Tax Titillation Drives Dollar

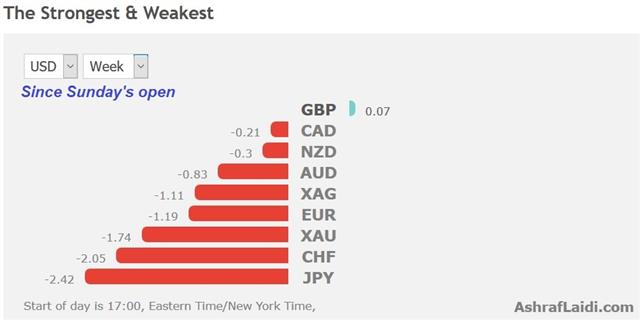

There are few things a market likes more than a tax cut but that's what was dangled on Wednesday and the US dollar bulls bit hard. USD was the top performer again while the New Zealand dollar and euro lagged. Interestingly, US stocks were muted. Australian employment and Chinese industrial production are due up next. A new USD trade has been posted ahead of a busy 2 days of BoE decision (MPC minutes, US CPI and retail sales).

The great promise of the Republican win 10 months ago was a tax cut, but the market lost faith after the Obamacare repeal failure general disarray the White House. The dollar suffered as a result.

Hope wasn't lost. Mnuchin and Cohn have been quietly working on the details and now the effort has begun. Trump's across-the-aisle efforts to raise the debt ceiling have some thinking the equation has changed. He will meet with top Democrats for dinner later today where he will talk more about tax reform. The aim is to have a plan ready for September 25 and a report today said Trump was insistent on a 15% corporate tax rate.

That talk kept the US dollar momentum going as it rose to 110.69 against the yen and sent EUR/USD below 1.1900. Along with soft UK wage data, the strong dollar also helped to retrace all the cable gains from Tuesday. At the moment, a tax break is the best hope for a sustained dollar rebound. It will be a treacherous path but we will be watching closely.

On the near-term calendar is a speech from the RBA's Debelle at 2315 GMT but the main event comes at 0130 GMT with Australian jobs for August. The market isn't sure which way the RBA is going to go but a beat on the +20.0K would make it easier for the RBA to embrace a hawkish bias.

Continued strong signs from China would also be welcome. August industrial production is expected to rise a solid 6.6% y/y with retail sales up 10.5% y/y. That split shows how China is successfully shifting to a consumer-led economy, at least so far.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (y/y) | |||

| 6.6% | 6.4% | Sep 14 2:00 | |

| RBA Assist Gov Debelle Speaks | |||

| Sep 13 23:15 | |||

| Employment Change | |||

| 17.5K | 27.9K | Sep 14 1:30 | |

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46