GBP Getting Best of Down Under

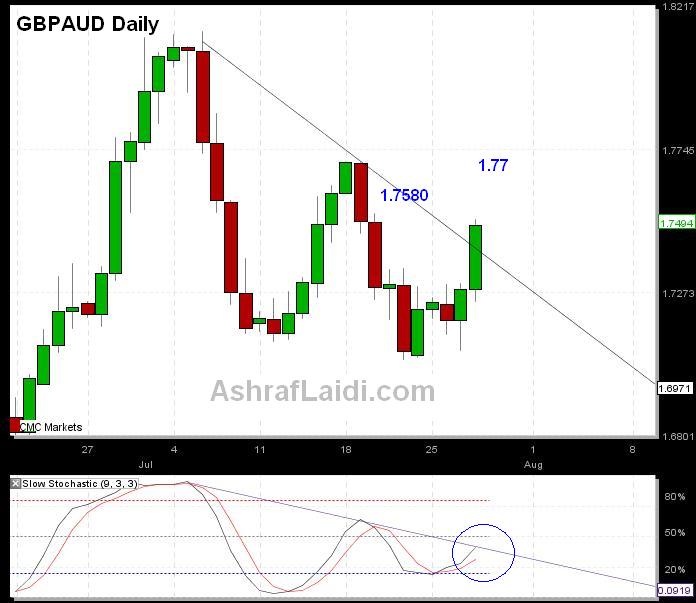

GBPAUD reflects contrasting expectations for the RBA and BoE, with the former expected to keep rates on hold due to softer than expected inflation and the latter seeing better reasons to listen to its hawkish members. Today marked the first time since July 2009 where GBP does NOT fall following Mervyn Kings testimony. With AUDUSD quickly FALLING back below its 200-day MA and GBPUSD RISING above its 200-day MA for the first time since Jan, the preferred play is favouring GBPAUD, especially that any GBPUSD longs from here may face resistance in the event of any sharp risk aversion. Since we know that AUD is the reliable victim of risk aversion, it is best to sell it vs. a currency whose fundamentals are neutral-to-positive. Having simultaneously broken above 200-day and 55-day MA today, GBPAUD eyes interim target at 1.7580s, followed by 1.77. While my bias remains firmly in favour of EURAUD, GBPAUD is an attractive alternative considering my negative positioning on EURGB. A a break below 1.72s merits scrutiny from the longs, while a close below 1.6980s is a red flag.

More Hot-Charts

-

Mystery Charts

Feb 5, 2026 20:48 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

2hr Gold Chart

Feb 3, 2026 13:09 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold Net Longs

Feb 2, 2026 17:16 | by Ashraf LaidiI really dislike after-the-fact analysis, but looking at this chart of Gold speculative net longs at the Comex, it shows speculators began lightening their longs on Jan 23.