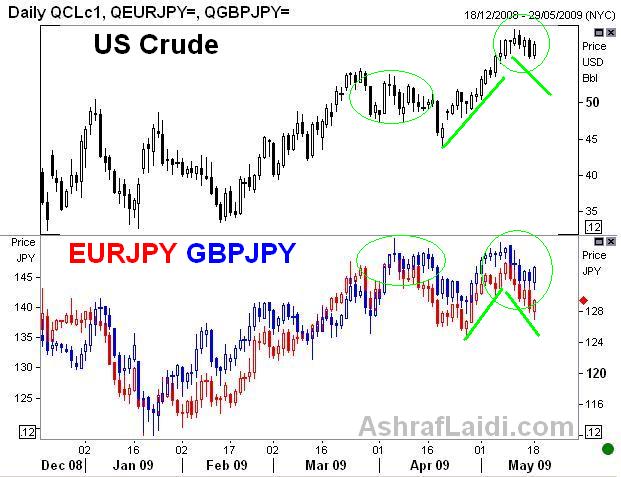

Oil & Yen pairs

Oil's prior rally largely coincided with the recent gains in equities and a resulting sell-off in the yen. Any deepening retreat in global risk appetite is expected to further weigh on the pullback in oil prices. Our case for lower prices has already been made by touching upon the Gold/Oil ratio. Fridays report from the IEA forecasting a 3% decline in 2009 global oil from 2008 (bgigest since '81) also added to the selling. With prices seen capped at $58.90, prospects for any substantial yen declines remain limited. GBPJPY is likely to face increased initial selling pressure at 148.70, while EURJPY remains capped at 131.80. Currently, EURJPY faces more downside than GBPJP, but do watch EURGBP for clues of a recovery.

More Hot-Charts

-

Gold Next Move

Dec 26, 2025 15:32 | by Ashraf LaidiWill send detailed note on latest parameters to our WhatsApp Bdcst Group - سأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - .. -

EURGBP & Bank of England

Dec 17, 2025 19:24 | by Ashraf LaidiToday's weaker than expected UK CPI sharply boosted EURGBP and dragged down GBPUSD on improved expectations the BoE will cut rates tomorrow (Thursday). -

Indices & Gold Update

Dec 16, 2025 12:16 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group...