Fed Brushes Off Q1

The Fed brushed off a weak first quarter and that was seen as a signal that Yellen still intends to hike in June. The US dollar led the way while the Australian dollar lagged to a 3-month low. Australian trade balance and comments from Lowe are out next. The Premium long in GBPJPY was closed with a 205-pip gain as a tactical positioning trade ahead of the Fed and the French elections. 7 trades remain progress.

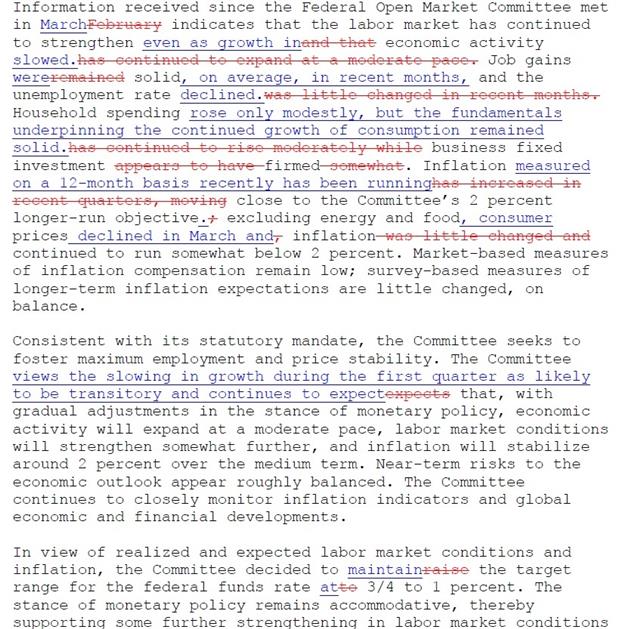

The Fed didn't offer anything new in the way of guidance in Wednesday's statement. The same 'gradual' language remained without committing to a timeline. But that's not how the market took it. The probability of a June hike rose to 93% from 70% after the statement. What the market latched onto was a line saying that the slowdown in Q1 growth was likely to be transitory. The assumption is that the Fed is brushing it off and still wants to hike in June. That may turn out to be true but not if data continues to miss. At 93%, it doesn't leave much room for error.

On the data front – at least on the soft data front – the Fed got some good news. The April ISM non-manufacturing index was at 57.5 vs 55.8 expected. In addition, the new orders component was at the best level in 11 years, jumping to 63.2 from 58.9. That will help convince the Fed that good growth is still right around the corner.

The other main release was ADP employment at 177K compared to 175K expected.

In the bigger picture, we're increasingly convinced that jobs growth and unemployment rates are nearly irrelevant to trading. Yesterday's New Zealand jobs numbers were extremely strong with unemployment falling to 4.9% from 5.2% a great jobs growth overall. The kiwi initially jumped 30 pips but was sold heavily for the remainder of the day in large part because wage growth was disappointing. Expect the market to have the same focus on wages in Friday's non-farm payrolls report.

The principal question is: Can a tight labour market still producer wage growth in a world of offshoring and automation?

The kiwi fell alongside AUD/USD which wiped out three days of gains and fell to the lowest since mid-January. Up next is the 0130 GMT trade balance report; it's expected to show a $A3.25m surplus.

The bigger potential market mover comes at 0310 GMT when Governor Lowe speaks on household debt, housing prices and resilience. That topic sounds ripe for hawkish comments but even if that's the case he will want to jawbone AUD lower at the same time.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance | |||

| 3.33B | 3.57B | May 04 1:30 | |

| ADP Employment Change | |||

| 177K | 178K | 255K | May 03 12:15 |

| RBA Gov Lowe Speaks | |||

| May 04 3:10 | |||

| Employment Change (q/q) | |||

| 1.2% | 0.8% | 0.7% | May 02 22:45 |

Latest IMTs

-

How I Nailed $5090oz

by Ashraf Laidi | Feb 4, 2026 11:44

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22

-

Warsh Odds Hit Metals

by Ashraf Laidi | Jan 30, 2026 10:56

-

Time Stamp تجزيء زمني للفيديو

by Ashraf Laidi | Jan 29, 2026 9:09