Intraday Market Thoughts Archives

Displaying results for week of Apr 08, 2018Waiting on war

Whatever happened to fundamentals? War, trade, and whatever else Trump tweets are drowning out everything else in markets. The pound was the top performer Thursday while the Swiss franc lagged. Chinese trade balance is due up next. The EURGBP trade (opened over 6 mths ago) was stopped out, leaving 5 trades in the green and 2 in the red. Do not forget Ashraf's webinar on Tuesday about Trends and cycles in Dax and US dollar.

Markets turned Thursday after Trump tweeted that an attack against Syria could happen very soon or not so soon at all. Leaks from the White House suggested he hadn't made up his mind and other suggested officials were considering 8 targets, including air bases.

For now, the market has reverted to a wait-and-see mode by giving back the gains in gold and Treasuries. The stock market climbed as well but earnings begin Friday and that will be a driver going forward.

As for FX, fundamentals briefly grabbed the spotlight after the FOMC minutes but there remains a major disconnect between what the Fed says it will do and what the market thinks is coming. At some point there will be a reckoning.

ECB policymakers may also have to recognize the recent disappointment in data. Eurozone industrial production fell 0.8% in February, far worse than the +0.1% reading expected. It's part of a pattern that has pushed Citi's economic surprise index for the eurozone to -89, which is the lowest since 2011.

The ECB is in a tough spot because there is a heavily-entrenched bloc that will demand an end to QE and shift to something closer to neutral, but it's possible that the stronger euro is hitting the economy harder than expected and that structural headwinds will continue to undermine growth. The euro dipped down to 1.2300 from 1.2360 after the data but rebounded to 1.2330.

Looking ahead, Chinese trade data threatens to highlight imbalances once again. Imports are expected up 7.5% y/y with exports forecast to rise 8.0% and a surplus of CNY181B.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Trade Balance | |||

| 20.2B | 19.9B | Apr 13 9:00 | |

بتكوين، إثيريوم، ريبل و اليويو

سجل اليوم بتكوين ارتفاع يتجاوز ١٥%، و هو أكبر إرتداد في خلال ٣ أشهر. في هذا الفيديو، يعالج الاستاذ أشرف العايدي فنيات بتكوين، إثيريوم وريبل بالإضافة إلى حركات اليورو/دولار الفيديو الكامل

Ashraf's Upcoming English Webinar

My English webinars are back. Join me next Tuesday for the 1st of two webinars with Swissquote titled: "Tend Cycles in the DAX & US Dollar". The 2nd webinar is next month. Please make sure to register for the correct session here.

Fed Minutes & Geopolitics Balance out on USD

USD struggles to hold on to gains sustained following the release of the March FOMC minutes revealed growing support for further tightening and improved view over growth and inflation. US-Russia relations hit hard by President Trump's statements on international espionage and threats of US strike on Syria and reports of Iranian-backed missiles seen above Saudi capital are all driving oil above $67 --- highest since December 2014. CAD and JPY were the highest performers of the day ahead of the minutes following the release of a March CPI at at 0.2% as expected. The premium short USDCAD trade was closed for 230-pip gain. Below is the week's Premium video.

The minutes indicated: “A number of participants indicated that the stronger outlook for economic activity, along with their increased confidence that inflation would return to 2 percent over the medium term, implied that the appropriate path for the federal funds rate over the next few years would likely be slightly steeper than they had previously expected”. Yet, most Fed members saw wage gains as "moderate", while a strong majority of Fed officials saw "trade war a downsid risk".

Aside from broad USD weakness, EURUSD remains boosted by ECB's Nowotny declaring the end of QE on Tuesday before the ECB walked back his comments, sending the euro for ride. Nowotny said the ECB will end asset buys by year-end then talked about raising the deposit rate in a speech in Austria. The market entirely expects an announcement to end QE this summer but Nowotny's early nod sent the euro a half-cent higher. An ECB spokesman later announced that he was only speaking for himself. Novotny is an experienced member of the Governing Council so it's an odd mistake for him to make, or perhaps odder that the ECB made the retraction. Today, EURUSD is up for the 4th straight day.

In the bigger picture, risk appetite was buoyant after Xi's attempts to de-escalate the brewing trade war. That was later followed by a tweet from Trump thanking him for the progress. The change in tone sent the commodity currencies and equities solidly higher.

