Intraday Market Thoughts Archives

Displaying results for week of Dec 07, 2014We never saw this in stocks

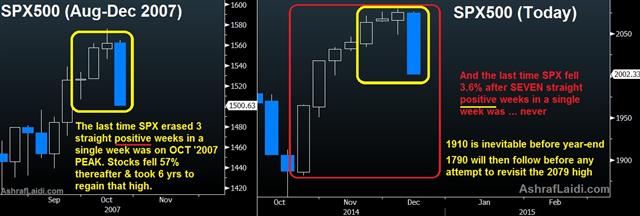

Much was written about this week's equity selloff, being the biggest drop since Sep 2011 etc. But two additional pieces of analysis we uncovered is that this week's 3.6% decline in the S&P500 single-handedly erased all of the prior 3 weeks' BACK-to-BACK GAINS. The last time this had happened was the week after the October 2007 record. Guess what stocks did after that... A more dangerous finding is that this week's S&P5 500 decline took place after SEVEN weekly consecutive gains, which was NEVER seen before in the index. I will post in Monday's Premium Insights new trades to exploit these developments.

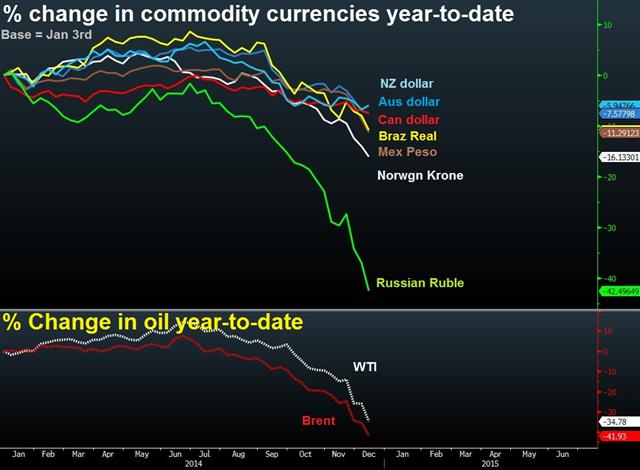

Commodities currencies' performance YTD

A brief look at the worst performing commodity FX so far this year shows the Russian ruble is down 43%, followed by the Norwegian krone and Mexican peso at -16% and 12% respectively. The carnage in energy and oil was largely to blame. But for those who regularly trade G20 currencies, the interesting point is in the Aussie and the loonie as currencies as almost identical in their 8% decline against the US dollar since January 3rd of this year. Full chart & analysis

US Consumers Pick Up Congressional Slack

A strong US retail sales report sparked a wave of US dollar buying but Congressional fears snarled the move later. On the day, GBP was the top performer while the yen languished. A midnight deadline faces the US House while Japanese industrial production is next. As USDCAD breaks 1.15, our Premium long in USDCAD hits 180 pips in the money. We issued a new CAD trade with 3 charts and cancel GBPCAD.

Today's story: The US dollar rallied on its strong consumers, but fell on its weak government. Retail sales ex-autos, gas and building supplies rose 0.6% vs 0.4% and that helped get the ball rolling on what was a very strong day for the US dollar.

USD/JPY had gained more than 160 pips at the highs but those gains were halved as murmurs from Washington began about Congress playing yet another game of chicken and the possibility of a government shutdown if legislation isn't passed by midnight.

Eventually, Congress will get the job done but it's impossible to say how much drama will come first. With the Christmas break looming, the odds are in favor of a deal but we take nothing for granted and neither does the market.

Aside from the late drama, Thursday's trading had the hallmarks of year-end. Moves were whippy and some of them were tough to explain, but that's how it always is at this time of year.

The other story is oil and the continuing fall in crude to $59.05. It took just 9 trading days to get from $70 to $60 and oil producers around the world are wishing they had hedged. Whenever something falls as far and as fast as oil, there are more winners than losers and even though consumers are winning, falling oilfield employment and investment will cause plenty of pain.

Aside from politics, the calendar is relatively light. The only notable event is at 2330 GMT with Japanese industrial production but it's the final revisions rather than the initial report, so don't expect a market reaction.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (NOV) (m/m) | |||

| 0.7% | 0.4% | 0.5% | Dec 11 13:30 |

| Industrial Production (OCT) (m/m) | |||

| 2.9% | Dec 12 4:30 | ||

| Industrial Production (OCT) (y/y) | |||

| 0.8% | Dec 12 4:30 | ||

RBNZ less dovish, Aussie jobs upside surprise

If one thing has been consistent in the post-crisis era, it's that the market throws a tantrum every time the Fed hints at getting less dovish and that could be what's driving the squeeze on the US dollar. Risk aversion was the theme Wednesday as the yen led the way and the loonie lagged on oil weakness. The Kiwi rose aross the board after the RBNZ sounded off a confusingly hawkish statement. Aussie jobs surprised with 43K net increase, three times greater than expected, but downward revisions, unemployment rising to 6.3% and part-time workers filling 80% of the rise were seen as neutralizing factors. Two new trades in the Premium Insights involving NZD were issued, after the earlier trades were stopped out.

