Intraday Market Thoughts Archives

Displaying results for week of May 08, 2016Ashraf Dubai Tuesday Conference

Join me for Live Trading with IG at the Ritz-Carlton in Dubai next Tuesday. Live Trading Conference REGISTRATION

محاضرتي عن التداول الحقيقي في دبي الثلاثاء القادم. احجز مقعدك الآن

Dollar Presses Higher, Kuroda and NZ Retail Sales Next

A small stumble in the US dollar Thursday was quickly erased in another sign of a change in dollar sentiment. CAD was the top performer while AUD lagged in a sign of the broader lack of conviction in markets. That could begin to change with New Zealand retail sales and a speech from the BOJ's Kuroda coming up later. 2 new Premium trades involving a commodity currency were added today, bringing the number of open Premium Insights trades to ten.

The dollar showed some life once again despite a jump in initial jobless claims. Midday rises in the euro, yen and sterling were later wiped out in a day where the overall moves were limited. Initial jobless claims rose 294K compared to 270K expected.

Fed hawks Mester and George were on the wires but the market remains comfortable in the idea that the Fed will stay on the sidelines. That theme could begin to change on Friday with the release of April retail sales.

The past three retail sales reports have disappointed and that's been a significant part of the dollar weakness this year. The Fed is confident that better jobs numbers will eventually lead to more spending but it's been slow to unfold. The consensus is for a +0.4% in the control group and that's the key metric to watch.

The market is struggling to find a theme at the moment. The BOJ is likely to fill that gap. Abe is considering more stimulus, delaying the planned consumption tax increase and an election. He will surely call on Kuroda to help as well (the BOJ isn't independent).

We will get hints about what's coming next in a 0330 GMT speech from Kuroda in Tokyo. The tertiary index is an hour later and expected to fall 0.1% in yet-another sign that the economy isn't improving.

But first, at 2245 GMT, Q1 New Zealand retail sales report is due. Top tier economic data in New Zealand is infrequent and – like the Q1 Australian CPI report – it can be a game changer. Sales ex inflation are expected to rise 1.0% q/q. That would be a solid pace and may take a bit of pressure off the RBNZ.

If the number disappoints, this week's low of 0.6713 in NZD/USD could quickly be back in focus and below that, support thins out, especially with that uptrend since January now broken.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (APR) (m/m) | |||

| 0.5% | -0.3% | May 13 12:30 | |

| Retail Sales (ex. Autos) (APR) (m/m) | |||

| 0.3% | 0.2% | May 13 12:30 | |

| Retail Sales (Q1) (q/q) | |||

| 1.2% | May 12 22:45 | ||

| Retail Sales ex Autos (Q1) (q/q) | |||

| 1.4% | May 12 22:45 | ||

| Initial Jobless Claims (JUN 07) | |||

| 294K | 270K | 274K | May 12 12:30 |

| Continuing Jobless Claims (MAY 30) | |||

| 2161K | 2124K | May 12 12:30 | |

US Dollar Might not be what it Seems

The risk in being a US dollar bull at the moment is that the trade is more crowded than it appears. On Wednesday, the New Zealand dollar and yen were the top performers in another sign of how correlations are frayed; USD and GBP lagged. The BOJ meeting summary later will be telling. A new trade was added to the Premium Insights in an FX pair, which was last entered 10 months ago. The trade is backed by 3 supporting charts.

The US dollar retraced some of its recent gains on Wednesday but not enough to seriously jeopardize the dollar-bounce theme. The news on the day focused on oil because of a surprise draw in US supplies that sent crude quickly higher and CAD along with it.

The past week was instructive in terms of broader market sentiment. Waves of economists and research analysts have been quick to jump back on the US dollar bandwagon. When we look at US dollar positioning in something like the CFTC report, it shows heavy bets against the dollar but listening to commentary, there is either a tremendous wave of money on the sidelines waiting to come in or those numbers don't truly reflect market positioning.

What's striking is how quickly the commentary has shifted. USD/JPY fell 2000 pips then bounced 300 and Goldman Sachs has already called the bottom.

