Intraday Market Thoughts

Gold vs Oil Revisited

by

Nov 30, 2022 14:58

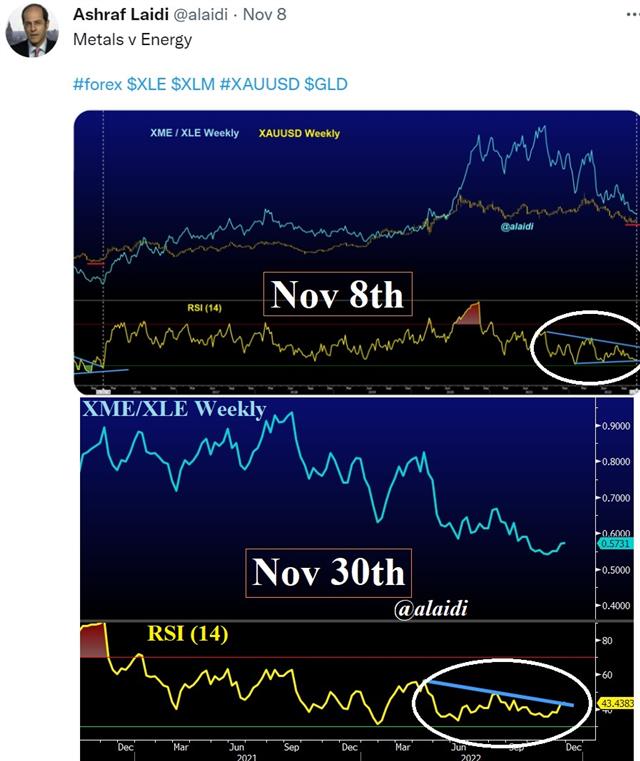

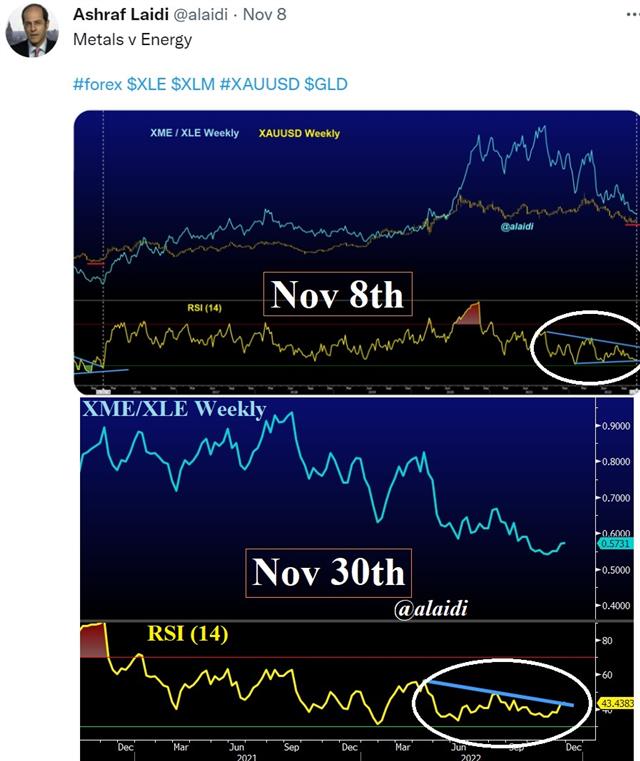

A lot has happened since I posted this XME/XLE chart from 3 weeks ago (click on this link and scroll down). Gold is a little stronger vs oil with XME/XLE ratio at 0.59 and the RSI is now testing the trendline resistance. As a reminder, XME is a major ETF for metals & mining stocks, while XLE is the biggest ETF for energy firms. Why am I mentioning this now? Metals (specifically gold) could further be boosted by the necessity for nations (especially oil-importers) to preserve the value of their monetary reserves against oil. Regardless of whether these nations are from the industrialized or less developed world, they must preserve their purchasing power of oil. See what Ghana agreed with the UAE about paying for their oil with gold in my tweet earlier this week. OPEC will be closely watching the ouctome of next week's EU discussions of the G7 price cap on Russian oil exports. Any prolonged decline in oil prices will see OPEC rushing to cut supplies, which would affirm the importance of stocking up on those few monetary/nonmonetary reserves that maintain their value relative to oil. And that would be no other than gold. Watch the RSI on XME/XLE.

Click To Enlarge

Latest IMTs

-

2x our Gains in 8 Weeks

by Ashraf Laidi | Feb 3, 2026 10:28

-

4500 and 72 Hit, now what?

by Ashraf Laidi | Feb 2, 2026 2:22

-

Warsh Odds Hit Metals

by Ashraf Laidi | Jan 30, 2026 10:56

-

Time Stamp تجزيء زمني للفيديو

by Ashraf Laidi | Jan 29, 2026 9:09

-

Trump Hits Dollar but Wait Bessent & Powell...

by Ashraf Laidi | Jan 28, 2026 11:47