Dots May Undermine Powell’s Message

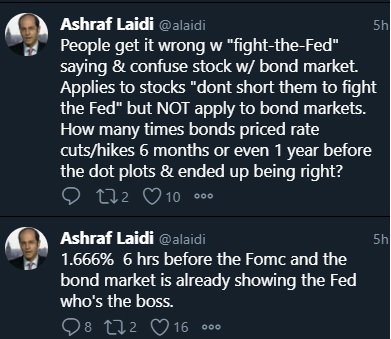

Many in the market believe that's a cue for the Fed to signal tighter policy and that's what many are saying ahead of Wednesday's decision. However that goes against the Fed's new doctrine of running inflation hot to prove the target is two-sided.

After all, if you signal hikes as soon as 2% is on the horizon, doesn't it reinforce that 2% is a ceiling?

In all likelihood, the message Powell will send is patience. He's repeatedly highlighted high numbers of unemployed Americans and the jobs picture hasn't materially improved this year. Expect that to remain the script on Wednesday.

The problem is that the dot plot may undermine the Fed chair. Currently, 5 of 17 dots show at least one hike in 2023. It would only take 4 dots shifting in that direction to put the median at a hike. Consider that since the Dec forecasts we've had two huge stimulus package and much better Q1 GDP than anticipated and the case is compelling.

In the past the message from the dot plots has drowned out the Chairman and that threatens to happen again. Moreover, this will be the first report to include 2024 dots, which may show a path to rates at 0.75%.

Finally, the forecasts and dots will land 30 minutes before the FOMC press conference so the initial move is likely to be higher in USD and rates before Powell can even attempt to walk it back.

Overall, the Fed faces a daunting communication challenge. Only two weeks ago, the market was begging for it to talk down yields and now some are calling for a tapering signal. That pendulum can swing quickly again.Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46