The RBNZ made references to the Kiwi being overvalued despite reiterating the outlook for further tightening down the line. After the Kiwi rallied hard, RBNZ governor Wheeler said he expected rates to remain where they were for a long time.

There are fresh worries about Chinese economic weakness and the regular fretting about Greece butthere hasn't been much news that would justify the sudden softness in the US dollar unless we take a look at the Fed.

There's a very good chance the FOMC removes the commitment to 'considerable time' at next week's meeting in what will be taken as a signal about rate hikes in six months. The market – especially the bond market – is saying it's a mistake.

Five-year breakevens fell another 5 bps on Wednesday and now imply average inflation of just 1.27% over that period. By June, some economists are forecasting US inflation will be at 0.0% year-over-year. The market is warning the Fed that it doesn't need to raise rates; the big surprise on Dec 17 might be that the Fed listens.

The conundrum is that the Fed might only listen if the market kicks and screams some more.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Employment Change | |||

| 42.7K | 15.2K | 13.7K | Dec 11 0:30 |

China struggles to support CNY

The PBOC is increasingly resisting traders' weakening of the Chinese yuan, by announcing higher rate in its daily central reference rate. But as Chinese data continue to weaken across the board, FX traders have no choice but to sell the yuan (pushing up the USDCNY rate). We should see this chart more regularly next year. Full charts & analysis.

Recording of my webinar wth Bob Lang

Here is the recording link to my 2-hr webinar from last night with Bob Lang iof Explosive Options. Recording link.

Dollar Storms Back, China CPI

The US dollar made a dramatic round-trip in New York trading in a wild day of trading. Yen shorts were squeezed across the board; AUD and USD were the laggards on the day. Up next, China releases CPI and Australian releases housing finance data.

We warned about overbought yen crosses at the start of the week and that proved prescient as those positions were squeezed hard on Tuesday. USD/JPY fell as low as 117.95 – more than 250 pips on the day – before the bleeding stopped.

It was a quick turnaround later in the day as the pair rallied all the way back to 119.82 in a dramatic day of trading. The S&P 500 fell by as much as 26 points but rebounded to close nearly flat.

Days like this are part of trading and a reminder to manage risk and be prepared for opportunities. The key driver was China, where securities regulators announced tighter repo lending rules and after Monday's soft trade data.

In addition, Greece appears to be headed for an election in early Feb and there are signs of a global economic slowdown despite a pickup in the US.

On spot very few people were talking about Tuesday was oil and that's because prices stabilized around $63.50 despite the turmoil elsewhere. That suggests the forced selling may be done, at least for now. API supply numbers were bearish late on Tuesday, however, so official data on Wednesday could spark fresh selling.

Ideally, a bearish headline or two will hit oil in the days ahead and prices won't fall. That could be a sign, at least in the short-term, that a bottom is in. The main focus in Asia-Pacific trading will be Chinese stocks after the Shanghai Composite fell 5.4% on Tuesday. Inflation numbers are in focus with November CPI expected up 1.6% y/y but the risks are definitely on the downside due to falling commodity prices.

Otherwise, Japanese PPI data is due at 2350 GMT and Australian home loans are due at 0030 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (NOV) (y/y) | |||

| 1.6% | 1.6% | Dec 10 1:30 | |

| Consumer Prce Index (NOV) (m/m) | |||

| 0% | 0% | Dec 10 1:30 | |

| Home Loans (OCT) | |||

| 0.0% | -0.7% | Dec 10 0:30 | |

Dow Transportation fails to Confirm Industrials

As stocks post their biggest daily declines since mid October on a host of factors, we note a rare divergence between the Dow Jones Industrials Average and the Dow Transportation Average, known as the failure of the Dow Theory. Full charts & analysis.

Risk Trades Dip, so does US Dollar

One major item remains on the USD calendar for the remainder of the year, the FOMC decision, and Lockhart added some extra intrigue with a comment Monday. The yen was the top performer to start the week while NZD lagged in a classic 'risk off' trade. The Asia-Pacific calendar is light. Existing Premium Inights include USDCHF, USDCAD and AUDCAD. The Aussie jobs report and SNB rate announcement will prove instrumental for these pairs.

The FOMC decision is on Dec 16 and given the improvement in economic data – especially jobs – most economists think the Fed will remove the pledge to keep rates low for a 'considerable time'. Not so, said Atlanta Fed President Lockhart.

Not only is Lockhart a voter in 2015, he also tends to reflect the core of the FOMC. He said the Fed isn't in a rush to drop the commitment and urged patience on liftoff, saying it could come in H2 2015 or later.

