Intraday Market Thoughts Archives

Displaying results for week of Jun 05, 2016Gold and NZD in Focus

The dust settled on the RBNZ move and gold rallied Thursday, leaving both poised for more. The kiwi and USD were the top performers on Thursday while the euro led. Japanese PPI is next. AUDNZD Premium trade was stopped out, while EURCAD short was closed at a gain, for possible review in tomorrow's Canada jobs repor.

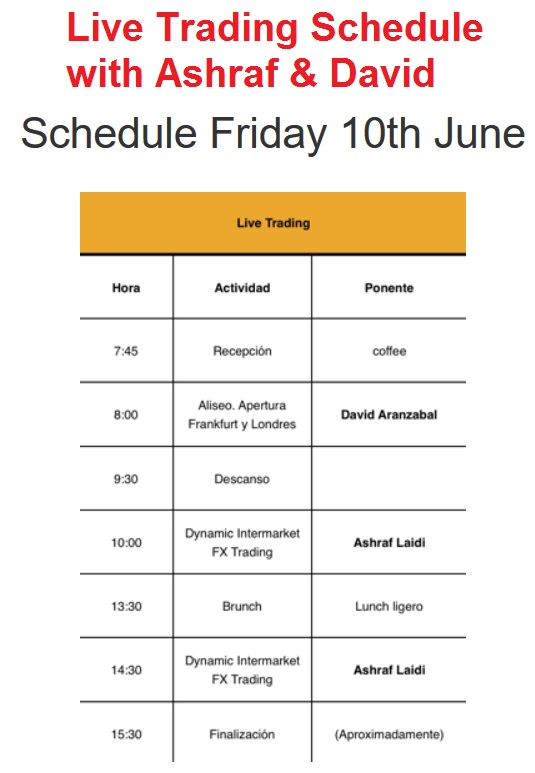

Ashraf will trading live on Friday at The Forex Day conference in Madrid, focusing on the Canada jobs report. He will be joined by David Aranzabal. Access is available via LiveStream on the web. Click for full details.

The best kinds of big technical breakouts are support by major fundamental news. That's what happened in NZD/USD and AUD/NZD after the RBNZ decision.

Suddenly, it looks like Wheeler might be done cutting rates. It will take a string of bad data but an August cut is less likely than the 50/50 pricing in the market.

NZD/USD finished well-above the May high and is trading at the best levels in a year. AUD/NZD broke the Nov 2015 low and is at a 13-month low. Neither chart is faces significant headwinds on a continuation. In the short-term, however, there could be a pullback as those breaks are retested.

Another chart we've highlighted is gold, which broke above the 55-day moving average this week. A story about Soros' bullishness did the rounds Thursday. It's currently flirting with $1270 but it broke the 61.8% retracement of the May decline in a positive signal.

In US trading, the theme was strength in yen crosses. The US dollar was aided by wholesale inventories in April rising 0.6% compared to 0.1% expected. That led to upward revisions to Q2 GDP, which is shaping up to be a key Fed metric for the July meeting. Initial jobless claims at 264K compared to 270K expected helped to dispel some of the jobs fears.

Looking ahead, China remains on holiday and that may dampen Asia-Pacific volatility. The lone indicators to watch are Japanese PPI at 2350 and the tertiary industry index at 0430 GMT but neither is likely to be a market mover.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Wholesale Inventories (APR) | |||

| 0.6% | 0.1% | 0.2% | Jun 09 14:00 |

| Initial Jobless Claims (JUL 04) | |||

| 264K | 265K | 268K | Jun 09 12:30 |

| Continuing Jobless Claims (JUN 28) | |||

| 2095K | 2172K | Jun 09 12:30 | |

Central Banks to the Sidelines

The inability of central banks to forecast more than a month in advance along with an unwillingness to surprise is increasingly leaving them paralyzed. The New Zealand dollar was the top performer Wednesday after the RBNZ stayed on the sidelines while the pound lagged. Chinese CPI numbers are due up next. A new JPY trade has been opened last night, while a new set of gold and USDX charts has been added to the Premium Insights.

The market was pricing about a 25% chance of a cut from the RBNZ and 7 of 17 economists were forecasting a move. But Wheeler decided to leave rates unchanged at 2.25% and the key parts of the statement virtually unchanged. He did a bit of optimism by noting that financial market volatility has abated. He also toned down the jawboning by removing the line that said 'a lower New Zealand dollar is desirable'.

