Is the Worse of the Aussie Behind ?

The latest economic numbers in Australia point to a stunted economy but there are also signs this could be the bottom. In FX trading on the US Thanksgiving holiday, the dollar didn't get any love as it was the laggard on the day as the yen led the way. Japan's Oct CPI rose 0.3% y/y, beating expectations of 0.2% and previous 0.0%. The Premium Insights have two GBP trades ahead of Friday's release of UK Q3 GDP revision.

Yesterday's Australian capex numbers were the worst in 30 years of records. Private capital expenditures fell a whopping 9.2% compared to the -2.9% consensus. The immediate reaction was a 40-pip decline in AUD/USD but it's stabilized since.

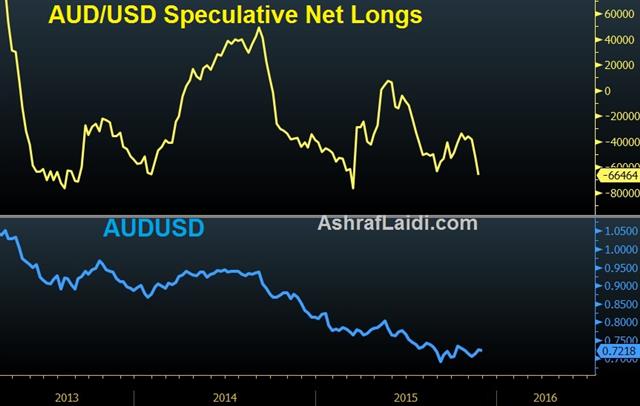

That's two poor readings for Q3 ahead of the RBA decision on Tuesday and GDP on Wednesday. What's impressive is that the market hasn't shuddered despite such scary numbers. If the Aussie can make it past the RBA and GDP without another push lower, it's a good sign that the worst is behind for the Aussie.

China and commodity prices will continue to be factors to watch but barring surprisingly weak news, the soft hands have probably already exited Australia. Once Q3 is in the rearview mirror, the RBA may look towards the middle of next year and an improvement in the non-mining sector of the economy.

Note that that in Sept/Oct/Nov there has been a series of higher lows in AUD/USD. The employment report was probably a mirage but AUD has been hit by some terrible news including 6-year lows in copper prices and the neverending decline in iron ore. We often ask: If something can't fall on bad news, why should it fall at all?

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Private Capital Expenditure (Q3) | |||

| -9.2% | -2.9% | -4.4% | Nov 26 0:30 |

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40