Intraday Market Thoughts Archives

Displaying results for week of Apr 05, 2015GBP volatility heightened by data & Labour lead

Sterling's 1-month option volatility vs the US dollar –a reflection of fear- broke above the 2011 highs to hit the highest level since the 2010 general election. Here's what's next?

Eurozone Investors Stuck With Negative Choices

ECB quantitative easing is working but it might be working too well. The euro plunged on Thursday while the Aussie led the way. Chinese CPI is due later. In today's Premium Insights, a new trade was issued and currently in progress. GBPAUD and CADJPY were stopped out.

The euro broke below 1.0725 in US trading on Thursday and didn't stop falling until 1.0638. There were some murmurs about Greece and deposit outflows after emergency bank lending was hiked but officials paid the money due to the IMF.

The larger driver is yield differentials. The US Treasury had an extremely weak bond auction, pushing 30-year bond yields to 2.6%, up 9 basis points from the earlier lows. Meanwhile, German bunds hit a fresh record low at 0.139% and French 5s fell into negative territory. Yields are also negative on issues dated 2 years or less in Austria, Belgium, Finland, Ireland and Holland.

The ECB has just passed the first month and 60 billion euros of a trillion euro experiment. It's extremely unappetizing for investors to consider buying bonds with negative yields and even the ECB won't buy below its -0.20% deposit rate. In the US, investors were able to move down the corporate ladder but the euro-denominated bond world is much smaller.

Some investors are clearly being chased into stocks as the CAC hit a record Thursday. Others are going into Treasuries and that's something that will keep downward pressure on the euro. Corporates and sovereigns are also coming to Europe. Mexico launched a 100-year bond this week and US multinationals may increasingly issue euro bonds and immediately convert them to US dollars.

Both trends are only in their infancy and with the ECB set to buy for more than a year, more is coming. At some point before the ECB hits 1 trillion euros (and with EUR/USD below parity) Draghi may start to have second thoughts.

Another central bank with something to mull over today is the PBOC with Chinese CPI data due at 0130 GMT. The consensus estimate is for prices to rise just 1.3% y/y compared to 1.4% previously. In any case, there is leaves plenty of room for stimulus but there has been no indication of imminent Chinese easing as leaders try to rebalance.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (MAR) (m/m) | |||

| -0.6% | 1.2% | Apr 10 1:30 | |

| Consumer Prce Index (MAR) (y/y) | |||

| 1.3% | 1.4% | Apr 10 1:30 | |

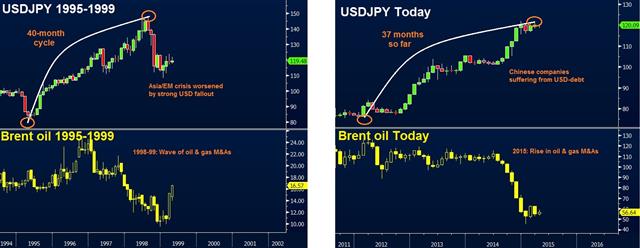

USDJPY, Oil M&As Recall Late 1990s

The growing parallels between 2015 and 1998 in global markets (soaring US dollar, plummeting oil prices, rising equities, escalating market volatility and flattening US yield curve) continue to extend. Full charts & analysis.

Dollar Higher on Minutes, Oil Drops

We look at 'several' reasons not to be concerned with the FOMC minutes. The pound and kiwi were the top performers while the Canadian dollar lagged with oil. The Asia-Pacific scheduled doesn't have any notable releases. 4 new Premium trades were issued today related to CAD and NZD. These trades are slightly longer-term in nature. All trades and their respective trades are found in the Premium Insights.

