Intraday Market Thoughts Archives

Displaying results for week of Feb 08, 2015USDCAD bulls beware as oil takes over

Take a look at the overlay between daily USDCAD chart Sep 2013-March 2014 and the daily USDCAD from today. Full chart & analysis here

Sterling breaks out on hawkish Carney

The BoE's hawkish inflation helps further sterling appreciation ahead – even against the US dollar — as the currency stands alongside USD as the only two major currencies whose central banks are not on an easing mode. This says a lot in a world of relative valuation, when currencies are priced by not only their absolute levels returns, but also by .... full Charts & analysis

No News, No Problem for USD

'All else being equal, the dollar rallies'. That's been the story for the past six months and it was again on Wednesday as USD was the top performer while the Aussie lagged. The Australian jobs report is the main even later but there are other notable releases as well. The latest Premium Insights include USDCAD, AUDNZD and NZDCAD.

Heading into the day the focus was on Greece/Eurogroup talks but they weren't a factor for most of the day. Instead, the continued breakout from the USD/JPY wedge pressed through 1.2000 to 1.2044 and the highest in a month.

It was part of a theme of broad US dollar strength that wasn't driven by any particular factor. There was hawkish talk from Fisher and Bullard but that's par for the course.

USD/CAD was another mover and touched 1.2700 as US oil inventories rose to a fresh record. After touching $48/barrel, WTI bounced and that sent USD/CAD back down to 1.2618.

The Australian dollar closed at a fresh cycle low of 0.7723 as support in the 0.7750 range gave way. The Australian employment report is due at 0030 GMT and expected to show a loss of 5.0K jobs and 6.2% unemployment. If it's on the soft side, there is very little support until the post-RBA spike low of 0.7626.

Gold is also struggling to find support after giving up most of its 2015 gains. The lows on the day at $1217 came after reports of a bridge deal for Greece tricked out of the meetings. That also briefly gave the euro a 45-pip boost but it was unable to hold the gains.

The euro has been flat for three consecutive days and that kind of triple-doji is often a precursor to another big move.

Other events to watch in the hours ahead are the Australian consumer inflation expectations report for Feb at 0000 GMT and Japanese preliminary machine tool orders data at 0600 GMT. Japan also returns from holiday today and that could add to the USD/JPY story.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Inflation Expectation (FEB) | |||

| 4.0% | 3.2% | Feb 12 0:00 | |

| Machine Tool Orders (JAN) (y/y) [P] | |||

| 33.8% | Feb 12 6:00 | ||

| Employment Change s.a. (JAN) | |||

| 5.0K | 37.4K | Feb 12 0:30 | |

| Fulltime employment (JAN) | |||

| 41.6K | Feb 12 0:30 | ||

| Part-time employment (JAN) | |||

| -4.2K | Feb 12 0:30 | ||

| Unemployment Rate s.a. (JAN) | |||

| 6.2% | 6.1% | Feb 12 0:30 | |

GBP Ahead of BoE Inflation Report

GBP rallis ahead of Thursday's release of the BoE quarterly inflation report, which could be contradictory at best as GBPUSD tests its 7-month down channel. Full charts & analysis

Which CAD Pair?

As the Canadian dollar posts its seventh trading session of alternate up-&-down days against the USD, figuring out the next move in the loonie becoming increasingly challenging. Dovish comments from the Bank of Canada and falling oil helped drag down CAD. But any signs of rebound in oil are helping cap the USDCAD. After close analysis, we found a currency against which we could trade CAD with more confidence and less certainty. Find out from the 2 new Premium trades and 2 charts in our latest Premium Insights.

Euro Wheels Not Yet ‘Greeced’

The euro started the week on the back foot with Grexit talk reignited but US traders didn't take the bait and EUR/USD recovered. On the day, the kiwi and loonie led the way while sterling lagged. Up next it's Chinese CPI.

The ebb and flow of Greek bailout negotiations will be in the spotlight for a few weeks but traders aren't ready to hit the panic button just yet. EUR/USD touched the lowest since Jan 28 at 1.1270 as US traders arrived but the market doesn't yet appear ready for another test of the post-ECB low of 1.1114 and the pair turned around to finish nearly unchanged at 1.1326.

The volatility on the day was a bit lower than we've had so far early in the year. Assisting the euro was a broader USD slide late in the day, in part due to a dip in stocks. Overall, the move was only a small retracement of the post-NFP surge in the dollar.

Headlines were mixed. One that stood out was Plosser saying it will be a challenge to remove 'patient' from the Fed statement. Plosser is a major hawk and after some less-dovish comments from Lockhart on Friday the Fed appeared to be setting up Yellen for a similar move her appearance on Feb 24. The market will continue to look for clues.

In the shorter term, the focus will be on China. At 0130 GMT, data on January inflation is due. The CPI is expected up just 1.0% year-over-year. There is certainly room for stimulus from China but indications continue to be cautious. That may change on a larger fall.

Other data to watch is from Australia with NAB business confidence and Q4 house price data, both at 0030 GMT.

The euro started the week on the back foot with Grexit talk reignited but US traders didn't take the bait and EUR/USD recovered. On the day, the kiwi and loonie led the way while sterling lagged. Up next it's Chinese CPI.

The ebb and flow of Greek bailout negotiations will be in the spotlight for a few weeks but traders aren't ready to hit the panic button just yet. EUR/USD touched the lowest since Jan 28 at 1.1270 as US traders arrived but the market doesn't yet appear ready for another test of the post-ECB low of 1.1114 and the pair turned around to finish nearly unchanged at 1.1326.

The volatility on the day was a bit lower than we've had so far early in the year. Assisting the euro was a broader USD slide late in the day, in part due to a dip in stocks. Overall, the move was only a small retracement of the post-NFP surge in the dollar.

