Intraday Market Thoughts Archives

Displaying results for week of Mar 06, 2016What's next for Equities?

Now that stocks have rallied 11% off their February lows, questions arise whether the increase is merely a corrective rally part of a general bear market, or it's the start of a new bull run, backed by fresh stimulus from the ECB, BoJ and inaction by the Fed. In mid-February, Premium subscribers were issued strategies to long the DAX and short the FTSE (see charts below). These were partly based on the 2008Parallel widely used to fade the November rally and recurring January selloff in US, UK and German equity indices.

After Friday's close, we issued a new video focusing on these aforementioned indices as well as the MSCI World Index, highlighting the latest technical parallels with 2008 in terms of price, momentum and internal strength.

Two Central Banks Burned

Extraordinary and experimental action from the BOJ and now the ECB has backfired in the market. The euro surged after Draghi hinted no more easing is in the planned pipeline. Looking abroad, the PBOC could be on the cusp of a major announcement. EURJPY was stopped out, EURUSD remains in progress and in the green along four other trades.

The law of diminishing returns was in full view Thursday. The ECB delivered more than almost anyone expected but a harsh squeeze higher came after Draghi said no more cuts are in the forecast. He qualified it by saying that if the economy falters there could be more cuts and/or other extraordinary measures but the damage was done and EUR/USD jumped as high as 1.1220 from as low as 1.0823.

The reactions to the BOJ and ECB moves may make policymakers reluctant to creatively unleash stimulus. That would leave them truly at the zero bound.

One story that was overlooked in the ECB excitement was a Reuters sources story saying the PBOC is preparing regulations that will allow lenders to give up bad loans to the government or central bank in exchange for ownership stakes. Official data shows banks hold $614 billion in non-performing loans but most believe the situation is worse. Still, if all the reported bad loans were transferred to the government, this program would be nearly as large as the original US TARP program and very similar.

The market hardly noticed this story but it could potentially free up Chinese banks for billions in new loans and provide a major boost for growth. Keep a close eye on Shanghai stocks in the days ahead to gauge the potential impact.

Two other central banks are also in focus. The FOMC decision next Wednesday could revitalize the dollar. Initial jobless claims Thursday improved to their best level since October and comments from Fed members have been relatively positive.

The RBNZ is one of the few developed market central banks with plenty of traditional monetary policy firepower. The NZD has ranged since the surprise cut yesterday. Wheeler singled out today's REINZ house sales data for February as a key metric. There is no scheduled time or consensus estimate but the prior reading was +4.3%. A slowdown in house price growth may give him more flexibility to cut the 2.50% overnight rate further.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Initial Jobless Claims (APR 05) | |||

| 259K | 275K | 277K | Mar 10 13:30 |

Draghi Giveth, Draghi Taketh Away

Could the euro's 400-pip rally be attributed mainly to Draghi's remarks that he did not anticipate more rate cuts based on the current view and that the ECB didn't see the need for further rate cuts? The timing of those remarks coincided with the euro's stabilisation before the spike turned into a full-fledged euro rally, USD plunge and all-round selloff in equities.

How far down would the euro have gone had Draghi not dampened expectations on further ECB action? Does that matter? The fact that the euro unleashed one of its biggest gains despite the record expansion of asset purchases of Eurozone debt to EUR 80 bn per month from EUR 60 bn and reducing all 3 interest rates, including the reduction of the deposit rate to a record low -0.4% from -0.3% speaks volumes about the efficacy of negative interest rates.

Traders are increasingly aware that limitless negative rates by central banks do not mean limitless negative rates by commercial banks. The latter may have some tolerance to negative rates on their reserves at the ECB, but the same cannot be said about businesses or individual depositor's reserves at commercial banks. Whether it is -0.70% or -0.90% at the ECB, neither Deutsch Bank, Santander or BNP Paribas will succeed in transferring the so-called penalty to depositors. At least, the ECB was honest enough to not disguise its new negative rates with a Japanese style “multi-tier” rate, whose selective levy only means the low rate will not be widespread.

On the 1st year anniversary of the start of ECB, on the 7-year anniversary of the start of the generational lows in global equities, we are likely to have seen the top of the 10% bounce in equities, which is in and of itself, part of a new bear market. SP500 futures peaked at 2011 today, in line with our prediction 3 weeks ago here.

As for EURUSD, it remains in line with our tactically bullish stance, communicated in the Premium Insights. The next move will be less obvious and requires patience and capital.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone ECB deposit rate decision (MAR 10) | |||

| -0.4% | -0.4% | -0.3% | Mar 10 12:45 |

| Eurozone ECB Interest Rate Decision (MAR 10) | |||

| 0.00% | 0.05% | 0.05% | Mar 10 12:45 |

RBNZ Cuts, BoC Holds, ECB Next

Central banks in New Zealand and Canada painted completely different pictures of the global economy in their announcements Wednesday. The surprisingly placid view from the BOC made CAD the top performer while the kiwi tumbled on an unexpected RBNZ cut. It all sets the stage for the ECB in the day ahead.