ندوة الإثنين القادم مع أشرف العايدي

كيف يمكنك الإستفادة من تأثير مخاوف الحرب التجارية على سعر الذهب مع توقعات بصعود الأسعار إلى ١٤٠٠$ تبحث عن الاجابة؟! سجل في الندوة الإلكترونية مع أوربكس وخبيرالأسواق أشرف العايدي

رابط التسجيل للسعودية فقط bit.ly/2Ev4rLm رابط التسجيل

CAD Shrugs Off NAFTA Setback

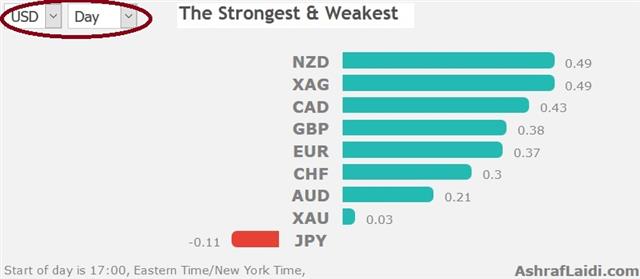

The Canadian dollar demonstrated how the reaction to bad news if often more telling than good news. The New Zealand dollar was the top performer while the US dollar lagged. The Asia-Pacific data calendar is light but a speech from Xi and developments in Syria will be watched closely. The English Premium video will be posted & sent in early Tuesday Asia trade.

حان وقت تقلب الديناميات (فيديو للمشتركين)

We often write about how markets respond to news is the most important indicator. Another example was the Canadian dollar on Monday after various reports that a positive announcement on NAFTA isn't coming this week.

The loonie fell at first, boosting USD/CAD 60 pips to 1.2820 but that move was erased in 12 hours. Later, the Bank of Canada released its latest survey of businesses. It showed rising inflation expectations and a solid underlying economy. From there, the pair crumbled as low as 1.2685. The decline came in a backdrop of broad US dollar weakness. There wasn't a particular catalyst for the soft USD but the situation in Syria sparked some worries with Trump promising a response in the day ahead.

Russian markets were hit hard by US sanctions and Trump's rhetoric named Putin in an eyebrow-raising change of tactics from the President. The ruble was beaten up and Russian bonds were battered. Watch to see if the selling spreads to other risk assets in the day ahead.

The euro rose despite words of caution on inflation from several top ECB policymakers, including Draghi. But the latter's optimism on growth shadowed concerns of trade wars.

Looking ahead, Xi's speech at the Boao remains a potential flashpoint for the week. Jitters about the talk may have contributed to the late slump in US stocks, along with the FBI raid on Trump's personal lawyer.

Xi’s Turn to Respond

China has been on the defensive in the trade war and aside from some tough commentary from second-tier officials, there has been no clear hint of how they will respond. That could change in the week ahead. A slow start to the week in terms of data but not in terms of USD weakness. The Canadian dollar was the top performer last week while the yen lagged. On Friday, the short USDCAD Premium trade was locked in with 140 pips of profit. A new CAD long was opened 15 mins prior to the Canada jobs report, which turned out to exceed expectations. There are currently 8 trades, 6 of which are in the green & 2 in the red.

CFTC positioning data shows a new spot to watch for strain. Chinese President Xi Jinping will have an opportunity to send a warning to the US on Tuesday if it insists on tariffs. Any signs that the a yuan devaluation increases in likelihood will add to a new wave of selling in equities. Xi's speech is scheduled to be delivered at the Boao Forum, which is Asia's answer to Davos.

The economically-charged event is a perfect opportunity for him to send a warning or look to ease tensions. At his speech in Davos, he called for more globalization and endorsed the WTO-led world order. That's the most-likely course once again but any departures will be carefully noted.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +134K vs +141K prior GBP +40K vs +34K prior JPY +4K vs -4K prior CAD -32K vs -27K prior CHF -10K vs -9K prior AUD 0K vs +8 prior NZD +18K vs +18K prior

The considerable yen short position from March has been completely wiped out but now it's the Canadian dollar traders who are off-side. A NAFTA deal Friday at the Summit of the Americas could spark a rush to the exits.