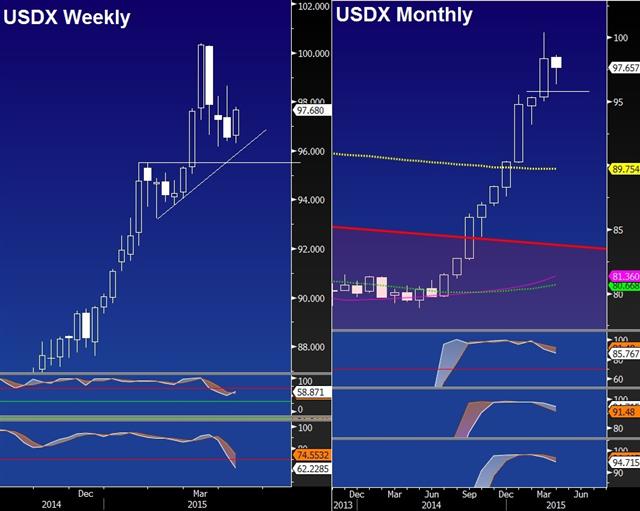

The US dollar was a steady riser in US trading after falling earlier in the day. The crescendo came after the minutes of the March 17-18 FOMC meeting. It cited 'several' members who believed June was the appropriate time to hike rates.

The comment shouldn't come as a surprise. There is no definition of 'several' but it's likely in the 4-6 range. The hawks have been clear in speeches and include Lacker, Bullard, Mester, George and perhaps Williams. That list includes only two voters with the bulk of the FOMC expressing a preference to wait.

In addition, the minutes are three weeks old and in that time there have been several soft releases, including non-farm payrolls. Because of that, on Wednesday Dudley said the bar had been raised for a June hike.

What may be an increasing factor for FX is M&A. Two mergers totalling nearly $100 billion were announced in the past 24 hours and there is non-stop chatter about other sales. That could mean some lumpy FX flows in the months ahead.

In the short term, the Asia-Pacific market is quiet but we are keeping a close eye on oil as extreme volatility continues. In a market like crude where real demand rather than financial flows are the driver, sometimes there are days where the funadmentals clash with price action. Yesterday we wrote about the multitude of reasons to sell crude and after a large build in US supplies, the market finally broke down and eventually fell more than 5% on the day.

How Long Can Oil Keep Rising?

Negative headlines kept hitting oil on Tuesday but prices kept rising until a devastating US supply report finally broke the market. The other main story in the market was the continued climb of the US dollar after the jobs report. The BOJ decision is later. A new set of Premium Insights will be issued on wednesday. EURCAD and CADJPY have been stopped out.

It's rare to find a true oil bull these days. Every view on the market points to the same thing – oversupply. Yet prices are holding the line.

In a weaker market, the headlines would have broken the bulls. There were four reasons to sell Tuesday 1) Goldman Sachs was doing the rounds touting another bearish take. 2) The EIA released a report that highlighted more than 30 million barrels of oil in storage in Iran and 700,000 bpd of untapped capacity. 3) The Saudi oil minister said March production was at 10.3 mbpd, a record. 4) The US dollar was stronger.

Instead the market ignored Goldman, focused on slightly lower US oil supply growth forecasts from the EIA, and ignored the actual Saudi numbers in favour of Saudi jawboning on prices and hollow talk about cutting production (but only if other countries do to).

WTI climbed to $54, almost matching the February highs in what looked like it could be a breakout. But the technicals were the signal to sell, at least temporarily, as a more than 12 million barrel build in API weekly supply data sent prices $1 lower late in the day.

The danger is that he supply story is priced in. It's tough to imagine where all the oil will go with storage capacity filling up but price action is the ultimate deciding factor and crude refuses to make another leg lower. The day ahead features the official US supply data and expectations will have moved sharply higher than the 3.2m barrel consensus after the API data.

In FX, the US dollar continues to rebound and momentum is building. Traders may be anticipating hawkish (or at least optimistic) FOMC minutes on Wednesday. The meeting was before the latest round of soft data that included nonfarm payrolls and that probably means it doesn't reflect the current views of the Fed and it could signal a (now-dated) inclination toward a June hike.