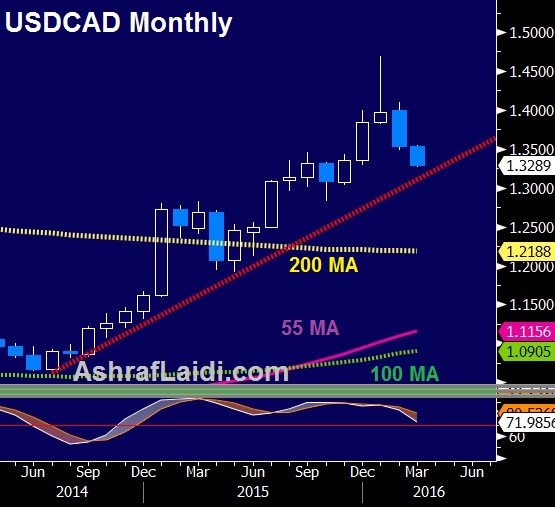

USD/CAD fell more than 150 pips to a fresh 2016 low after the Bank of Canada held rates at 0.50%. No move was expected but many expected dovish commentary or jawboning from the BoC. Instead, the statement said the global economy was progressing as anticipated and forecasts were on track. Oil was a big part of the CAD rally as it climbed 5%.

The RBNZ had a different view on the global economy with Wheeler saying it has disappointed and that he expects IMF downgrades in April. He also said Chinese building and manufacturing are “very much under stress.” Domestically, he jawboned the kiwi and said more cuts could come if data shows falling inflation expectations or faltering growth. NZD/USD fell 125 immediately on the decision and later continued another 25 pips lower.

The focus now shifts to the ECB decision Thursday. Draghi and other core members have dangled the likelihood of action and most economists expect a 10 bps cut in the deposit rate to -0.40% from -0.3%. A significant minority see a 20 bps cut.

The larger intrigue will be the combination of asset purchases, possibly raising monthly QE to 70-75 billion euros from 60B or adding other tools into the mix. What's fresh in the mind of market participants is a replay of the BoJ decision when they surprised with negative rates and crushed the yen only to see it reverse in the days ahead.

The euro rallied Wednesday, climbing 75 pips, perhaps as the euro bears get out of the way of a complicated and touchy central bank decision.

Are Fresh China Worries Real?

The shocking decline in Chinese exports yesterday may have been partly due to Lunar New Year holidays but it raises fresh questions. In a classic risk-off pattern, the yen was the top performer while the Canadian dollar lagged. In light of the turn in markets, we recap what we know about the Chinese economy. There are currently six Premium trades in progress, one of which 1 is short a major equity index.

As shocking as the headline is, a 20.6% y/y decline in Chinese exports isn't always cause for concern. The country essentially shuts down for Lunar New Year and because the holiday hits at different times, the data can be difficult to adjust.

What makes this time so worrisome is that exports were also down 6.6% in the prior month in numbers that also badly missed expectations. If the trend continues in March, there are serious risks that something is amiss.

But we don't want to wait another month to assess.

Here is a sampling of recent data:

- Feb official manufacturing PMI 49.0 vs 49.4 prior

- Feb Caixin manufacturing PMI 48.4 vs 48.4 prior

- Jan new loans 2510B vs 1900B yuan exp

- Westpac MNI China consumer sentiment 111.3 vs 114.9 prior

There is a major risk that the data is manipulated but at face value, there is nothing screaming that the economy is especially suffering. Much of it can be explained by slower global demand and a shift towards a consumer-led economy.

What argues for worry are actions from officials and signs from markets. The RRR was cut Feb 29 and the Shanghai Composite is down 44% since June. Perhaps the most worrying signal is that officials on the weekend signaled fresh lending in housing.

I wrote yesterday about the positive side of the renewed growth-at-all-costs mentality but the flip side is that it may be a sign of desperation. In an opaque economy like China, good information is difficult to find and what market participants believe is happening is more important than reality.

If fresh doubts about China arise, the ECB disappoints and the Fed is surprisingly hawkish next week, the recent gains in risk assets could quickly evaporate.

In the hours ahead, continue to watch for headlines from the NPC. Given the rebound in Shanghai stocks yesterday, the only signal that market is providing is one that officials are intervening.

Commodity Shorts Crushed, China Trade Figures Next

After big days in metals and oil, we look at what has been fuelling the commodity rally. The Australian dollar was the best performer on the day while its kiwi cousin lagged in a sign of the soft/hard commodity divergence. Australian business confidence, Chinese trade balance and Japanese GDP revisions are due later. A new Premium Video om oil, gold and equity indices will be posted and sent to subscribers about 60 mins after this IMT.

