Intraday Market Thoughts Archives

Displaying results for week of Jul 05, 2015From Tsipras' Proposal to Yellen's Bar

This afternoon's speech by Fed Chair Yellen at 12:30 Eastern (16:30 GMT/17:30 BST) is expected to reveal her reiteration the message that more will be needed from jobs and inflation before rates lift-off, especially 48 hours before another emergency EU/Greece summit. Yellen's take on the China and Greece issues will undoubtedly be highlighted as to be taken into consideration by the Federal Reserve. Yellen will be asked more on these global issues on Wednesday's semi-annual testimony to Congress (a crucial hour, coinciding with the Bank of Canada decision).

Wednesday's release of the Fed minutes from the June meeting highlighted a warning by a number of FOMC members to avoid premature tightening, while broadening their mention of Greece risks and the market fallout (not economic) onto global risk appetite. More importantly, the Fed faces an increasingly high bar for rates liftoff, underlined by three conditions: i) prolonged strength in GDP growth (this was revised down at June FOMC); ii) persistent improvement in labour markets (participation rate fell to fresh record low, average hourly earnings came up short); iii) inflation must continue trending upwards towards 2.0% target (core PCE fell to 1.24% in May from 1.29% and 1.35% in April and March respectively).

And Back to Tsipras

Greece finally delivered a post-referendum proposal, seeking a 3-year loan under ESM funding worth EUR 53.5 bn, including small pension reforms and higher corporate taxes, including the sale of regional airports. Initial reports stated the proposal is similar to that of the EU proposal from June 26, but the main difference is that the EU demands did not include debt-relief. Greek hardliners are likely to back Tsipras' proposal today. The ESM board will also vote for it today.

Markets say 'Yes' to Greece Proposal, Onto China

Euro & equity futures rally across the board, cheering the latest Greek proposal but regardless of the outcome the driver of the second-half of the year is much more likely to be China. On Thursday, markets were more settled with CAD leading and JPY lagging in a minor retracement. Japanese PPI is up next.

Greece finally delivered a post-referendum proposal and it's triggered a quick rally in the euro. Greece seeks a 3-year loan under ESM funding worth EUR 53.5 bn, including small pension reforms and higher corporate taxes, including the sale of Tsipras reportedly told a Syriza meeting to be ready to compromise in a sign that he wants to make a deal. Initial reports said it's similar to an EU proposal from late June so that will probably lead to a deal. The risk might be Greek hardliners vote against it. Bloomberg says the proposal is similar to that of the EU's on June 26.

Debt may prove the sticking point in negotiations with German leaders digging in and shunning haircuts. Very little has been sorted on debt and Greece can't sustain its current load.

The euro rallied to 1.1065 from 1.1035 shortly after the deal after falling to 1.0991 from a high of 1.1125 in US trading. EUR/JPY quickly gained 70 pips on the proposal.

What unfolds in Greece is critical for the next week in markets but what happens in China will matter for months. Officials are increasingly signalling that they won't tolerate slower growth or stock market declines. The stock market correction is still relatively small compared to the 150% rally over the past year and banning short selling is a panic move.

The takeaway is that China bent on high growth and talk of painful reform is hollow. Once the dust settles, that will underpin commodity currencies and China-connected companies.

In the immediate term, look to Greek headlines for guidance. Japanese PPI is also due at 2350 GMT amidst a report in Nikkei that the BOJ may lower its 2015 growth estimate from 2.0% closer to the consensus at 1.0%.

Stocks Rocked, Yen Wins

The wall of worries finally sent stocks crumbling on Wednesday. The yen was the main beneficiary in FX while the pound was the laggard. China CPI is up next with all eyes on the short-selling ban. The latest deterioration in Canada data sent the Premium long in EURCAD to +130 pips, while EURAUD is 120 pips in the money. A new CAD pair has been added to today's Premium for the first time since end of March, supported by 3 key charts in the Premium Insights.

The bounce in markets late Tuesday was quickly unwound. Greece remains in a difficult position and progress is slow but global growth worries were a larger concern Wednesday. Chinese stocks fell 5.9% yesterday and commodities are under growing pressure.