No one likes to be in a crowded trade and the constant battle is to stay ahead. Obvious is obviously wrong. There is a quiet consensus that the US dollar will resume its climb as the Fed perks up and plenty of indicators point in that direction.

The deeper theme in markets is a new uncertainty. There are no correlations and all the themes are weak. It's not a question of dovish and hawkish central banks; it's a matter of dovish and more dovish. It's not a question of good growth or bad growth; it's a question of bad growth or not-as-bad growth.

Comparatively the differences and divergences are small; that makes flows and ever-changing sentiment more important than the big themes; at least until a central bank can recapture the imagination of the market.

The prime candidate at the moment is the Bank of Japan. The 'Summary of Opinions' of the most-recent meeting is due at 2350 GMT. The minutes aren't due for another six weeks but this report could offer some critical insight on the question of when (not if) the BOJ plans to add more stimulus. The idea that the April 28 non-decision was merely a pause could be a powerful idea and bullish for USD/JPY.

Arabic Webinar in 1 hour from now

ندوة أشرف العايدي ستبدأ بعد ساعة من الآن. للتسجيل و التفاصيل الرجاء النقر هنا

USD/JPY Rebound Nears Hurdle

The US dollar continued to recover against the yen as oil and stock markets rebounded. The Australian dollar was the top performer while the yen lagged. Aussie home loans data and the RBNZ's Wheeler are due up later. A 46-minute Premium video on the existing and likely trades in FX, commodities and equity indices is posted below.

One thing that is increasingly clear is that market correlations are at a minimum. The dollar and euro moves over the past month have largely disconnected from bonds and stocks.

USD/JPY climbed for the fifth time in the past six days on Tuesday. The pair is nearing the 61.8% retracement of the post-BOJ drop. That technical level is at 109.49 with spot trading at 109.33.

Economic data was light but included March JOLTS rising to the best level in more than a year. Job openings jumped to 5757K compared to 5450K expected. Wholesale inventories also beat estimates at +0.7% compared to +0.5% in what will be a small bump to Q1 GDP.

The euro rallied above 1.14 for the third consecutive day but once again closed below as the pair continues a series of lower highs and lower lows.

The Asia-Pacific calendar features an appearance by RBNZ Governor Wheeler at 2300 GMT. The topic is the financial stability report so macro-prudential concerns might dominate but the press will surely ask about rates and the kiwi dollar.

Next is the 0130 GMT release of Australian home loans data. RBA cut expectations have continued to creep higher and the market now sees a 24% chance of a cut in June, rising to 73% by year end. The home loan data is unlikely to move the needed but it may be a small factor. It's expected to show a 1.5% decline.

The final data point to watch is the March preliminary Japanese leading index. The consensus is for a 96.3 reading but it's unlikely to move the market. The chatter around the latest JPY moves attributes it to intervention fears, that's something we warned about last week. The paradox of gains on intervention talk is that they make actual intervention less likely.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Home Loans (MAR) | |||

| -1.5% | 1.5% | May 11 1:30 | |

| Leading Economic Index (MAR) [P] | |||

| 96.8 | May 11 5:00 | ||

The Quiet Challenge for Central Banks

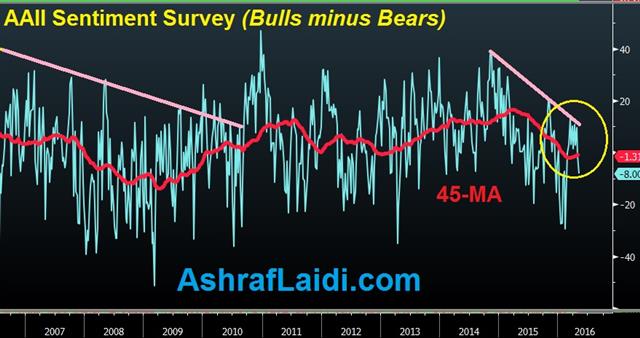

The Bank of England joined a trend of central banks cutting down on the number of meetings. We look at what it signals about the future role of monetary policy. In Monday trading, the US dollar extended post-NFP gains in a clear sign of improving momentum the yen lagged. There are 7 Premium trades in progress: 3 in FX, 2 in commodities and 2 in equity indices. The chart below was posted by Ashraf to the Premium service last week.

