Intraday Market Thoughts Archives

Displaying results for week of Nov 09, 2014Keystone XL & Lower Oil: Careful what you Wish for

Oil traders are watching today's vote at the US House of Representatives on the long-awaited bill approving the Keystone XL oil pipeline, transporting crude oil from western Canada to the US Gulf Coast. The chorus in favour of alternative energy sources has grown so loud, to the extent that the resulting decline in energy prices is hurting producers and exporting nations. Loonie traders have seen the currency fall 7% as oil lost 1/3rd of its value. Full charts & analysis.

5 Consequences of the Oil Drop

1. Russia is in trouble

Nevermind the fighting in Ukraine. The ruble is down 39% against the dollar since June and that's despite near-constant intervention from the central bank. Russia has been remarkably stable so far but if prices keep falling a genuine crisis is certain

2. Other emerging markets too

Colombia was begging for FX weakness for years but now the peso is down 16% in 5 months as its biggest export slides. In the Middle East, lower oil could bring instability and cause capital flight. Other emerging markets are winners but the speed of the oil move brings unwanted volatility.

3. Lower oil is good for the US…to a point

Lower gasoline prices are great news for consumers ahead of the holidays but there's a flipside. The shale boom has single-handedly revived US 'manufacturing' and has dramatically helped the trade balance but shale drilling has extremely high costs and wells deplete quickly. Below $75 the industry will begin to shut down.

4. If you think WTI is low…

Canadian oil may get some good news on the Keystone XL pipeline but it won't help right away. Canadian benchmark Western Canada Select is trading at just $58.70/barrel and the loonie is beginning to move tick-for-tick with crude.

5. Forget Inflation

Falling oil prices will cut the legs out of inflation. Even if wage growth begins to materialize, low oil will hurt inflation and lead to some second-round effects as it passes through the supply chain. On Thursday, even the ultra-dovish Plosser said inflation is not a concern in the near term. If the Fed hikes in Q2 2015, it will be purely to stem the risk of excess in the credit markets.Growth + Yield = Gains

Treasury yields edged up after a dip in early trading and although 2.35% sounds like a pittance it's now more than Germany, Japan, Italy, Spain, Canada and the UK. Combine that with developed-world leading growth and a central bank that's growing more hawkish and there is a compelling case to continue buying dollars.

For the second time this week, newsflow was rather quiet in US trading and once again the 'default' mode of the market was to slowly accumulate dollars. USD/JPY briefly broke 115.00 but rebounded to 115.61 while EUR/USD failed in three attempts at 1.25 and then sagged to 1.2425.

The pound was its own worst enemy following the BOE inflation report and it fell to a 14-month low of 1.5778. Curiously, the market wasn't overly excited about the break of last week's low of 1.5791. There is very little support on the chart.

The commodity complex was able to bounce despite lower commodity and stock prices in what could be interpreted as a good, albeit early sign. The loonie continues to benefit from Friday's excellent jobs report and a vote scheduled for Thursday could be more good news as Senators are likely to vote in favor of the Keystone XL pipeline. That won't force the President to approve it but it's a step in that direction in the six-year ordeal.

Looking ahead, a busy day awaits in Asia-Pacific trading with PPI, machine orders and industrial production on tap. They're unlikely to affect yen trading as the focus is on what Abe might do next. He's likely to win an election and strengthen his mandate but the uncertainty of the vote (if called) could help the yen (hurt USD/JPY) on the headlines.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (SEP) (m/m) | |||

| -1.9% | Nov 13 4:30 | ||

| Industrial Production (SEP) (y/y) | |||

| -3.3% | Nov 13 4:30 | ||

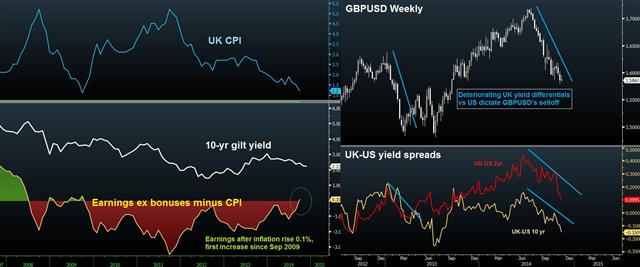

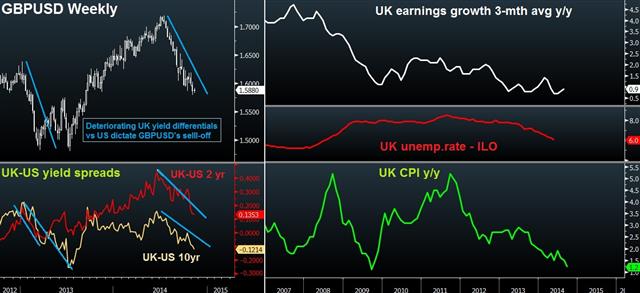

UK Jobs giveth, BoE inflation report taketh away from GBP

GBPUSD dropped near 14-month lows after the BoE inflation report sharply lowered near-term inflation forecasts, erasing all the gains emerging after release of a favourable UK jobs report. Those subscribers to our Premium Insights taking the short GBPCAD trade have seen a decline of more than 100 pips in the pair. Full charts & analysis here.

