Dollar Rope-a-Dope, GBP Brexited

Muhammad Ali died Saturday and the idea of a US recovery is on the ropes too but looking back on his career is a reminder that his greatest victory – like a great trade – was when he looked like he was defeated and then stormed back. The US dollar is the top performer in early-week trade while the pound sags on more pro-Brexit polls. On Friday, the GBPJPY Premium short was closed at 155.05 for 255 pips gain after Wednesday's 230 pips. Weekly CFTC data was little changed.

Non-farm payrolls missed badly. No seasonal skew or one-time factor could come close to explaining the miss and the downward revisions to the prior readings.

On the face of it, the number is a game changer and it certainly takes a June hike off the table. Yellen speaks on Monday and she is likely to sound a similar tone to Brainard, who spoke on Friday and called the employment data 'sobering'.

Yellen would have liked to hike but she won't do it until all the stars align. Even if the number had been strong, the increasing uncertainty about the Brexit vote would have made a hike highly unlikely.

Weekend polls showed the 'leave' side ahead around 3 points and bookmakers have shortened odds of a Brexit. The pound was beaten up at the open, falling more than 150 pips and wiping out the NFP-inspired gains on Friday.

This is a likely a final dalliance with the idea of a protest vote. The 'remain' side likely overplayed their hand with a non-stop chorus of exaggerated fear mongering and the public senses the bluff. But almost 20% of voters remain undecided and when it comes down to it, they will side with safety.

In the meantime, fear is hitting mainstreet and real money is getting out of GBP. Expect the outflows to peak around a week before the vote.

There are two beaten up currencies in the dollar and the pound. Yet if you take a step back, they both have tremendous reserves of strength. Growth in the UK and US this are likely to lead the G7 (although Australia's latest GDP numbers may change that).

In the Rumble In the Jungle, not many were betting on Ali through seven rounds but in Round 8 he pulled off his most incredible win. A handful of better US indicators and a 'remain' vote could be much of the same.

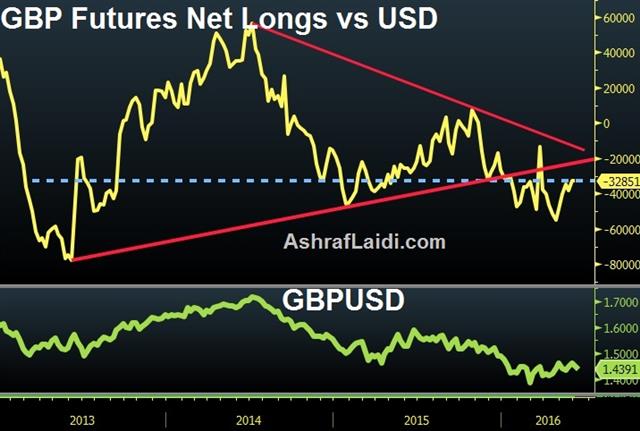

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -38K vs -38K prior JPY +15K vs +22K prior GBP -33K vs -33K prior CHF +0K vs +4K prior AUD -5K vs +0.1K prior CAD +26K vs +20K prior NZD +5.5K vs +4.6K prior

The rush out of Australian dollar continued as it flips to negative. Otherwise, the market was playing a game of wait-and-see.

Latest IMTs

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10