Charts Hesitant on Trade Narrative

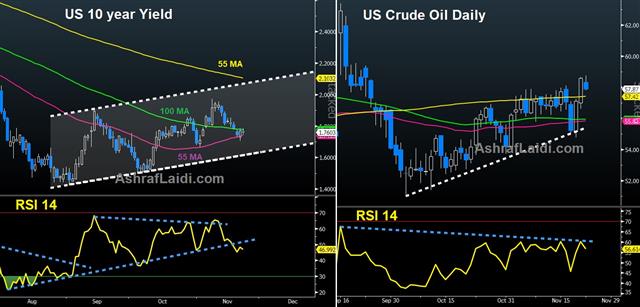

A number of reports pushed back on the negative trade narrative on Thursday but the source of the comments raises eyebrows. The Canadian dollar was the top performer while the Australian dollar lagged. UK services PMI fell back below 50, Canada retail sales fell by less than expected and US Nov manuf and services PMIs rose further above 50, further cementing expectations that Fed will hold rates over the next 3 months. Indices push hesitantly higher, but as Ashraf suggests in the charts be low, US crude's failure at 58.60s and USDCAD's rebound towards 1.3290s is raising doubts over the risk-on swings (more below).

Until today, the pattern in trade headlines over the past two days has been unmistakable --Statements from the US and US reporters has been pessimistic, while those from China have been upbeat, including remarks from president Xi that he wants to work out an initial deal. Pres Trump did reiterate today that a deal with China is close.

One possibility is that those closer to Trump are sensing his unwillingness to do a deal but at the same time Lighthizer and Mnuchin are stringing Beijing along in the hope that the President changes his mind. With regards to Congress' HK bill, Trump is expected to sign it into law, while making his intentions clear to Beijing that he wants a deal.

US dollar strength is gradually returning with stabilising equities, but overall market moves have been modest and that continues to be the case as we bounce from headline to headline.

One mover Thursday was the Canadian dollar as it got a double tailwind from a two-month high in WTI crude (in an impressive reversal) and comments from Poloz that poured cold water on building rate cut expectations. The odds of a BoC 25 bps cut in December hit 25% on Tuesday after Wilkins said there was room to maneuver on rates if needed but Poloz pushed back saying that rates were 'in a good place'. USD/CAD fell to 1.3270 from 1.3320.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash PMI Manufacturing | |||

| 48.3 | 48.8 | 49.6 | Nov 22 9:30 |

| Flash Manufacturing PMI | |||

| 52.2 | 51.5 | 51.3 | Nov 22 14:45 |

| Core Retail Sales (m/m) | |||

| 0.2% | -0.1% | -0.1% | Nov 22 13:30 |

Latest IMTs

-

How I Grew the Account 5x

by Ashraf Laidi | Mar 2, 2026 11:54

-

Breakout to 2 Month Highs

by Ashraf Laidi | Feb 27, 2026 12:12

-

Grow an Account 5x

by Ashraf Laidi | Feb 26, 2026 14:36

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21