The BoE announced Monday a plan to cut the number of meeting per year down to 8 from 12. That follows similar moves by the BoJ and ECB. The foremost signal is that rate moves are now guaranteed to be more gradual.

More Opinions, Fewer Decisions

The risk is that central bankers do more talking and stoke speculation between meetings. The challenge for central bankers is to remain quiet. Monetary policy makers have frequently lamented that they have been forced to carry too much of the burden of stimulating growth. Fewer decisions will take some of the media, market and (hopefully) political pressure off them to act.The risk is that meetings are supplemented by more frequent central banker speeches and appearances in the media. That's a mistake, or perhaps planned to do just that. As Ashraf said: "Fewer decisions, more speeches, greater noise".

If central bankers want to hand the burden of stimulating growth onto the politicians then the best thing they can do is fade into the shadows.

Unfortunately, that's unlikely given the trend towards more communication. The idea is more transparency but paradoxically the increase in talking has sent more mixed signals and made markets less certain.

In the shorter term, the focus is shifting towards China. The weak trade numbers contributed to declines in commodity prices Monday. The latest round of Chinese stimulus is likely over but pressure could start to build if economic data disappoints. The next number due up is the April CPI report at 0130 GMT. The market is looking for a 2.3% y/y rise in prices.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (APR) (m/m) | |||

| -0.2% | -0.4% | May 10 1:30 | |

| Consumer Prce Index (APR) (y/y) | |||

| 2.4% | 2.3% | May 10 1:30 | |

Dollar Shrugs Off Jobs Data

Non-farm payrolls sent a powerful signal about US dollar demand. Oil jumped in early trading but FX moves have been minimal. Weekend data continues to show softening Chinese trade.There are currently 7 Premium trades in progress.

When something can't fall on bad news, it often won't fall at all. That's the lesson from non-farm payrolls on Friday. Jobs growth missed estimates at 160K versus 202K expected and a 0.2 pp drop in the participation rate was the only thing that kept unemployment from rising.

The kneejerk reaction was a 50-pip drop in the US dollar across the board but that turned out to be the extreme of the day. USD quickly bounced back and then continued higher. Some of it may have been fractionally better wage growth but underlying US dollar demand was clear.

A similar theme played out throughout the week, including after weak ADP jobs data. It's still very early in a potential US dollar bounce but it passed the NFP test with flying colours.

On the weekend, China released April trade balance data. The good news was that the trade surplus was $45B compared to $40B expected and that will support GDP. However, it came as overall trade slumped. Exports fell 1.8% y/y compared to a flat reading expected while imports tumbled 10.9% y/y versus the -4.0% consensus. It wasn't a one-off month either as trade in the Jan-April period is down sharply.

Some slowing in trade was expected given the shift away from infrastructure spending but the hope was that Chinese consumers and better global growth would pick up the slack. That's clearly not happening.

One spot to watch early in the week is oil as WTI jumps $1.06 to $45.72 in early trade. The April high was $46.78. The forest fire in Canada has taken about 1 million barrels per day out of production. The fire continues to grow but the predominant winds are now pushing it away from the oilsands.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -23K vs -40K prior JPY +61K vs +66K prior GBP -40K vs -49K prior CHF +7K vs +9K prior AUD +52K vs +59K prior CAD +19K vs +12K prior NZD +9K vs +7K prior

These are the first look at positioning heading into the Fed and BOJ. The market has largely scaled out of US dollar longs. Heading into the RBA, Australian dollar speculators were deeply offside but appeared to be scaling back.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance (APR) | |||

| $45.562B | $40.000B | $29.860B | May 08 2:29 |

| Exports (APR) (y/y) | |||

| -1.8% | -0.1% | 11.5% | May 08 2:31 |

| Imports (APR) (y/y) | |||

| -10.9% | -5.0% | -7.6% | May 08 2:31 |

| ANZ Job Advertisements (APR) | |||

| 0.2% | May 09 1:30 | ||