Confidence was further undermined by a 3 hour outage in the NYSE and the S&P 500 fell 1.7% to close below its 200-day moving average for the first time since October.

The Fed Minutes struck a dovish tone with most meeting participants still skeptical that the data is good enough to warrant hikes. The latest developments in China and Greece will no-doubt test their resolve to hike in September.

A final note on today's trading is the outperformance of the euro despite worries about Greece and Merkel expressing disappointment. It underscores the euro's role as a carry funding currency (like the yen). That's a dynamic that's still in its infancy but could last for years.

Later, the focus will continue to be on China where policymakers banned short-selling stocks for six months. The government and PBOC are increasingly likely to act, especially if a relief rally is short-lived. The CPI report due at 0130 GMT is expected to rise 1.3%, which leaves officials with plenty of room to act.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (JUN) (m/m) | |||

| -0.1% | -0.2% | Jul 09 1:30 | |

| Consumer Prce Index (JUN) (y/y) | |||

| 1.3% | 1.2% | Jul 09 1:30 | |

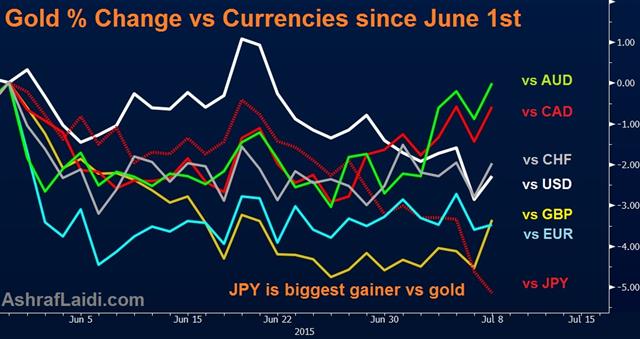

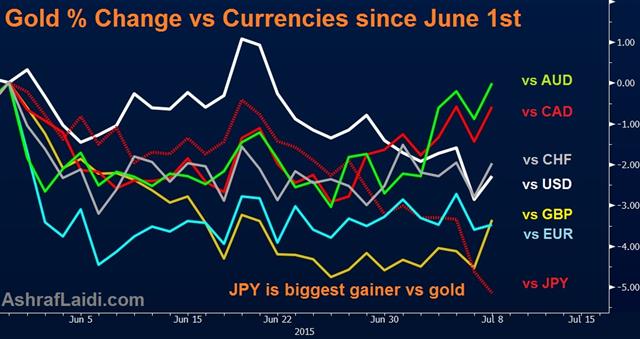

Yen vs Gold - The Extreme Trade

Gold's accelearating sell-off since June 18 highlights the metal's deteriorating role as a safe haven amid Greece uncertainty as other factors take priority. Oil's 19% decline from its May highs at a time when central banks have barely begun seeing some sort of positive trend in inflation resurrects fears of deflation or prolonged disinflation. We saw these price worries escalate back in January-February in the midst of the winter plunge in oil. And with gold seen as a hedge for inflation, any signs that disinflation or deflation returning would eliminate gold's attribute as an anti-inflation hedge.

The 34% plunge in the Shanghai Composite index over the last 3 ½ weeks and the 14% drop in the DAX-30 from its April highs, combined with the 19% drop in oil have stopped bond yields in their tracks, highlighting renewed downside risks to global growth, which is prominently reflected in falling commodities, falling yields and falling equities.

The aforementioned dynamics explain yen's outperformance relative to all major currencies as charted against gold due to unwinding of carry trade back to the original funding currency.

The acceleration of gold's sell-off since June 18 highlights the metal's deteriorating role as a safe haven amid Greece uncertainty as other factors take priority. Oil's 19% decline from its May highs at a time when central banks have barely begun seeing some sort of positive trend in inflation resurrects fears of deflation or prolonged disinflation. We saw these price worries escalate back in January-February in the midst of the winter plunge in oil. And with gold seen as a hedge for inflation, any signs that disinflation or deflation returning would eliminate gold's attribute as an anti-inflation hedge.

