Intraday Market Thoughts Archives

Displaying results for week of Sep 17, 2017أهم الأسئلة بعد اجتماع الاحتياطي الفدرالي

هل يوافق السوق مع تفاؤل الفدرالي؟ غموض التضخم؟ تخفيض الميزانية العمومية ماذا عن الاعاصير؟ عامل الدولار المقال الكامل

Will S&P's China Downgrade Matter?

The US dollar gave back some of its gains on Thursday but risks in China are rising after S&P downgraded its sovereign rating to A+ from AA-. The pound was the top performer while the Australian dollar lagged. Japan is on holiday. British PM Theresa May's speech about the EU on Friday followed by German elections on Sunday. A new Premium video was posted following the post-Fed moves in FX, indices and metals.

China undoubtedly has a debt problem but it's had one for years without causing any real spillovers or consequences. It's one of those looming problems that's impossible to ignore but equally impossible to bet against.

A rarely-talked-about driver of western growth in the past 30 years is credit. It's a magical wealth creator until exhausted and that's what happened in the US financial crisis. China has been endlessly extending credit to companies and individuals and it's helped to pull hundreds of millions out of poverty.

So far bumps in the road have been handled by central planners but virtually everyone believes there will one day be a true hiccup. Whether that's next month or next decade is the impossible question to answer. Other catalysts are needed.

When trouble erupts, it's not likely to be from a downgrade or even a shift in the market. Like we saw two years ago, it's likely to come on some kind of change in policy. For every percentage point higher in growth or incremental rise in credit, the stakes are raised for regulators and economic planners.

That's why we will be watching the once-every-five years Congress that opens on Oct 18. Murmurs from China are that a theme will be stability. That's something we've heard many times before and lends itself to mitigating problems, rather than tackling them.

In other news, the USD rally failed to follow through Thursday. That was despite a fall in initial jobless claims to 259K from 302K in the aftermath of Harvey. The Philly Fed also improved to 23.8 from 17.1.

Perhaps the most-telling indicator was eurozone consumer confidence. It rose to -1.2 from -1.5 – that's the best since 2001. After falling as low as 1.1853 Wednesday, the euro slowly climbed to 1.1938.

Expect a quiet wind down to the week in Asia with Japan on holiday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone ECB President Draghi Speaks | |||

| Sep 22 8:00 | |||

December Dots Drive Dollar

The FOMC delivered a hawkish forecast on Wednesday and a fresh message of cautious optimism despite a hurricane-driven setback. The US dollar jumped across the board on the headlines while the euro was the laggard on the day. The Bank of Japan is next. A new JPY trade has been issued ahead of the Fed.

We warned about a hawkish surprise ahead of the Fed and the implausibility that the dots would be significantly downgraded. They weren't. 12 of the 16 FOMC attendees expect the Fed to hike again this year, that's the same as in June.

That's a strong message that despite worries about inflation, the Fed remains optimistic about the economy. That was partly reflected in the statement, where they touted a pickup in business investment. The formal forecasts on GDP, jobs and PCE inflation were tweaked but not enough to overshadow the dots.

It is a similar story for 2018, where the Fed median continues to show three hikes in addition to one before year end. The market doesn't believe in such an aggressive path and the Fed has frequently overstated the path but even two hikes in the next 15 months may be sufficient for a sustained USD bid.

As expected, the balance sheet reduction will also get underway in October but we will have to wait a few weeks before we get more details.

We won't have to wait long, however, for more central bank news. The BOJ decision is due around 0300 GMT plus-or-minus 30 minutes. There are no expectations for any kind of change in policy. Kuroda is happy to watch as other central banks tighten policy and depress the yen. He won't want to give any kind of indication that Japan is prepared to join in the global tightening.

The yen stance is reflected in things like AUD/JPY. On Wednesday, the pair broke above the July high to the best levels since December 2015 in what could be a significant break.

Fed Into Focus

Choppy USD trade ensues ahead of today's highly anticipated Fed announcement, Yellen conference and dot plot forecats. The antipodean currencies dominate trading, led by a soaring kiwi as NZ's ruling National party pushes wirg a 9-pt lead ahead of Saturday's elections. UK retail sales beat expectations and US existing home sales fell by more than expected. New trade actions and videos will be posted this afternoon ahead of the Fed's announcement.

Trump was at the UN and ramped up rhetoric against North Korea and Iran but there is little international consensus in favour of near-term action, especially on Iran where France immediately said it was against abandoning the nuclear deal. At the moment, the dollar is less-sensitive to geopolitical headlines than it was a month ago. That's in part due to higher liquidity but there is also a newfound sense that a rash move is unlikely.

Balance Sheet to Overshadow Dots

Expect the focus to center on the balance sheet reduction program, which is anticipated to begin next month. What will be the planned reduction amount in 2017? $30 bn, $40bn or more? And how would the amount be distributed in 2018 and thereafter? Ashraf tells me to get ready for a potentially "faster & earlier than expected" balance sheet reduction schedule, which could prop USD higher.The FOMC decision may prove to be more hawkish than many believe. The dot plot will be downgraded to some degree but 12 of the 16 dots in June pointed to more hikes this year and it would be a tremendous shift to eliminate that.

