Xi’s Turn to Respond

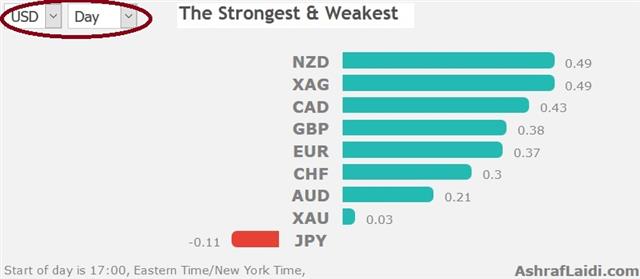

China has been on the defensive in the trade war and aside from some tough commentary from second-tier officials, there has been no clear hint of how they will respond. That could change in the week ahead. A slow start to the week in terms of data but not in terms of USD weakness. The Canadian dollar was the top performer last week while the yen lagged. On Friday, the short USDCAD Premium trade was locked in with 140 pips of profit. A new CAD long was opened 15 mins prior to the Canada jobs report, which turned out to exceed expectations. There are currently 8 trades, 6 of which are in the green & 2 in the red.

CFTC positioning data shows a new spot to watch for strain. Chinese President Xi Jinping will have an opportunity to send a warning to the US on Tuesday if it insists on tariffs. Any signs that the a yuan devaluation increases in likelihood will add to a new wave of selling in equities. Xi's speech is scheduled to be delivered at the Boao Forum, which is Asia's answer to Davos.

The economically-charged event is a perfect opportunity for him to send a warning or look to ease tensions. At his speech in Davos, he called for more globalization and endorsed the WTO-led world order. That's the most-likely course once again but any departures will be carefully noted.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +134K vs +141K prior GBP +40K vs +34K prior JPY +4K vs -4K prior CAD -32K vs -27K prior CHF -10K vs -9K prior AUD 0K vs +8 prior NZD +18K vs +18K prior

The considerable yen short position from March has been completely wiped out but now it's the Canadian dollar traders who are off-side. A NAFTA deal Friday at the Summit of the Americas could spark a rush to the exits.

Latest IMTs

-

Mystery Chart & Coordinated Silver Attack

by Ashraf Laidi | Feb 6, 2026 10:52

-

From 4920 to 5090 and back

by Ashraf Laidi | Feb 5, 2026 9:41

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22