Headlines were mixed. One that stood out was Plosser saying it will be a challenge to remove 'patient' from the Fed statement. Plosser is a major hawk and after some less-dovish comments from Lockhart on Friday the Fed appeared to be setting up Yellen for a similar move her appearance on Feb 24. The market will continue to look for clues. The Premium Trades in USDJPY and both of AUDNZD remain in progress.

In the shorter term, the focus will be on China. At 0130 GMT, data on January inflation is due. The CPI is expected up just 1.0% year-over-year. There is certainly room for stimulus from China but indications continue to be cautious. That may change on a larger fall.

Other data to watch is from Australia with NAB business confidence and Q4 house price data, both at 0030 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (JAN) (m/m) | |||

| 0.4% | 0.3% | Feb 10 1:30 | |

| Consumer Prce Index (JAN) (y/y) | |||

| 1.0% | 1.5% | Feb 10 1:30 | |

| NAB's Business Confidence (JAN) | |||

| 2 | Feb 10 0:30 | ||

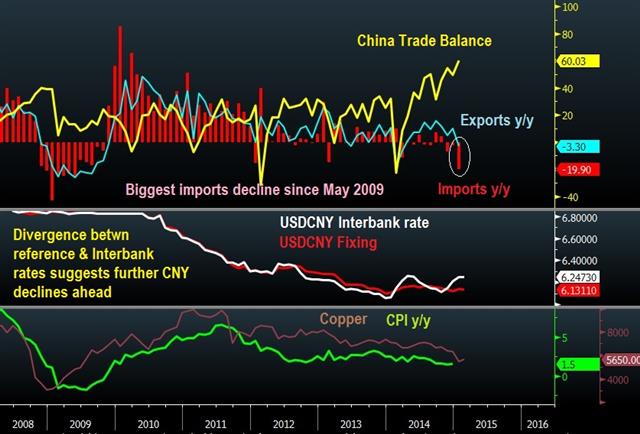

China’s crashing imports assure more CNY depreciation

The 19% y/y slump in China's trade was the biggest decline since May 2009 and the seventh decrease over the last 12 months. Disappointing China figures ahead of G20 meetings are far from rare, but the long term trend in the data is another reminder that Beijing will cut its benchmark lending/borrowing rates and pave the way for further CNY depreciation. Full charts & analysis.

China Trade Crumbles, AUD Lower

The Australian dollar starts the week on the back foot after a troubling trade report from China. Last week, the Aussie struggled after the RBA rate cut and it starts a quarter-cent lower. CFTC positioning data showed EUR shorts nearing an extreme.

The US dollar starts the new week with momentum after non-farm payrolls. The data was strong almost without exception and the Fed took note immediately. On Friday, Atlanta Fed President Lockhart said a hike in June is possible. He typically shares the same sentiment as the core of the Fed and it means a high likelihoods that the reference to 'patients' before liftoff will be removed in June. A stronger signal could come from Fed Chairman Yellen at Humphrey Hawkins on Feb 24.

Given that backdrop, it's difficult to envision the dollar rally ending in the near term. Two violent dollar dips last week proved to be buying opportunities and higher Treasury yields will prove attractive for foreign capital.

A wildcard is oil. The volatility last week was almost unprecedented and certainly warrants caution.

The Australian dollar was on the back foot in early trading but the first bullet was dodged as PM Abbott survived a confidence vote. However, he's been wounded and it could only be a matter of time.

The larger factor for the Aussie was Chinese trade data. Exports fell 3.3% compared to a 5.9% rise expected. Imports plunged 19.9% compared to a 3.2% fall expected. Economists point to seasonality due to the lunar new year and the market has generally taken it in stride but it's not a great sign for the global economy.

The focus stays on trade with Japanese trade balance due at 2350 GMT. The December numbers are expected to show a ¥ -472.0B deficit, a significant improvement from the prior reading of ¥ -636.8B.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -196K vs -185K prior JPY -60K vs -64K prior GBP -42K vs -45K prior AUD -56K vs -49K prior CAD -27K vs -24K prior CHF -5K vs -7K prior

The euro net short is the second-most extreme on record. The largest since the records began was in May 2014 and EUR/USD bottomed about two months later. Note that yen shorts – the darling of the FX market just a few months ago – are now hardly more popular than AUD or GBP shorts. If the range breaks to the upside in USD/JPY, that could draw in fresh shorts and make for a quick move to 125.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Exports (JAN) (y/y) | |||

| -3.3% | 6.3% | 9.9% | Feb 08 2:00 |

| Exports (JAN) (y/y) | |||

| -3.3% | 5.8% | 9.7% | Feb 08 2:27 |

| Exports CNY (JAN) (y/y) | |||

| -3.2% | 9.9% | Feb 08 2:27 | |

| Imports (JAN) (y/y) | |||

| -19.9% | -3.0% | -2.3% | Feb 08 2:00 |

| Imports (JAN) (y/y) | |||

| -19.9% | -3.2% | -2.4% | Feb 08 2:27 |

| Imports (JAN) (y/y) | |||

| -19.7% | -2.3% | Feb 08 2:27 | |

| Trade Balance - BOP Basis (JPY) (DEC) | |||

| -¥395.6B | -¥472.0B | -¥636.8B | Feb 08 23:50 |

| Trade Balance (JAN) | |||

| $60.03B | $48.90B | $49.10B | Feb 08 2:00 |

| Trade Balance (JAN) | |||

| 60B | $48.20B | $49.61B | Feb 08 2:27 |

| Trade Balance (JAN) | |||

| 366.90B | 304.56B | Feb 08 2:27 | |