Wednesday's double UK release

Will Wednesday's double release release of the UK employment/earnings figures and Bank of England's quarterly inflation report send sterling to fresh multi-month lows, or will traders exploit any bounce for further selling? Full charts & analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Bank of England Quarterly Inflation Report | |||

| Nov 12 10:30 | |||

The Trend Until the End

The US dollar rally restarted after a hiccup on Friday. The jobs report was hit and miss but if you want to sell the dollar, you have to buy something else and the alternatives were lacking Monday in a trend that was underscored as New York entered the fray.

USD/JPY steadily climbed to 114.90 from 114.10 in a gentle move. The largest intraday correction was just 15 pips high-to-low and it was the same sort of shape in other dollar pairs. The steady dollar bid on the day underscores the steady bid that seems to be there every day except when there's a distinct reason to sell dollars.

Newsflow was negligible and the dollar's ability to rally in a quiet market is a positive sign. It was confirmed by similar moves that erased the squeezes in gold and bonds on Friday.

EUR/USD briefly touched above 1.25 in European trading and then slid down to 1.2420. The ECB's Mersch was on the wires saying sovereign QE is an option if the outlook deteriorates but markets shrugged off the comment.

The focus now shifts to Japan where two separate reports on Monday highlighted the split at the BOJ on the effectiveness of QE in boosting inflation expectations. The headlines did little to stop the climb in USD/JPY strength which is a sign of the strength of the pair.

In terms of data, Japan's current balance is due at 2350 GMT and expected to show a 537B yen surplus. The trade deficit is expected at 782B.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Current Account n.s.a. (SEP) | |||

| ¥534.2B | ¥287.1B | Nov 10 23:50 | |

| Trade Balance - BOP Basis (SEP) | |||

| ¥-831.8B | Nov 10 23:50 | ||

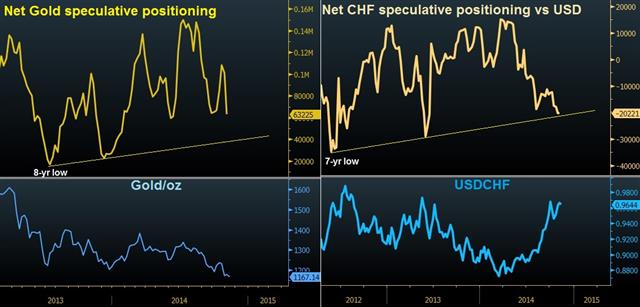

Swiss gold referendum and SNB risk

As EURCHF falls below 1.2030, it's time to highlight the potential problems facing the Swiss National Bank, as we approach the November 30th Swiss gold referendum on whether the central bank should raise gold reserves to hold 20% of its total reserves from the current 7.8%. And given the risks to its policy-making, the SNB may have to act pre-emptively. Full charts & analysis.

Euro Starts Higher, China CPI Next

Signs of a small round of profit taking in US dollar longs continue following Friday's non-farm payrolls. The dollar is generally weaker in early trading led by a quarter-cent gain in the euro. Weekly CFTC positioning data once again showed only moderate interest in yen shorts.

The US dollar finished near the lows of the day on Friday. The details of the non-farm payrolls report were solid but low inflation, including low wage inflation in the NFP report, are a growing concern.

On the weekend, the focus was on China's import/export data. Exports were solid, up 11.6% y/y compared to 10.6% expected but imports were a touch soft at 4.6% y/y compared to 5.0% expected. The Australian dollar is slightly higher in early trading but we warn that softening imports show that Chinese companies are seeing softer demand and that could later mean lower production and exports.

Another story to watch is the unsanctioned referendum in Catalonia as the region seeks to separate from Spain. The non-binding vote was called off several times but took place with volunteers Sunday and more than 2 million of the 5.5 million eligible voters cast votes.

The results are due Monday morning in Spain and a vote for independence is likely and could weigh on the euro.

The focus will be on China in the early going with CPI/PPI numbers due at 0130 GMT. The consensus is for a 1.6% y/y rise in the CPI and 2.0% decline in the PPI. Those inflation numbers leave room for economic stimulus; something more likely with trade and GDP falling short of government targets.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -178K vs -166K prior JPY -72K vs -67K prior GBP -8K vs -6K prior AUD -38K vs -34K prior CAD -19K vs -21K prior CHF -20K vs -20K prior NZD -4K vs -4K prior

It's tough to explain yen shorts remaining near a three-month low despite the dramatic fall in the currency. We can only reason that specs missed out and failed to find a dip to buy. Rest assured they will be there on pullbacks in a factor that should underscore the trend higher in USD/JPY.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (OCT) (m/m) | |||

| 0.1% | 0.5% | Nov 10 1:30 | |

| Consumer Prce Index (OCT) (y/y) | |||

| 1.6% | 1.6% | Nov 10 1:30 | |