Intraday Market Thoughts

VVIX VIX Inflection

by

Apr 29, 2022 12:52

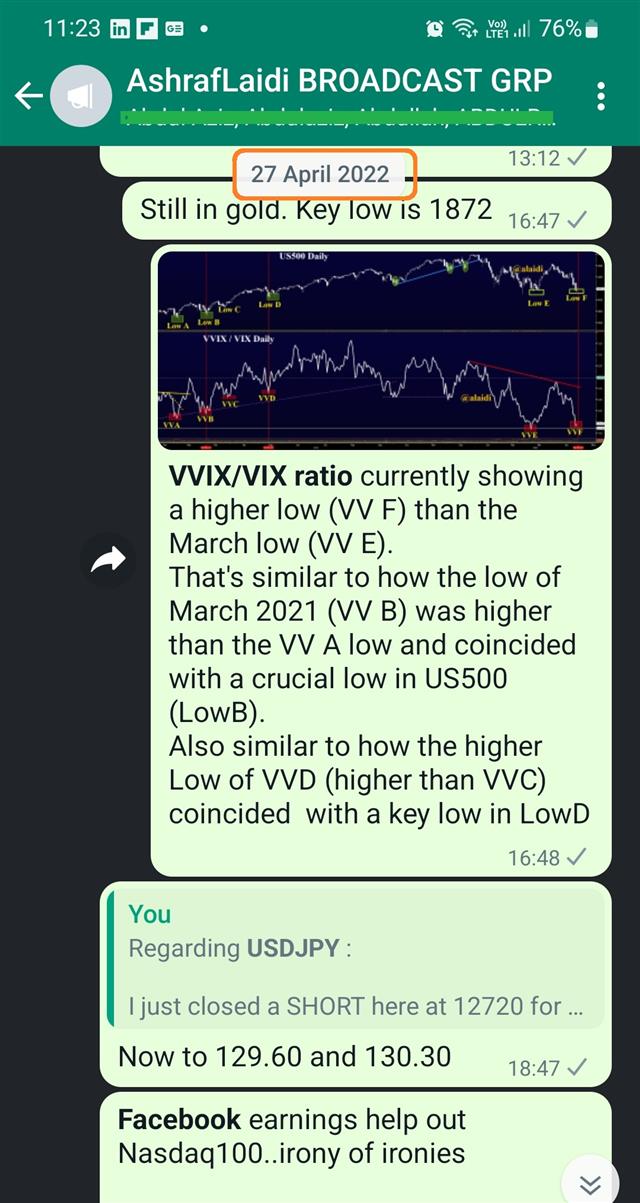

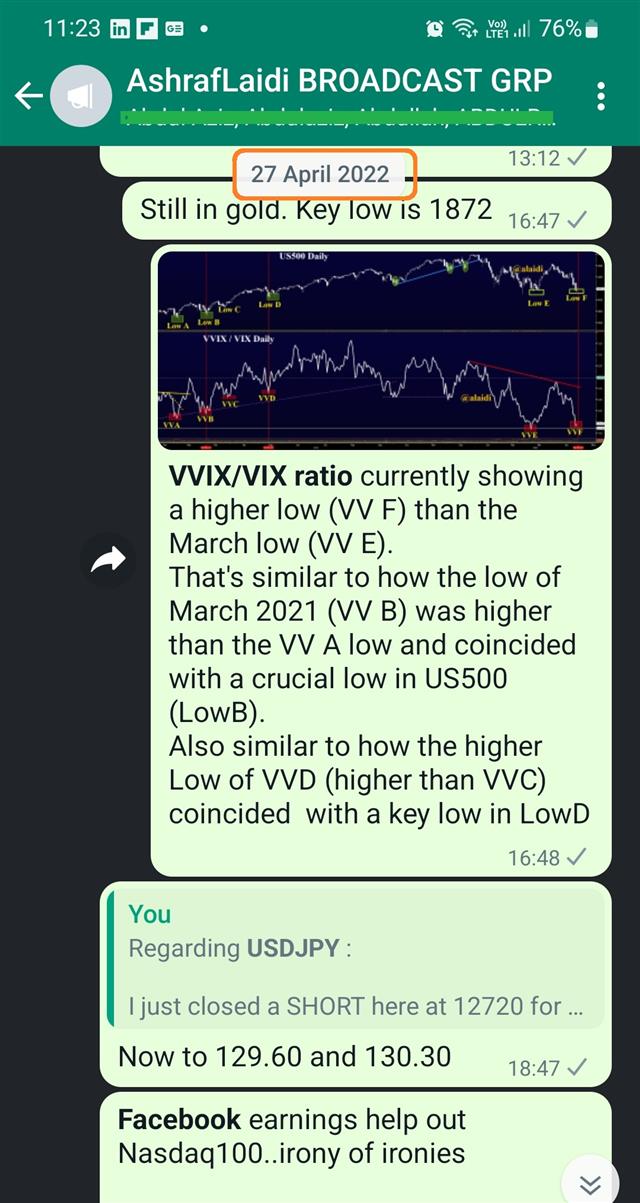

What's the point of using fancy indicators ratios such as the VVIX/VIX ratio, when you can simply use the VIX, or the S&P itself? You know that I'm a fan of using the VVIX/VIX ratio in helping me spot inflection points in indices, particularly the S&P500 index. Here's an instructional video on using the VVIX/VIX ratio. Two days ago, I sent the below chart below to our WhatsApp Broadcast Group, in pointing out that stabilizing bearishness in indices will transition to gradual upside ahead.

Click To Enlarge

As the WhatsApp snapshot shows, the idea is to observe the higher lows in the VVIX/VIX index. This means the VVF low from this week is higher than the VVE low of mid-March. This is similar to the lows in March and May of 2021, when VVB and VVD coincided with crucial bottoms in LowB and LowD respectively.

For a detailed overview on how to use the VVIX/VIX, watch this video.

Tying the fundamental rationale to the aforementioned thesis, could be supported by Beijing's latest vow to stimulate the economy ahead of May Day Holiday, a dovish 50-bp rate hike from the Fed and propagation of forward-looking optimism by Apple and Meta Platforms.

Click To Enlarge

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46