Whale Watching

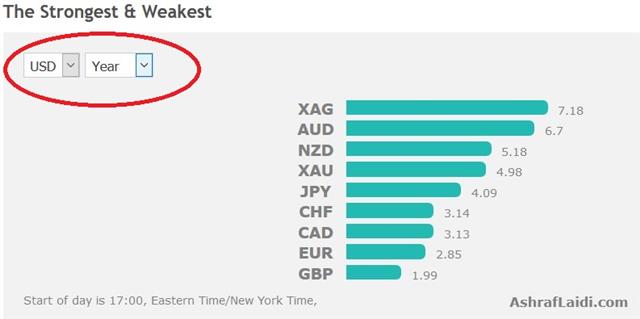

Trading daily is like fishing. You survey the scene and the weather, fish where it's best and catch a few pips. Sometimes they're large fish, sometimes they're small fish and sometimes there are no fish at all. There are 6 Premium trades currently in progress ahead of Friday's US jobs report: 3 in FX, 2 in indices and 1 in metals. The chart below shows the strongest and weakest vs the USD Year-to-Date.

Once in a while something completely different comes onto the fishing radar or nibbles at the hook. Something you might only see a few times in a lifetime – a whale. There is one circling now. Of course, there are always whales in the ocean and in the markets. They're huge trades that last years and the hauls are legendary. Identifying and catching them is a different game than the day-to-day trade but it's possible.

Trump himself isn't a whale but he is stirring up the entire ocean of trading and a whale of Moby Dick proportions might be surfacing. It's the official strong dollar policy of the United States. It's been the policy of the Treasury Department for a generation and markets are vastly underestimating the risk it will be eliminated and the potential rewards of trading it.

This week, Trump came within a stutter of saying he is going to weaken the dollar; or at least go to a currency war with others who have weakened their currencies.

A weak dollar would be a panacea. It could mean higher stock markets, higher inflation, higher nominal growth, higher wages and more competitiveness. Jawboning alone would do much of his work and it could be followed up with a Yellen replacement next year to do the heavy lifting. The FX winners in such a war would be the yen and euro. Both would struggle to find ammunition to fight back. An even bigger winner would be gold. It might be tomorrow, two months from now or two weeks from now but the weak-dollar whale is one we want to be ready to catch.

And as Ashraf reminds me, FX & politics will shift to the France elections and when/if Republican presidential candidate Francois Fillon officially drops out of the race. He was long considered as ideally euro-positive due to his stance on free market reforms.

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46