The kiwi surged in response. NZD/USD rose to 0.7115 from 0.7020 on the knee-jerk and then faded back to 0.7070 before a fresh climb to 0.7093. The level to watch is 0.7054, which was the May high and had represented the best level in 11 months. A close above there raises the possibility of a significant climb.

What's helping to fuel the pair is the indecision at the Fed. At the start of May, Fed expectations for a hike this month were high. They were dashed by April non-farm payrolls, re-stoked by the FOMC minutes and then dashed again by May non-farm payrolls.

The Fed has struggled to predict anything since the crisis and has now adopted a wait-and-see approach that requires near-perfect economic data before a move.

The story elsewhere is a dovish bias but the malaise has been prolonged because central banks make overly-optimistic forecasts and hold onto them until they've been completely dashed.

What does it mean going forward? The trend is for central bankers to talk more but offer less, for fear of damaging their already-strained credibility. Data dependence is the crutch for poor forecasting.

What we may see more of is central banks holding strong biases – like the Fed and RBNZ – while keeping markets guessing about when they will act.

China is in focus in the hours ahead with the CPI report due at 0130 GMT. The consensus is for a 2.2% y/y rise. Yesterday, strong import numbers from China set a positive tone and kept the commodity rally going. Note too that these numbers are being released on a Chinese holiday that extends into the weekend.

Live Trading this Friday from Madrid

Ashraf will be doing Live Trading this Friday at The Forex Day conference in Madrid. He will be joined by David Aranzabal. Access will be available via LiveStream on the web. FULL DETAILS.

Commodity Climb Recharged

Commodity currencies continued the recent run-up Tuesday. The Aussie led the way after the RBA dropped its dovish stance, while the US dollar lagged. Australian home loans are next. Japanese GDP was unrevised at 0.5%. The latest Video is found below for Premium subscribers.

The reverberations of the unusual spike in GBP, the RBA decision and a rally in commodity prices were the dominant themes on Tuesday.

The US economic data calendar was light. Q1 unit labor costs rose 4.5% compared to 4.0% expected. It's yet-another drag on productivity but the good news for US dollar bulls was that nonfarm hourly compensation rose 3.9%, higher than the 3.0% originally reported. That may give the Fed more confidence that underlying demand and hiring in the economy is robust.

The S&P 500 touched a 2016 intraday high of 2119 but faded in the final hour of trading to close only slightly higher.

The main story was commodity gains, which were fuelled by dovish Fed expectations and the falling US dollar. WTI crude oil rose above $50 to a fresh cycle high. The October high of $50.92 is the next technical level to watch. A break may clear the way for a retest of $60.

The Australian dollar was given an extra lift from the RBA statement. There was speculation they would offer a dovish bias but they remained ambiguous. Stevens is fast approaching the end of his term in September and the thinking is that he will cut to 1.50% before leaving rather than dealing risking Lowe will be forced to cut early on and lose his inflation-fighting credibility.

For now, however, the positive backdrop in risk assets spurred by the Fed is the dominant theme.

The other focus is the potential Brexit. The 200 pips spike yesterday in Asia-Pacific trading left everyone scratching their heads. Ultimately, there were no headlines or fundamental reasons behind it. Still, speculators were reluctant to fade it and that tells us that the momentum trade will be dominant in GBP until the referendum. Japan final Q4 GDP remained unrevised at +0.5% q/q.

At 0130 GMT, Australian home loans are due. A 5.0% m/m jump is expected. If anything can keep the RBA from hiking, it's worry about an overheating housing market, despite a sluggish economy.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Unit Labor Costs (Q1) | |||

| 4.5% | 4.0% | 4.1% | Jun 07 12:30 |

Ashraf on BNN Earlier Today

Ashraf's interview on BNN earlier discussing Brexit, GBP volatility, global indices and the loonie. Full interview.

Yellen Won’t Let Go, RBA Next

Fed Chair Janet Yellen highlighted uncertainty in the economic outlook and made no mention of a hike in the 'coming months' but maintained some optimism. The Canadian dollar led the way Monday while the yen lagged. The RBA decision is next. The Premium Insights closed the USDCAD short at 1.2835 from the 1.3100 entry for a 265-pip gain. 8 trades remain in progress, including a CAD long.

Less that two weeks ago Yellen said a hike was likely in the coming months if the economy developed as she expected. But the jobs report raised huge questions about the path of investment, employment and growth so she switched to a more cautious stance while maintaining an overall hawkish bias. “New questions about the economic outlook have been raised by recent labor market data,” she said.

In the Fed funds futures market, the likelihood of a July hike fell to 21% from 27%. The chance of a June hike is now virtually nil. Stocks liked it and the S&P 500 rose to the highest level of the year.

