Dollar Digs its Own Grave

Yesterday we wrote about potentially negative consequences of trade disputes on the US dollar, today it was soft economic data and more Russia drama hurting USD. The pound was the laggard on the day while yen led the way. US and Canadian jobs reports are up next. After closing out of the Premium cable long at 170-pip gain just ahead of the BoE decision, we opened a long above the prevailing price, which was not filled. The trade was cancelled and a new one was issued.

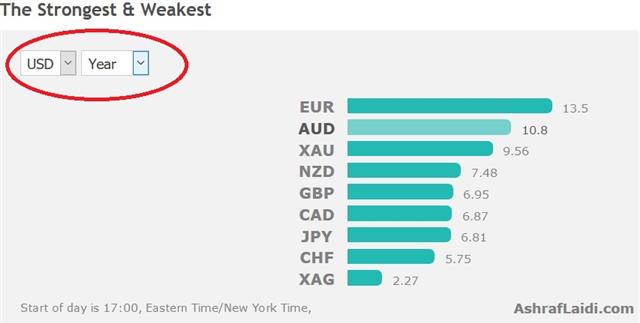

It's rarely one thing that sinks a currency. All the reasons to sell the US dollar would evaporate if growth was at 3%. Through the first half of the year, it's been at a 2% pace and the remainder of the year is a question mark.

One forward-looking indicator is the ISM non-manufacturing index but it stumbled on Thursday to 53.9 compared to 56.9. That set off another round of US dollar selling. Still, USD/JPY buyers made a stand at the weekly low and it bounced… at least until a few hours later when reports revealed Russia special prosecutor Robert Mueller had gathered a grand jury.

The last thing that's really propping up the dollar is the Fed. Despite a slightly more cautious tone at the Fed, the core of the FOMC is close to Williams who on Wednesday said he expects another hike this year and three more in 2018. If that happens the dollar will easily erase the last few months of losses.

The easy path to make that happen via tax reform and infrastructure spending. The problem now is that time is running out on the debt ceiling, and that will eat up more political capital, while the Russia story continues to eat up the remainder.

Still, the US economy has showed remarkable resilience despite Washington's best efforts for years and could do it again. A big signal will come Friday in the non-farm payrolls report. The consensus is 180K new jobs but the market will be almost-entirely focused on average hourly earnings, which are forecast up 0.3% and 2.4%. If those miss, the Fed and markets may begin to lose patience.

A central bank on the opposite side of the spectrum is the Bank of Canada. Canadian jobs data is also due Friday and expected at +10K. The consensus has consistently been too cautious and the numbers have beaten expectations in 10 of the past 11 months, often by a large margin. Another strong report could light another fire under CAD.

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46