The bond market is sending the same signal with 5-year breakevens falling another 5 basis points on Monday to 1.31% -- implying inflation well-below the Fed's target.

On the other side was the Fed's Williams who repeated that mid-2015 is a reasonable guess for the first rate hike.

In the market, after rallying in early-week trade to a cycle high of 121.84, USD/JPY fell to as low as 120.22. We warned yesterday that USD/JPY was severely overbought on a variety of timeframes and the soft Japanese GDP and Chinese trade numbers were the queue for a correction. The 162 pip decline in the pair was the second-largest low-to-high correction in USD/JPY since the BOJ decision on Oct 31. Several retracements into that zone have proven to be buying opportunities in the past.

The overall theme was risk aversion with the S&P 500 falling 15 points in the largest decline since Oct 22. So far the retracement is nothing out of the ordinary and there are no signs that the rip in the US dollar is done but some caution is warranted.

In Asia-Pacific trading, the calendar features Japan November preliminary machine tool orders. The report is due at 0600 GMT; there is no consensus but the prior reading showed a massive 30.8% y/y jump.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (Q3) (q/q) | |||

| -0.5% | -0.1% | -1.9% | Dec 07 23:50 |

| GDP Annualized (Q3) | |||

| -1.9% | -0.5% | -7.3% | Dec 07 23:50 |

| GDP Deflator (Q3) (y/y) | |||

| 2.1% | 2.0% | Dec 07 23:50 | |

| Machine Tool Orders (NOV) (y/y) [P] | |||

| 31.2% | Dec 09 6:00 | ||

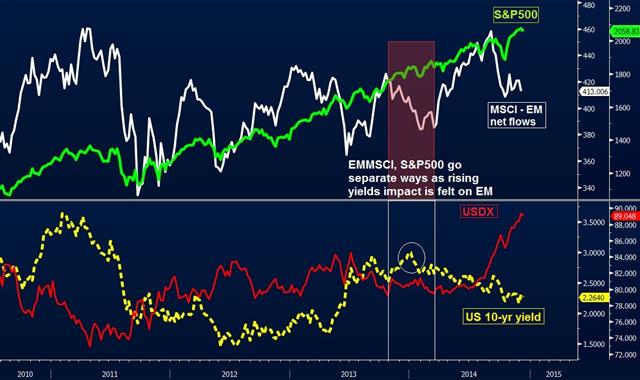

EM fearing US dollar, yields, China trifecta

The Bank of International Settlements finds that emerging markets face rising risk of servicing their USD-denominated debt owing to the rising value of the US currency. But the real danger will come from bounce in US bond yields as well as persistent deterioration in Chinese economic figures. See full charts & analysis.

USD/JPY Starts Strong, Japan GDP Next

In early trading in Asia, there has been no hangover for the US dollar after the non-farm payrolls rally on Friday. USD/JPY is up 34 pips to 121.80 to start the week; it's overbought on multiple timeframes but the latest CFTC report shows why buyers may still emerge on any dip. The final revisions to Q3 Japanese GDP are due later. Our final 121.10 target in USDJPY was hit with 300 pips. 5 more currency pairs remain in progress in the Premium Insights.

The UD dollar laid a thrashing on the rest of the forex market on Friday and was the best performer last week – once again. The year is winding down and the rule of thumb for early/mid-December is to keep doing what has worked for the year so that augers well for the dollar.

The market is fully anticipating the Fed to shift more hawkishly at the Dec 16 meeting and to continue to do so in 2015. The danger, perhaps, is that the trade is already overcrowded.

We have read dozens of forecasts for 2015 and virtually all of them argue for continued US dollar strength. It's difficult to argue against the reasoning but that degree of consensus always makes for a dangerous situation.

Note that the daily, weekly and monthly RSI in USD/JPY is above 80. If the market suddenly finds a reason to buy yen, a violent squeeze could take place. That could come with final revisions to Q3 Japanese GDP at 2330 GMT. The shockingly soft -1.6% q/q (annualized) reading helped cause the rout on the yen but economists expect it to be revised to -0.5%. A better revision could even erase the recession.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -159K vs -165K prior JPY -111K vs -104K prior GBP -31K vs -31K prior AUD -41K vs -44K prior CAD -18K vs -16K prior CHF -23K vs -23K prior NZD -2K vs -2K prior

One reason not to be worried about a lasting squeeze in USD/JPY lower is that the short position still remains short of the -120K from late September and -145K at this time last year.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q3) | |||

| -0.5% | -7.3% | Dec 07 23:50 | |

| GDP (Q3) (q/q) | |||

| -0.1% | -1.9% | Dec 07 23:50 | |

| GDP Deflator (Q3) (y/y) | |||

| 2% | Dec 07 23:50 | ||