Intraday Market Thoughts Archives

Displaying results for week of Mar 08, 2015PPI Reminds Fed, GBP Vol Highest since Sep

If last Friday's message from non-farm payrolls was a reminder of a recovering and healthy US jobs market, today's producer prices index report is a reminder that not only deflation has crept into suppliers' pipelines but, that the Fed's description of lower energy prices having “transitory” effects will remain in next week's FOMC statement as oil prices drop back 20% from their post-FOMC meeting peak and are now a mere 10 cents above the last FOMC meeting on January 28. Meanwhile, here is what sterling has done.

USD Hiccup, But Hardly a Headache

A soft retail sales report led to a momentary US dollar drop but it once again proved resilient in a sign of the underlying strength. The Australian dollar was the top performer on the day while sterling lagged. The Asia-Pacific week ends on a relatively quiet note with only revisions to industrial production on the calendar. Last night's post-RBNZ Premium short in GBPNZD is more than 200 pips in the money. EURUSD hit its 1.0500 target for 200 pips. AUDNZD and EURAUD remain more than 100 pips in the money. All these trades are in the Premium Insights.

US retail sales fell 0.2% in February excluding autos and gas, compared to a +0.3% rise expected. The prior report was also revised down to -0.1% from +0.2%. The internals of the report were also soft but US dollar bulls were hardly dissuaded.

A 30-pip dip in USD/JPY was reversed in minutes and the pair the rallied another 30 pips to 121.34 and a nearly-flat close on the day. The rebound was given a helping hand by a 25 point rally in the S&P 500 that took the edge of the recent declines.

Even the beaten-down euro couldn't hold onto retail sales-driven gains. A rally to 1.0675 was quickly sold back down to 1.0600. It rose three-quarters of a cent on the day but that's hardly impressive given the magnitude of the recent losses.

The main theme was a paring of USD strength but a secondary story was the weakness in cable. Carney told a regional paper he's in no rush to hike rates and that accelerated a slide. GBP/USD fell as low as 1.4851. The major level to watch is the 2013 low of 1.4814.

Up next it's the final reading Japanese IP at 0430 GMT. The initial reading was +4.0% m/m.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Advance Retail Sales (FEB) | |||

| -0.6% | 0.3% | -0.8% | Mar 12 12:30 |

| Retail Sales (ex. Autos) (FEB) | |||

| -0.1% | 0.5% | -0.9% | Mar 12 12:30 |

| Industrial Production (JAN) (m/m) | |||

| 0.8% | Mar 13 4:30 | ||

| Industrial Production (JAN) (y/y) | |||

| 1% | Mar 13 4:30 | ||

| Eurozone Industrial Production s.a. (JAN) (m/m) | |||

| -0.1% | 0.2% | 0.3% | Mar 12 10:00 |

| Eurozone Industrial Production w.d.a. (JAN) (y/y) | |||

| 1.2% | 0.1% | 0.6% | Mar 12 10:00 |

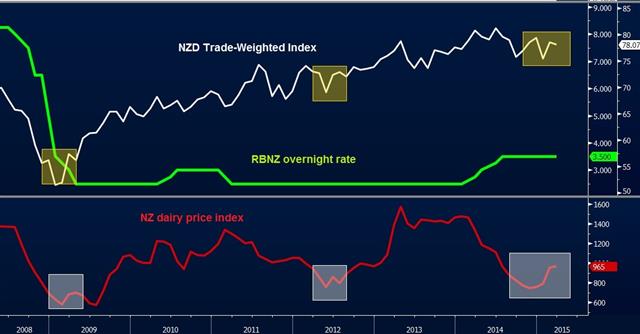

Neutral RBNZ good enough for kiwi

The NZD has no choice but to flex its high yielding muscle following last night's announcement from the Reserve Bank of New Zealand to keep the overnight rate unchanged at 3.50%, while reiterating its neutral policy stance by sticking to the phrase “rates could go up or down”. Here is the latest analysis, charting hcarting against NZ dairy prices. Full charts & aalysis.

RBNZ Defies Cut Chatter, Euro Drops Again

The RBNZ signaled it won't join in the race to cut rates, at least not yet. A late charge in NZD helped it unseat the US dollar as the top performer while the euro lagged. The Australian employment report is next. The RBNZ announcement sent the Premium short of AUDNZD deeper into the green. USDCAD was stopped out and yesterday's EURUSD short is 40 pips away from realizing its 190-pip target. A new NZD Premium trade will be sent out to subscribers prior to RBNZ governor Wheeler's testimony at the top of the hour.

NZDUSD was at the lows of the day at 0.7192 and just a handful of pips above the Feb low when the RBNZ decision was released. There was talk about a surprise cut with 2 of 16 economists making that prediction but it didn't come and NZD rallied.