Up next is the BOJ decision, which will be released in the 0230-0330 GMT range. Expectations are extremely low for a cut but there another meeting in three weeks time and that is a more 'live' decision. If anything, there could be some subtle hints at more easing later.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Minutes | |||

| Apr 08 18:00 | |||

From NFP to FOMC Minutes

Euro drops back below the $1.09 level, remarkably shrugging a host of upbeat PMI surveys from the Eurozone and assurances from Athens that Greece will make its repayment to the IMF due this week. AUD was the biggest winner following the RBA's decision to hold rates unchanged, but USD was the resurging winner, building upon Monday's gains and erasing all of Friday's post-NFP losses. USD's nexy test is tomorrow's release of the latest FOMC minutes. Charts & Analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Spanish Services PMI | |||

| 57.3 | 56.5 | 56.2 | Apr 07 7:15 |

| Eurozone Final Services PMI [F] | |||

| 54.2 | 54.3 | 54.3 | Apr 07 8:00 |

RBA on the Razor’s Edge

The Australian dollar slumped on Monday in the ninth decline in the past 10 sessions. It's near a cycle low as the clock ticks down to the RBA decision. We look at what's expected and what to expect. The latest Premium trades include EURGBP. EURCAD, CADJPY and GBPAUD.

The OIS market is pricing in a 75% chance of a cut when the decision is delivered at 0430 GMT. Probabilities swung toward a cut in the past two weeks as iron ore prices dropped and capex spending dried up.

Economists are a bit less convinced of a cut but they're usually loath to change their estimates so close to decision unless it's a slam dunk. In Bloomberg's survey, 13 economists see a cut and 17 see no change. Even for those expecting the RBA to remain on hold, a rate cut is only a matter of time. All but one economists sees Stevens lowering rates to 2.00% at the subsequent meeting at the latest.

That might mean that any bounce in the Australian dollar on a decision not to cut rates might just set up AUD shorts from better levels in the days ahead – especially if the US dollar rebound from Monday continues. The best argument not to cut is housing, the latest data on the home market remains buoyant including a 14.3% rise in building approvals reported last week. Approvals were expected up 10.7%.

A final data point before the decision is the Feb retail sales report due at 0130 GMT. It's expected to rise 0.4% and with the decision so close, it may lead to extra volatility.

A final thing to keep in mind is an ongoing investigation into a leak at the RBA. The Aussie rallied about 45 pips about 30 seconds before the March decision to hold rates. The bank said it wasn't leaked on its website and doesn't yet have any answers.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (MAR) (m/m) | |||

| 0.4% | 0.4% | Apr 07 1:30 | |

Jobs Report an Outlier The Fed Must Heed

A solid ISM non-manufacturing report underscored that non-farm payrolls was more likely skewed by one-time events. Yet the US dollar is broadly lower on the belief that the soft report will cement a cautionary approach at the Fed. The euro continues to press against the late-March highs. Current Premium trades in progress include EURCAD and GBPAUD.

The March ISM non-manufacturing index was in-line with expectations at 56.5 in a slight decline from the February reading. It was far from the kind of dramatic drop in the jobs report. In the sub-indexes the employment component rose to 56.6 from 56.4.

Along with recent jobless claims data, the Markit surveys and other quickly delivered data, it shows that the economy remains steady. There have been other data points that agree with payrolls – like ADP – but markets are likely to believe that weather was the factor in February, not a turn in the economy.

Yet the Fed is forced to play it safe and that has left the US dollar vulnerable. Yellen made her preference for jobs data as the key liftoff indicator clear. The soft report is just a single data point but with inflation low, it adds a compelling argument for the Fed to wait.

EUR/USD rose another half-cent on Monday in the fourth day of gains. The pair is testing the late March highs that extend to 1.1051. A break and a close above may squeeze the crowded short position.

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -227K vs -221K prior (most bearish on record) JPY -24K vs -46K prior GBP -37K vs -39K prior AUD -24K vs -28K prior CAD -30K vs -33K prior CHF +1K vs -4K prior

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Non-Manufacturing Composite (MAR) | |||

| 56.5 | 56.5 | 56.9 | Apr 06 14:00 |

| Eurozone Spanish Unemployment Change | |||

| -60.2K | -18.3K | -13.5K | Apr 06 7:00 |

| ANZ Job Advertisements (MAR) | |||

| 0.9% | Apr 07 1:30 | ||