ميزات الذهب الأساسية و الفنية، مع النفط و المؤشرات

There is no science in seeing in a market squeeze, but there are signs. Pockets of the commodity market are moving like traders have no other choice but to buy.

Accelerating gains are one sign of a short squeeze. Oil has risen $3.34 in the past two sessions, having risen just $2.86 per barrel in the seven trading days before. Technicals are often another clue and the break above the late-January high of $34.82 late last week would definitely have spooked the bulls.

Some of the best signs are in positioning data. Like FX, the oil market is extremely large and liquid so some caution is warranted but the net short position was 150k contracts in the latest data.

A clearer example of a short squeeze in commodities was the approximately 20% rally in iron ore on various exchanges Monday. Short interest has risen 210% in 2016 and the FT outlined Monday hedge funds had been shorting metals and miners as a proxy for a China slowdown. With some metals up 50% since January, there is a high probability that funds have been forced to buy back shorts. More margin calls could come in the day ahead.

Two big-picture fundamentals trends kicked off the rally. 1) Better signs on growth from the United States. Aside from OPEC jawboning, nothing has changed in the supply picture but worries about a US recession have faded, especially after Friday's strong jobs data. 2) The comments, deficit and housing stimulus from China were interpreted as a sign of a growth-at-all-costs mentality.

With the cornerstones of global growth – China and the US – looking better, the demand equation is much improved.

Overall global demand remains sketchy. The question about how well developed market commodity exporters will performer remains. A leading indicator is the Australian NAB business conditions survey. It was previously at +5 with confidence at +2. The latest data is due at 0030 GMT.

The other data to look out for is Chinese trade balance. The consensus is for a 12.5% drop in exports and a 10.0% decline in imports. The data is usually released just before 0300 GMT.

Final revisions to Japanese Q4 GDP could also have an impact if they surprise.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance - BOP Basis (JAN) | |||

| ¥188.7B | Mar 07 23:50 | ||

| Trade Balance (FEB) | |||

| 406.2B | Mar 08 2:00 | ||

| Trade Balance (FEB) | |||

| $50.15B | $63.30B | Mar 08 2:00 | |

| GDP Annualized (Q4) | |||

| -1.5% | -1.4% | Mar 07 23:50 | |

| GDP (Q4) (q/q) | |||

| -0.4% | Mar 07 23:50 | ||

| GDP Deflator (Q4) (y/y) | |||

| 1.5% | Mar 07 23:50 | ||

| Exports (FEB) (y/y) | |||

| -12.5% | -11.2% | Mar 08 2:00 | |

| Imports (FEB) (y/y) | |||

| -10.0% | -18.8% | Mar 08 2:00 | |

| NAB's Business Conditions (FEB) | |||

| 5 | Mar 08 0:30 | ||

| NAB's Business Confidence (FEB) | |||

| 2 | Mar 08 0:30 | ||

China Re-Starts the Dangerous Property Game

The era of 7% growth in China essentially came to an end at the National People's Congress on the weekend. Early trading is light but the AUD is lagging and USD leading. CFTC data showed euro shorts and Aussie longs in fashion. Monday's key events will be mostly central bank related, including a speech from BoE's Haldane (4:10 ET/9:10 GMT), Fed's Brainard (17:00 GMT) and Fed's Fischer (18:00 GMT).In the Premium Insights, a new trade has been added on Friday, adding the total of existing trades to 7.

Top Chinese officials met in Beijing on the weekend and unveiled a 6.5-7.0% target, the first departure from +7% expectations. It was well telegraphed in advance but it underscores the difficulty in maintaining momentum. One concern is that the deficit will swell to 3% of GDP from 2.3% but a larger worry is that the government plans to stimulate the mortgage lending industry as well.

Along with reports of mass layoffs last week, the PBOC's Zhou voiced his support for an overhaul in state-owned enterprises in order to reduce overcapacity. That's something that could reduce demand for raw materials.

Overall, talk of more difficult reforms has been softly shuffled to the back burner. The clearest sign is the mortgage market. While that's good for near-term domestic and global growth, there will eventually be a bill to pay.

The lone event of note in Asia-Pacific trading is yet another speech from Kuroda at 0340 GMT. His recent comments left little doubt that he's prepared to ease again but there has been no hint of the timing.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -68K vs -47K prior JPY +60K vs +53K prior GBP -39K vs -33K prior CHF -1.5K vs -2K prior AUD +17K vs +10K prior CAD -30K vs -2K prior NZD -4.2K vs -6.6K prior

The Australian dollar was the best performer last week, rising more than 4% on upbeat GDP and no hints of easing from the RBA. It doesn't take much to get momentum going in a high yielder and with positioning still relatively neutral, there is plenty of room for longs.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Stanley Fischer speech | |||

| Mar 07 13:30 | |||

| RBA Deputy Governor Lowe Speech | |||

| Mar 07 23:30 | |||