in yen crosses, we select a new pair in today's edition of the Premium Insights. After realizing a total of 260 pips in last week's CADJPY shorts, we raise the question as to whether to keep on shorting CADJPY or to move into another pair, which has more downside potential. The 2 trades and 3 relevant charts are in today's Premium Insights.

A Dose of Fright Boosts Yen

Monday was a classic case of risk aversion as the yen climbed, stocks dropped and bonds rallied. The latest CFTC data shows a growing appetite to sell yen. China's services PMI and Aussie trade data are due up next. The first Premium CADJPY short entry at 103.30s hit the final 102.00 target last night, while the 2nd short hit its final target today for a total of 320 pips. A new edition of the Premium trades has been deferred to Tuesday.

There was no clear catalyst for the moves Monday as new-year flows dominate. In Asian trading, the dollar rally dominated but FX took a back seat to stock market and bond volatility. The S&P 500 plunged 1.8% and European stock markets fell upwards of 3%. US 30-year Treasury yields fell 9 basis points to 2.59% -- the lowest since 2012.

An interesting divergence took place in USD/JPY as the day worse on. The stock market and yields continued to carve out new lows but after touching 119.34 in early trading, USD/JPY rebounded 30 pips and never retested the lows. That's a positive sign and CFTC positioning data (see below) showed yen shorts aren't overly crowded.

Looking to Asia-Pacific trading, the Australian dollar will be in focus for two reasons. The first comes at 0030 GMT when Aussie trade balance is due. The consensus is for a A$1.6 deficit in November, rose than A$1.3B a month earlier. At 0145 GMT, it's the HSBC China services PMI. There is no consensus but the prior reading was 53.0. Neither release is major report but AUD/USD remains close to 5-year lows and any headline could tip it lower.

Commitments of Traders

Speculative net futures trader positions as of the close on Dec 23. Net short denoted by - long by +.

- EUR -152K vs -147K prior

- JPY -96K vs -94K prior

- GBP -19K vs -15K prior

- AUD -41K vs -39K prior

- CAD -14K vs -12K prior

- CHF -17K vs -17K prior

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit PMI Composite (DEC) | |||

| 56.1 | Jan 06 14:45 | ||

| Markit Services PMI (DEC) | |||

| 56.2 | Jan 06 14:45 | ||

| ISM Non-Manufacturing PMI (DEC) | |||

| 58.2 | 59.3 | Jan 06 15:00 | |

| PMI (DEC) | |||

| 53 | Jan 06 1:45 | ||

| Eurozone Markit PMI Composite (DEC) | |||

| 51.1 | Jan 06 9:00 | ||

| Eurozone Markit Services PMI (DEC) | |||

| 51.9 | 51.1 | Jan 06 9:00 | |

| Trade Balance (NOV) | |||

| -1,323M | Jan 06 0:30 | ||

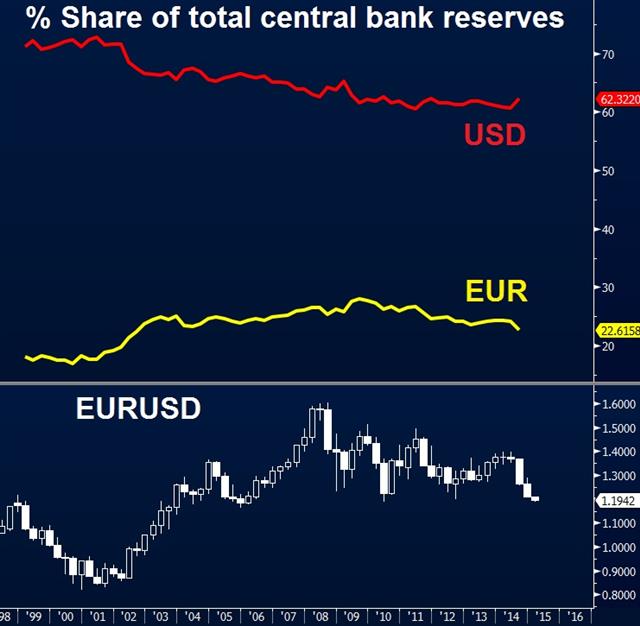

Euro's selloff & central bank allocation

The latest IMF showing central banks' euro-denominated FX holdings fell to 22.6% in Q3 2014, reaching the lowest level in 12 years. The proportion of euro holdings fell over the last three consecutive quarters on record. In contrast, the proportion of central banks' USD-denominated currency holdings rose to 62.3%, the highest level since Q1 2011. Full charts & analysis.

Euro Cracks in Early-Week Trading

The euro hovered just above 1.20 as trading wound down on Friday but it didn't take long for the level to give way in nearly 150-pip breakdown to start the week. The euro continued lower through the Eurozone crisis low to 1.1864 before bouncing. On the weekend, Fed officials continued to emphasize a positive but data-focused outlook. The latest from our Premium Insights, 1 of last week's CADJPY short at 103.30 hit its final 102.00 target, leaving the other CADJPY short in progress with +95 pips in the green.

The week began with a bullet as stops below 1.20 in the euro cascaded and dollar strength spread across the market. It wasn't confined to only the euro as cable busted down to 1.5176 before rebounding a full cent.

The commodity currencies and yen have been relatively stable against the US dollar but one spot to watch is AUD/USD as it tests the 2010 low of 0.8066. In early economic data, the Australian AiG performance of manufacturing index fell to 46.9 from 50.1 in a sign of continued pain in the Australian economy.

Large moves in such low liquidity leave us skeptical and it will be critical to see how the euro performs once trading has completely ramped up.

There was no clear catalyst for the moves. The latest Greek polls show Syriza with a 3 point lead and there is some talk of a Eurozone exit if they win but the dynamics are completely different from the 2011 crisis. Even if Greece leaves, it's unlikely Portugal or Spain will follow because they're now borrowing at such low rates.

A Fed hawk and dove each spoke on the weekend with Mester and Rosengren on the wires. Mester re-emphasized that the Fed sees low oil as a good sign and that officials believe it will contribute to growth-driven inflation after the one-time effects of lower gasoline.

Rosengren highlighted a more-cautious path and said the Fed can afford to remain patient until clear signs of inflation return.

The remainder of Asia-Pacific trading is quiet and then the focus will shift to German regional CPI data before the national numbers in early US trading. If the numbers are soft, the market will have a fresh reason to sell euros.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Germany CPI (DEC) (m/m) [P] | |||

| 0.2% | 0.0% | Jan 05 13:00 | |

| Germany Harmonised Index of Consumer Prices (DEC) (m/m) [P] | |||

| 0.3% | 0.0% | Jan 05 13:00 | |

| Germany CPI (DEC) (y/y) [P] | |||

| 0.4% | 0.6% | Jan 05 13:00 | |

| Germany Harmonised Index of Consumer Prices (DEC) (y/y) [P] | |||

| 0.2% | 0.5% | Jan 05 13:00 | |

| AIG Performance of Manufacturing (DEC) | |||

| 46.9 | 50.1 | Jan 04 23:30 | |