Intraday Market Thoughts

2020: From Highs to Higher Highs

by

Dec 31, 2020 18:18

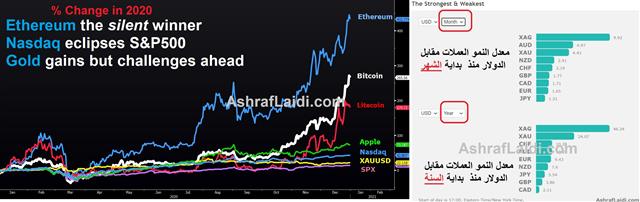

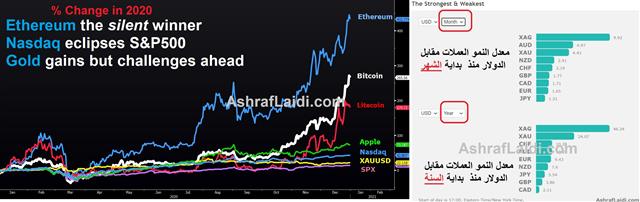

2020 -- The year of tumult and volatility -- ending the same way it began in terms of record highs in asset prices, but deeply different in terms of economic growth. Vaccines are gradually emerging worldwide along a rapid surge in Covid-19 related cases and deaths. The 12% decline in the US dollar prompted a much-needed rebound in energy prices and a fresh surge in industrial metals. Gold and silver both closed markedly higher-albeit below their summer highs as bond yields could present some competition ahead. The Medical-Quantitative-Easing of vaccine should undoubtedly swell indices to new heights. But will stocks be accompanied by a boost in nominal yields as well as real yields? If inflation fails to keep up with rising yields, then gold and silver may sustain fresh downside—or at least extend into a choppy path. Copper has come off its highs and may even suggest a modest head-&-shoulder formation. Bitcoin and Ethereum end 2020 in much the same way they ended 2017, but the combination of accelerating levels of institutional money and tempered level of speculative mania from retail promises further upside ahead. We thank our readers and followers for all your support and wish you a happy, safe and healthy New Year ahead.

Click To Enlarge

Latest IMTs

-

Avoid Yen Intervention Trap

by Ashraf Laidi | Jan 17, 2026 11:20

-

Winners & Losers

by Ashraf Laidi | Jan 15, 2026 16:22

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jan 15, 2026 13:55

-

Update on Gold & Silver after USSC

by Ashraf Laidi | Jan 14, 2026 19:54

-

Gold Channel Intact

by Ashraf Laidi | Jan 12, 2026 20:58