Gold Glows Ahead of US & Canada Jobs

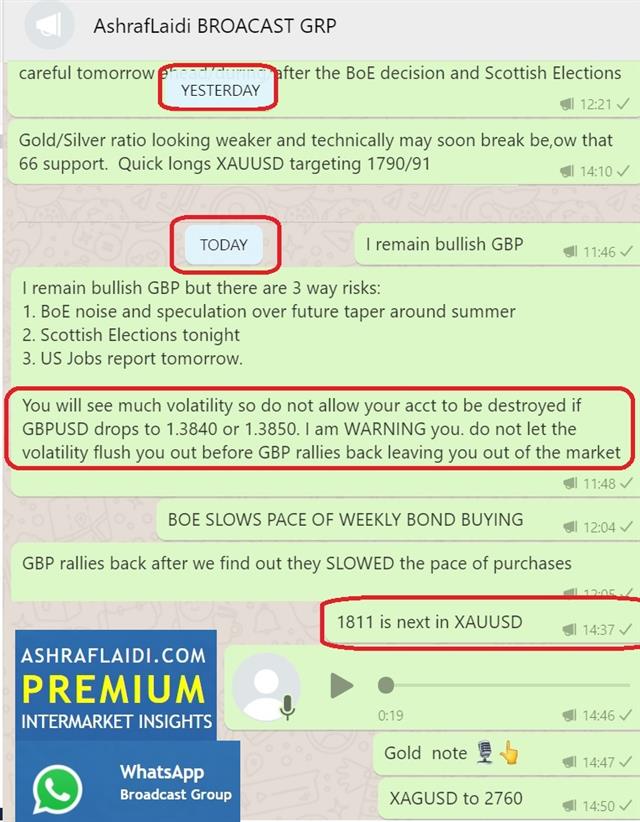

Cable traded in an 80 pip range in minutes after the BoE announcement as traders and algos were left confused by a statement that was more or less unchanged followed a minute later by the monetary policy report, which said the pace of QE purchases could be slowed somewhat. Cable initially dropped to 1.3858 then spiked to 1.3940 – both session extremes.

It was a communication mess, largely because Bailey was frightened (no other way to put it) to admit to anything like tightening or signal that it's on the horizon. There appears to be a strong school of thought outside of the Bank of Canada that markets and the economy can't handle any taper talk. Given the enormous improvements in the global economy, it's all getting a bit ridiculous.

Outgoing chief economist Andy Haldane dissented in favor of a real taper. His comments with it emphasize a different possible approach, noting that there's evidence of a rapidly recovery economy and good reason to believe it will be maintained.

The risk is that by being overly cautious, central bankers will fall behind the curve. A brighter outlook along with associated inflation risks are a big part of the gold recovery. It rose to the best levels since February on Thursday, rising $30 to $1815.

Further evidence of economic strength could come in jobs reports from the US and Canada up next. Non-farm payrolls are expected at exactly 1 million but digging through the estimates, there's a clear skew higher. There's every reason to believe there was massive hiring in April, notwithstanding the disappointing ADP print (it also underestimated March jobs by nearly half). Economists tend to get gun shy when predicting extremes so there's room for an upside reading, with some bolder economists calling for 2m jobs. The unemployment rate is expected to ease to 5.8% from the prior 6.0%, while average hourly earnings edging up to zero from -0.1%.

In Canada, it's a different picture as many parts of the country went in a tight lockdown in April that has continued. The consensus is between -150K & -160K. The loonie is trading at 4-year highs though, and is looking beyond this tough stretch, so this datapoint is likely to be ignored.Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46