Intraday Market Thoughts Archives

Displaying results for week of Dec 05, 2021Heightened Anticipation

The heightened anticipation ahead of this week's crucial FOMC, BoE and ECB decisions has been responsible for last week's range-trading pattern in FX, indices and metals. USDJPY is unable to break above 114, EURUSD rests above 1.12 but is capped at 1.14, while XAUUSD is immobile in the 1770/90 wedge and XAGUSD continue to hold 22.0. Only one FX cross has broken out, which we pointed out to our WhatsApp Broadcast Group subscribers and will be 1 of our 2 candicates for FX longs this week. The idea is to avoid USD-pairs out of aversion to surging volatility/noise/mis-interpretations to the Fed dotplot, FOMC statement and Jerome Powell's presser. The chart below shows how the upturn in VVIX/VIX encouraged us to to stay out of indices after the NASDAQ short hit its 16200 target. Watch the full video on how to use the VVIX/VIX to help anticipate intermediate peaks and bottoms in indices.

Nasdaq Hits it, VVIX/VIX Called it

On Wednesday we went short the Nasdaq100 for the WhatsApp Broadcast Group near 16315/20s, targetting 16200, with a stop above 16400. Those whose stop was not hit, saw the index fall as low as 16230 and now is testing 16210. We used the VVIX/VIX ratio as an added basis for shorting the Nasdaq (not the DOW30, nor the SPX) and laid out the below chart in today's Tweet to bolster confidence in the call. Again, entering a trade (or any other trade) is all about confidence i.e having as sufficient technical reasons (such as patterns, moving averages, trendlines and/or confluence of all) and fundamental reasons (if you're adept at figuring them out). In the case of the VVIX/VIX, the possible double top (see chart below) helped call a quick short -- just as conversely the double bottom (laid out in the latest Youtube Video) helped us call the longs in DOW30. See the latest video on how to use the VVIX/VIX ratio and where to get and chart the index.

It's not too late to use the tool

It's not too late to learn how to implement the VVIX/VIX ratio in helping you spot inflection points in indices i.e. shifts in risk appetite. No, the ratio is NOT standalone tool. Instead, it can be valuable and helpful in enabling you to anticipate lows (stabilisation patterns) and peaks (exhaustion) in the S&P500 and DOW30, especially when incorporating other technical tools. We use the late September 2021 example for identifying bottoms (7:02 mins of the video) and the March 2020 as well as Aug 2020 exampes for identifying peaks (9:52 mins of the video) . I also show you how to use the ratio and where to obtain free.

VVIX & VIX for Indices إستعمال مؤشر الفيكس للتداول

ندوة أوربكس مساء اليوم مع أشرف العايدي

Is the Bottom In?

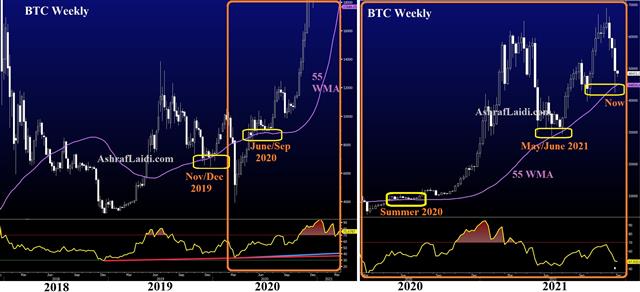

Prepare to hear/read this question at least 5x this week and the next.."Is the Bottom In? Bitcoin respected the 55-WEEK MA as did the Dow Jones Industrials Index held above its 200-DAY MA and the S&P500 bounced off its trendline support from the late Sep low. What about gold's trendline support at 1760...or the horizontal support on the 10-year yield at 1.38% -- in line with the 100-DMA. Figuring our all of these levels make us appear astute and especially clever when they're all in synch. But the challenge lies with the repetitive manner these levels will likely have to be tested, just as we saw in the SPX bottom of late Sep/early Oct. Back then, the index re-tested its 100-DMA at least 4x before mounting a 450-pt ascent in a mere 7 weeks. All of the aforementioned markets are sure to retest their recent lows sometime this week (US CPI report due Friday) and most likely next week when the Fed, BoE and ECB all decide on QE and interest rates. One thing we learned during the lows of late Sep/early Oct is to look beyond wicks and focus on the cash close. Whether you're bullish or bearish make sure to exercise extra caution ahead of next week --considered one of the most important weeks of the year. Earlier today we told the WhatsApp Broadcast Group we were long the DOW30 based on the VVIX/VIX technicals. I've explained how to use/read the VVIX/VIX in a detailed video here and will make sure to do an update very soon.