In fact, it wasn't even close. Wheeler said the central bank has a neutral bias and talked about a period of stability in rates. He continued to jawbone and some traders noted that he said a correction is 'needed' from a depreciation is 'expected' and that could signal intervention. But that intervention is unlikely to come versus the US dollar as Wheeler said he was 'pleased' with the NZDUSD rate.

Aside from the kiwi, the main story in the forex market was the continued plunge in the euro. It was the second consecutive day of more than 130 pip declines in EUR/USD and the ninth negative day in the past 10. Core and periphery yields are continuing to fall and Nowotny openly wondered about the potential consequences of buying bonds with negative yields. He expressed worry that QE might be too successful in the bond market.

In the FX market, it's increasingly clear there is no appetite for buying euros whatsoever. Every bounces fades within hours and near-term technical support is nearly negligible aside from psychological levels like 1.05.

The other big story in FX is the roaring US dollar. Other currencies also fell against the dollar on Wednesday, especially the pound as it cratered through 1.50. The commodity currencies haven't been spared with USD/CAD rising to within a hair of the 2015 high of 1.2799.

The Australian dollar 'only' fell a half cent on the day but part of the reason may be light trading ahead of the Feb employment report due at 0030 GMT. The consensus is for 15K new jobs after a 12.2K drop a month earlier. As always, the full-time/part-time breakdown along with the unemployment rate are important caveats. Another one is the increasing skepticism about the ability of the ABS and RBA to protect sensitive information. An investigation is underway after an apparent early move in AUD/USD on last week's RBA announcement.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Employment Change s.a. (FEB) | |||

| 15.0K | -12.2K | Mar 12 0:30 | |

| Fulltime employment (FEB) | |||

| -28.1K | Mar 12 0:30 | ||

| Part-time employment (FEB) | |||

| 15.9K | Mar 12 0:30 | ||

| Unemployment Rate s.a. (FEB) | |||

| 6.3% | 6.4% | Mar 12 0:30 | |

RBNZ & Aussie Jobs preview

The upcoming RBNZ decision (due at 20:00 GMT) should be expected to leave rates unchanged, but beware of any new signs of dovishness in the statement aimed at guiding the kiwi lower. The other event of the evening is Australia's jobs report (due at 00:30 GMT). Both the Aussie and NZD have been punished hard against the USD, but AUDNZD has recovered substantial ground since last week. Full charts & analysis.

Stocks correct, euro resumes downfall

At some point it was inevitable that the rising US dollar and growing chance of rate hikes would hurt the stock market. After the worst day of the year so far in the S&P 500, we consider whether that time is now and what it means for FX. The yen and US dollar were top performers on the day while the euro lagged. Japanese machine orders are due later. In the latest Premium Insights, Ashraf issued issued 2 new trades on EURUSD with 2 key charts. EURJPY, USDCAD, AUDNZD and EURAUD are all in progress. 1 USDCAD was stopped out earlier this morning, while EURJPY shorts remains +100 pips in the money.

The S&P 500 tumbled 35 points, or 1.7% on Tuesday, closing at the lowest since Feb 4. The move was essentially a continuation of the fall after non-farm payrolls on Friday. It wasn't extremely strong but strong enough to make most market participants confident the Fed will remove 'patient' next week.

At the same time, the ECB has launched its QE program and the market is staring a trillions of euros of Eurozone bonds that already have negative yields with a wave of ECB buying likely to push them even lower. German 30-year bond yields are down a quarter point in the past two days to just 0.75%, almost on par with US 2s.

The best-case scenario for the Eurozone is that economic data picks up but so far good news has been shrugged and every EUR/USD bounce is hammered into oblivion. There is a sense in the market that the ECB might not find the supply to purchase 60 billion euros per month but rumors of just 25-50 million of buying on Monday were dispelled by Coeure who said the ECB and national central banks purchases 3.2 billion, which is slightly above the 60 billion pace.

Looking at stocks, the immediate takeaway is how resilient the US dollar has been against the yen. USD/JPY climbed for four consecutive days leading into Tuesday, mostly in a risk-negative environment. An attempted break above 121.20 was beaten down but the pair managed to close nearly flat. If USD/JPY can't mount more of a correction on the tail-end of a 4-day rally plus a rout on stocks, when can it correct?

Part of the story is the yen equation after the soft Q4 GDP numbers. The economy will remain in focus with January machine orders due at 2350 GMT. They're expected to fall 4.0% m/m after an 8.3% gain in December. A larger fall would further nudge the BOJ toward action. Japanese officials also won't be impressed that EUR/JPY is at 18-month lows.

Euro damaged, kiwi panics

Fresh 12-year lows in EURUSD and another hit to NZD re-emerged in global markets as Greece and the EU put off talks to another day, while stock traders let the shine of Apple's iWatch presentation wane after it was revealed that the battery life of the much awaited accessory lasted no more than 18 hours. Full charts & analysis.