The 34% plunge in the Shanghai Composite index over the last 3 ½ weeks and the 14% drop in the DAX-30 from its April highs, combined with the 19% drop in oil have stopped bond yields in their tracks, highlighting renewed downside risks to global growth, which is prominently reflected in falling commodities, falling yields and falling equities.

The aforementioned dynamics explain yen's outperformance relative to all major currencies as charted against gold due to unwinding of carry trade back to the original funding currency.

Tumult, Trouble and the Titanic

A flash of optimism from European and Greek leaders sparked a flash comeback in markets Tuesday. The US dollar gave up much of its gains but remained the top performer while the pound lagged. Japanese trade balance is due later.

Watching the rebound in markets today we're reminded of the movie Titanic. A calm briefly comes over the passengers when the doomed ship briefly rights itself. The sinking euro bobbed to 1.1050 from 1.0918 in a snapback rally as sentiment turned around. A rout in stocks turned into solid gains as well.

The lows of the day came as Greece appeared to show up empty handed at the eurogroup meeting. Finance ministers were miffed that Athens didn't have a fresh proposal. We touched on the unfolding dynamic yesterday: In order for the euro to tread water, it needs a steady-stream of positive news and progress on Greece. The minute that stops, it begins to sink.

Sentiment had turned extremely sour after the eurogroup but European leaders were more upbeat. Italy's Renzi said a deal could come within hours and then reports began to appear about a two-part Greek proposal that would include bridge financing and a 2-3 year deal.

There was also a clear change in tone from top leaders as they seemingly want to get Greece on the backburner rather than roiling markets in a delicate global economy. Each of the Premium longs in EURAUD and EURCAD are +100 pips in the green. Today's GBPUSD trade was stopped out by 15 pips. EURUSD remains in progress. A new CAD trade will be issued in the next 24 hours, ahead of Friday's important Canada jobs report.

Still, Athens has been woefully underprepared for winning the referendum and they are slowly squandering their momentum. These deals rarely come together without a deadline and the latest one is a July 20 payment to the ECB.

What could eventually overshadow Greece – whatever the result of the negotiations – is trouble in China and commodities markets. Metals joined yesterday's oil rout and signals about global growth are worsening.

Prices for metals will be the focus of Asia-Pacific trading but that will be briefly interrupted but the Japanese trade balance report at 2350 GMT. Trade has been a pillar of the early-year strength in Japanese economy but there are questions about if it's a one-off bounce or a sign of better competitiveness due to yen weakness.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance (MAY) | |||

| -$41.87B | -$42.75B | -$40.70B | Jul 07 12:30 |

| Trade Balance | |||

| -3.3B | -2.6B | -3.0B | Jul 07 12:30 |

| Trade Balance - BOP Basis (MAY) | |||

| ¥-146.2B | Jul 07 23:50 | ||

Times Not on The Euro’s Side, RBA in Focus

After falling by more than 150 pips, the euro closed lower by just a half cent at 1.1056 in a tumultuous day. Anxiety about a Greek exit cooled, at least for the moment, after comments from European leaders suggested room for negotiation. Greek finance minister Varoufakis also offered an olive branch of sorts by resigning. European finance ministers disliked his brash style and his exit is a strong signal that Syriza wants a quick deal.

The conciliation from both sides was some measure of progress but we underscore that small steps and platitudes aren't nearly enough. Greece's economy is hemorrhaging and the ECB tightened the noose Monday by raising the haircut on collateral from Greek banks. That effectively narrows the ELA lending program and will exacerbate the cash crunch when (if) banks reopen.

The next 2-3 days present a narrow window of opportunity for a deal but time-and-time again leaders have delayed and missed deadlines. In addition, there is no special incentive for Troika creditors to make a deal. It will take a steady stream of continued positive signs to keep risk trades afloat.