What's unclear is if a dovish Fed alone can sustain risk assets. Over the past 15 months, the Fed has repeatedly backed away from hikes but the market has struggled to sustain new highs.

Looking ahead, the RBA decision is the highlight of Asia-Pacific trading but a change from the 1.75% cash rate is unlikely. The OIS market sees a 10% chance of another surprise cut but traders will mostly be watching Stevens for a dovish hint about the July or September decisions.

The announcement is due at 0445 GMT (0545 BST/London) and follows a cut at the May 4 meeting. After that surprise move, the market began pricing in more cuts. However, the meeting minutes released later suggested the surprise cut was a close call and that led to an AUD bounce on speculation of a longer wait before another cut.

Recent economic data included soft wages, a modestly disappointing jobs report and signs of slowing construction (including a soft AiG index earlier today). But the biggest release was Q1 GDP as it jumped to 1.1% q/q versus 0.8% expected on strong trade. That number crushed hopes of a cut today but the market is reluctant to abandon the coming meetings.

For the July 27 meeting, the market is pricing a 31.4% chance of a cut and for August, that rises to 51.2%. The Australian dollar lagged risk assets and commodity FX Monday so there may be an element of catch-up if Stevens isn't outright dovish.

Dollar Rope-a-Dope, GBP Brexited

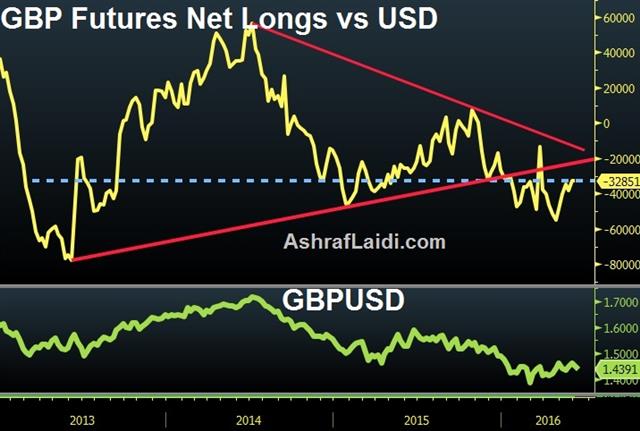

Muhammad Ali died Saturday and the idea of a US recovery is on the ropes too but looking back on his career is a reminder that his greatest victory – like a great trade – was when he looked like he was defeated and then stormed back. The US dollar is the top performer in early-week trade while the pound sags on more pro-Brexit polls. On Friday, the GBPJPY Premium short was closed at 155.05 for 255 pips gain after Wednesday's 230 pips. Weekly CFTC data was little changed.

Non-farm payrolls missed badly. No seasonal skew or one-time factor could come close to explaining the miss and the downward revisions to the prior readings.

On the face of it, the number is a game changer and it certainly takes a June hike off the table. Yellen speaks on Monday and she is likely to sound a similar tone to Brainard, who spoke on Friday and called the employment data 'sobering'.

Yellen would have liked to hike but she won't do it until all the stars align. Even if the number had been strong, the increasing uncertainty about the Brexit vote would have made a hike highly unlikely.

Weekend polls showed the 'leave' side ahead around 3 points and bookmakers have shortened odds of a Brexit. The pound was beaten up at the open, falling more than 150 pips and wiping out the NFP-inspired gains on Friday.

This is a likely a final dalliance with the idea of a protest vote. The 'remain' side likely overplayed their hand with a non-stop chorus of exaggerated fear mongering and the public senses the bluff. But almost 20% of voters remain undecided and when it comes down to it, they will side with safety.

In the meantime, fear is hitting mainstreet and real money is getting out of GBP. Expect the outflows to peak around a week before the vote.

There are two beaten up currencies in the dollar and the pound. Yet if you take a step back, they both have tremendous reserves of strength. Growth in the UK and US this are likely to lead the G7 (although Australia's latest GDP numbers may change that).

In the Rumble In the Jungle, not many were betting on Ali through seven rounds but in Round 8 he pulled off his most incredible win. A handful of better US indicators and a 'remain' vote could be much of the same.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -38K vs -38K prior JPY +15K vs +22K prior GBP -33K vs -33K prior CHF +0K vs +4K prior AUD -5K vs +0.1K prior CAD +26K vs +20K prior NZD +5.5K vs +4.6K prior

The rush out of Australian dollar continued as it flips to negative. Otherwise, the market was playing a game of wait-and-see.