China FX Reserves & CNY Implications

China FX reserves fell $94 bn to $3.56 tn in August, posting the biggest decline on record, tell us a little more than just China is slowing.

We already know that a key reason to the decline in reserves is China's selling of reserves, such as US treasuries, in order to support the CNY, preventing it from falling rapidly after last month's devaluation announcement.

We also know Beijing has allocated as much as $90 bn from reserves to recapitalize local banks.

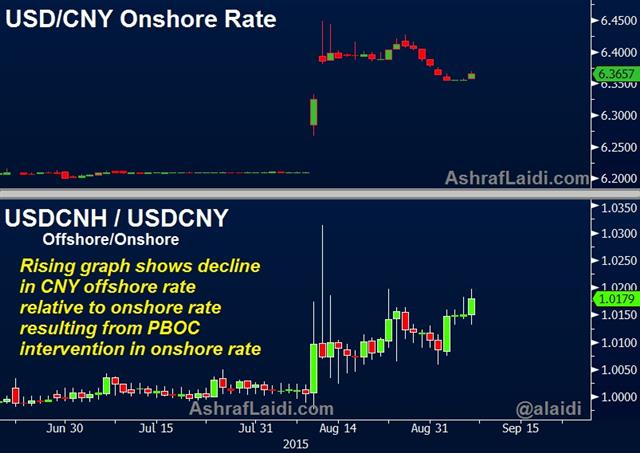

Thus, the policy of selling reserves aimed at stabilizing the CNY is unsustainable, which highlights our expectation for the currency's long term direction to be downwards. This is already shown in the chart below, illustrating that yuan's offshore rate (traded in Hong Kong) is lower than then onshore rate due to PBOC intervention in the latter and growing capital outflows impacting the former.

Back to the Fed & Yields

We mentioned last week the uncharacteristically high level of US 10-year yields relative to the recent declines in US equity indices, asking “If China were not selling treasuries to prevent CNY declines, then how low could yields be?”The declining SPX/Yields ratio, suggesting that it's a matter of time before yields catch-down with stocks, regardless of whether the Fed raises rates or not.

And so we reiterate it's a question of time before Beijing's seizes its currency manoeuvres and lets its currency depreciate. This time, instead of reversing the rise of the currency, it becomes, slowing its decline.

Latest IMTs

-

Warsh Odds Hit Metals

by Ashraf Laidi | Jan 30, 2026 10:56

-

Time Stamp تجزيء زمني للفيديو

by Ashraf Laidi | Jan 29, 2026 9:09

-

Trump Hits Dollar but Wait Bessent & Powell...

by Ashraf Laidi | Jan 28, 2026 11:47

-

Retail Traders' Hastiness

by Ashraf Laidi | Jan 27, 2026 9:40

-

From Silver to Yen

by Ashraf Laidi | Jan 26, 2026 11:55