In the hours ahead the focus shifts to the RBA decision at 0430 GMT. There are virtually no expectations for a cut although the continue fall in iron ore prices, the rout in Chinese stocks and Greece make it a small possibility. More likely is that Stevens' statement makes an easing bias more explicit and that could weigh on AUD/USD.

CFTC Commitments of Traders

Net speculative positions as of the close on Tuesday (-/+ denotes net short/long vs USD).

EUR -100K vs -90.9K prior

GBP -12.8K vs -22.2K prior

JPY -78.8K vs -87.7K prior

CAD -23.5 vs -17.6K prior

AUD -12.0K vs -9.0K prior

CHF +6.9K vs +7.1K prior

The numbers were delayed because of the US holiday but it's notable that despite all the the talk about delaying Fed rate hikes, that US dollar longs remain extremely popular. Cable shorts have stubbornly hung on despite the rally in June but the pair has now given up more than 50% of that rally. Still, the net GBP short is the smallest since December as BOE hikes creep closer.Bringing back October

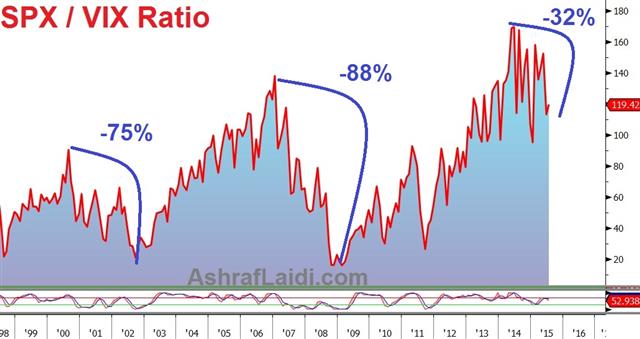

Regardless of the intra-day rebound in US and European indices last Monday and today, the recurring declines continue to stand out. In the case of the DAX-30, the German index gapped down about 450 points on Sunday November 28 in the futures market, before recovering half of those losses. But the gap remains unfilled. Today's post-Greek referendum recovery in the Dax also failed to fill the yesterday's 500-pt gap. The Dow Jones Industrials index will close below its 200-day MA for the 3rd time in the last five days, as the weekly chart remains above its 55-MA. The S&P500 nearing its own 55-WMA, which hasn't been crossed since the infamous October lows.

Combining these technical dynamics with the onset of US earnings season and the usual Greece developments, markets have sufficient reason for further volatility, especially as the Fed moves to keep its door open for an autumn hike at this month's FOMC meeting. The concentration of two appearances by Fed chair Yellen this month (10th and 16th) and July 29th FOMC should oblige with the fundamental catalysts for such volatility.

A painful summer lies ahead for the bulls.

Greece Says ‘No’, more Talks Ahead

Greeks have rejected the Troika bailout proposal. The euro is down 1.5 cents in early trading and markets are sure to be roiled for days. BOJ's Kuroda speaks later but all the focus will remain on Greece.

The tally is nearly complete and shows 61.5% of Greeks voting 'No' in a solid rejection of another round of austerity and a massive win for PM Tsipras. Polls were much closer in the days ahead of the vote but fear about a Grexit failed to materialize and voters showed they were fed up with failed austerity programs.

The path forward is entirely unclear and European leaders have quickly called summits for Monday and Tuesday. Hopes for some fresh round of negotiation got a lift in Tsipras' victory speech. He said he's convinced his mandate isn't to clash with Europe and that Greece will return to the negotiating table tomorrow.

The important question now is: How do top European leaders respond. Comments from Juncker, Merkel and Lagarde will be critical in the hours ahead. If they are defiant, it may lead to an impasse. But if they concede too much it would set a dangerous precedent.

Analysts have quickly pointed to a heightened possibility of a Grexit, ECB action and the Fed delaying rate hikes but that may be an overreaction. If European leaders concede some ground and some path to Greek debt relief is found, Tsipras may be happy to take it and declare victory. The main risk is if Merkel wants to continue the fight.

In the short-term, however, uncertainty reigns and safe-have n flows into the yen will accelerate as European markets come online. But the dust may settle sooner than expected.