Yellen will also want to keep her options open, especially if Republicans can find a way to deliver a tax cut. The market overall is net short the US dollar but Yellen and the Fed are optimistic about the economy. All it would take to restart the US dollar rally is a fresh hint at a December hike and a reiteration that policymakers are confident inflation will return to 2% in 2018.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 1.0% | 0.2% | 0.6% | Sep 20 8:30 |

| Current Account | |||

| -0.62B | -0.82B | 0.22B | Sep 19 22:45 |

فنيات الذهب و الفضة

The Reluctant Hawk

Mark Carney cast himself as a less-enthusiastic hawk on Monday while the BoC flexed its jaw muscle. The US dollar was the top performer while the Canadian dollar lagged. The RBA meeting minutes are due out later.

BoE Governor Carney had a chance to fine-tune his comments Monday, reiterateing that some tightening might be needed in the coming months. However, he also said that monetary policy may have to 'move in order to stand still' because rates are rising elsewhere.

In headline-driven markets, that's what stood out but a closer inspection showed that was just a small part of his overall justification for hiking. A bigger reason – and one that will last longer – is that he believes Brexit will be inflationary. Others may differ but the market voted for lower GBP on the overall message, perhaps more in a nod to the outsized recent gains than a genuine re-think on the path of rates. Cable fell a cent on the day.

In the bigger picture, a shakeout is emerging in markets trying to make sense of central bank policy. The BoC showed that the shift from dovish, to neutral to two rates hikes can take place in six months and we are all on the lookout for the next target. There are also signs the BOC is having second thoughts. Deputy Governor Lane said Monday that they will be “strongly” taking into account the CAD leap in upcoming decisions. That spooked loonie traders and sent USD/CAD nearly a full-cent higher.

Maybe the more-interesting comment in his speech was that rates are still relatively low compared to what they believe is the neutral level. It's another sign of how jumpy markets are right now. That means opportunities will abound in the weeks ahead.

Or even the day ahead. The RBA Minutes are up next as the market tries to sort out which way Lowe will tilt. The headlines are due at 0130 GMT.

Before & After the Hurricanes

Hurricanes will get the bulk of the blame but the latest data showed growth was slowing before Harvey and Irma. A big week ahead: Trump's UN speech on Tuesday; Fed decision & Yellen presser on Wednesday; PM Theresa May's EU speech on Friday and German Elections on Sunday. A new Premium note has been added to further our existing index trade.

A cascade of growth downgrades followed US retail sales and industrial production numbers on Friday. Retail sales fell 0.2% compared to +0.1% expected in August. The control group, which excludes autos, gas and building supplies was down 0.2% compared to +0.2% expected. In addition, July sales were revised lower.

It wasn't just consumers with bad news. August industrial production fell 0.9% compared to +0.1% expected in the worst monthly decline in five years. The Fed said Harvey reduced output by 0.75 pp so it's not as bad as it looks, but it's undoubtedly a poor reading. How poor? The NY Fed and Atlanta Fed GDP trackers were both lowered by 0.8 pp for Q3 while Q4 estimates were trimmed as well.

The market took the weak data in stride in a sign that it views Harvey as the culprit. That may be a hint on how buoyant the dollar will be in the week ahead as the market prepares for details of Trump's tax plan at the end of the month.

What was unambiguous was pound strength as cable finished the week just under 1.36. The OIS market is pricing in a 65% chance of a BOE hike on Nov 2 and 73% before year-end. What makes that probability even higher is that Carney's credibility can't afford another misstep.

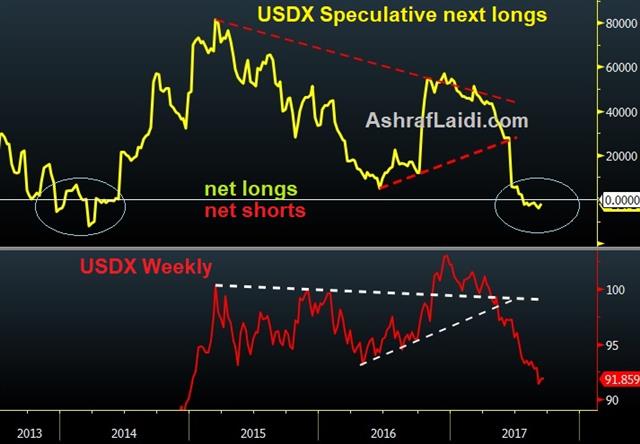

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +86K vs +96K prior GBP -46K vs -54K prior JPY -57K vs -74K prior CHF -2K vs -2K prior CAD +50K vs +54K prior AUD +60K vs +65K prior NZD +12K vs +15K prior

Those sterling shorts are suddenly rather vulnerable and no doubt many covered since the Bank of England decision. Watch out for Carney's speech today at 11 am EST (4 pm London). Euro shorts were pared after last week hitting the most-extreme since May 2011.

ندوة الثلاثاء قبيل الاحتياطي الفدرالي

-بين هبوط التضخم من 1.7% إلى 1.4% و انخفاض الزخم في الوظاءف الأميركية، تبقى حجة رفع الفائدة و ارتداد الدولار محدودة. ولكن ماذا عن بيع السندات ؟ كيف ستتأثر معادلة الدولار، الين و الذهب بقرار المركزي الأميركي و مسار الذهب بالنسبة لعوامل التضخم و كوريا الشمالية؟

احجز مقعدك هنا