DUP in, Italy bailout, Qatar squeezed out

The UK Conservative Party has reached an agreement with the Democratic Unionists, helping it win support for Theresa May's minority government as the DUP gets an additional £1bn for Northern Ireland over the next two years.The geopolitical thermometer is quickly rising in the Middle East as Saudi Arabia squeezes Qatar with toughened demands in a development the oil market can't ignore forever. European bourses rally across the board after Italy led a 17 billion euro bailout to clean up two failed banks. US durables data is next. There are 8 Premium trades in progress; 4 in FX, 2 in indices & 2 in commodities.

On Friday, Saudi negotiators presented a list of 13 demands to Qatar including cutting relations with Iran, shuttering all media, reparations and closing a Turkish military base under construction. The demands came with a 10-day deadline to comply without mentioning the consequences of defiance. They strike us impossible to fulfill. Qatar has already responded that they are unjustified and Turkey said they're illegal.

Whether Saudi Arabia is more eager to test Qatar's resolve rather than easing the situation in the Gulf remains to be seen as new Crown Price Bin-Salman manoeuvers to further bolster his position in and out of the region. Others see more-dangerous motives.

There are no answers yet but the lack of a response in oil can't last. Crude has fallen nearly 20% in the past month and declined for five straight weeks. Qatar isn't a significant oil producer but a more assertive Saudi Arabia is a step towards direct or indirect confrontation with Iran and that's the ultimate possible buy-signal for oil.

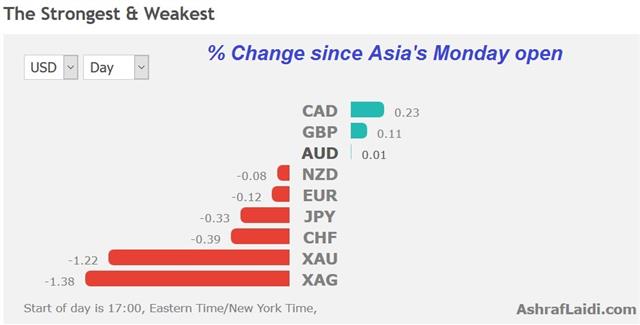

In addition, WTI and Brent are both near support at the November lows so shorts could be looking to cover anyway. If crude can get some momentum to the upside, the Canadian dollar is especially well positioned as it threatens to break out against USD and JPY.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +45K vs +79K prior GBP -38K vs -39K prior JPY -50K vs -51K prior CHF -3K vs -14K prior CAD -82K vs -88K prior AUD +15K vs -1K prior NZD +21K vs +1K prior

A portion of the euro bull gave up quickly after soft inflation data. There were hopes for a V-shaped reversal in ECB policy in the year ahead but there is increasing talk about a U-shaped shift if not a L-shaped one where rates stay at zero for years.

What also stands out is the rush into antipodean currencies, especially the kiwi. It had held a strong bid recently and the flood of specs helps to explain why.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Durable Goods Orders (m/m) | |||

| 0.4% | -0.5% | Jun 26 12:30 | |

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46