Pound Bounces, Yen Slides

The heavy round of risk aversion late last week partially retraced on Monday. The pound was the top performer while the yen lagged. Chinese inflation is up next. Our Premium trades in USDCAD, EURJPY, EURAUD, AUDND remain open and in progress.

Last week ended with a rout on risk-sensitive trades on worries about Fed hikes but the moves overextended and bounced today. The pound led the way, with cable recovering nearly half the 200-pip fall on Friday.

An exception was the euro, which failed to register any kind of meaningful gain. EUR/USD climbed to 1.0910 in early European trading as the ECB QE program got underway. Two factors might have led to euro buying at the start of QE. The first may have been some 'buying the fact' as the long-touted program finally began. The second may have been inflows into Eurozone assets. In any case, the bounce didn't last and the euro slid back to 1.0850.

The larger theme was yen selling on a better day for US stocks. USD/JPY continues to edge toward a breakout in the third day of gains. The ability to climb in a risk-on or risk-off environment is a positive sign and yesterday's soft Japanese GDP report increases the likelihood of more BOJ action.

In the shorter-term the focus shifts to China. The market disregarded the far-out-of-line weekend Chinese trade figures but that won't be the case with CPI at 0130 GMT. The consensus is a 1.0% y/y rise after a 0.8% reading in January. The PBOC already has the scope to cut the RRR but a low reading would add to the urgency.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q4) | |||

| 1.5% | 2.2% | Mar 08 23:50 | |

| GDP (Q4) (q/q) | |||

| 0.4% | -0.6% | Mar 08 23:50 | |

| GDP Deflator (Q4) (y/y) | |||

| 2.4% | 2.3% | Mar 08 23:50 | |

| Consumer Prce Index (FEB) (m/m) | |||

| 0.8% | 0.3% | Mar 10 1:30 | |

| Consumer Prce Index (FEB) (y/y) | |||

| 0.9% | 0.8% | Mar 10 1:30 | |

Chinese Exports Roar, Markets Skeptical

The euro is down 20 pips to start the week and at a fresh 12-year low at 1.0824. The focus later in the week will be industrial production but at the moment the US dollar is in charge. Non-farm payrolls weren't as strong as the 150-200 pip moves on Friday would indicate but it underscores the near-insatiable appetite for dollars at the moment.

The main weekend news was the remarkable rise in February Chinese trade as exports rose 48.3% y/y compared to 14% expected and imports were down 20.5% compared to 10% expected. That translated into a trade surplus 10-times the $6B expected.

The key caveat in that data set is the month. Markets are extremely skeptical of any Chinese data from February because it's extremely difficult to adjust for the Lunar New Year. Still, taking Jan and Feb combined, exports rose 15% compared to the government's 2015 full year target of 6%. That may largely reflect a pickup in US exports and a weaker yuan.

The drop in imports, however, is a concern. It speaks to softer domestic demand and it may also show that factories are ordering less raw materials in response to soft global orders. Overall, the wild swings continue to sharpen the focus on China.

In the near-term the focus will be on Japan with final Q4 GDP not expected to be revised from the 2.2% annualized pace in data at 2350 GMT. Ten minutes later, PM Abe delivers a speech and at 0100 GMT BOJ Deputy Gov Nakaso speaks. Much later, at 0500 GMT, the February Japanese eco watchers survey is due.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Exports (FEB) (y/y) | |||

| 48.3% | 14.2% | -3.3% | Mar 08 2:00 |

| GDP Annualized (Q4) | |||

| 1.5% | 2.2% | Mar 08 23:50 | |

| GDP (Q4) (q/q) | |||

| 0.4% | -0.6% | Mar 08 23:50 | |

| GDP Deflator (Q4) (y/y) | |||

| 2.4% | 2.3% | Mar 08 23:50 | |

| Imports (FEB) (y/y) | |||

| -20.5% | -10.0% | -19.9% | Mar 08 2:00 |

| Imports (FEB) (y/y) | |||

| -20.5% | -10.0% | -19.7% | Mar 08 2:51 |

| Fed Minneapolis's Narayana Kocherlakota speech | |||

| Mar 09 17:05 | |||

| FOMC's Mester speech | |||

| Mar 09 18:25 | |||

| Fed's Richard Fisher's speech | |||

| Mar 09 23:30 | |||

| BoJ Deputy Governor Nakaso Speech | |||

| Mar 09 1:00 | |||

| Eco Watchers Survey: Current (FEB) | |||

| 45.6 | Mar 09 5:00 | ||

| Eco Watchers Survey: Outlook (FEB) | |||

| 50 | Mar 09 5:00 | ||