Intraday Market Thoughts

Back to the GoldBugs Ratio

by

Mar 1, 2022 22:38

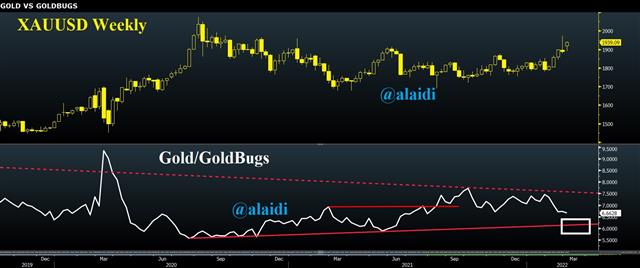

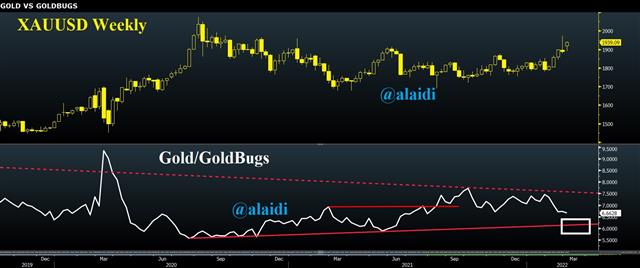

As you debate whether to take funds from your underperforming altcoins and place them in gold miners or ETFs, you take a look at the latest Bitcoin chart and decide against it. So you freeze. What to do? Do you finally realize that 60% portfolio loss in your tech stocks and re-allocate it to energy, metals or cryptos? The chart below shows how gold is generally inversely correlated with Gold/miners, aka the GoldBugs ratio. How can it help you?

Click To Enlarge

As gold rises along gold stocks (metals and miners), the latter tends to rise faster relative to bullion. I've shown in past youtube video how to use the relationship (specifically in 6:47 mins of this video)

With the goldbugs ratio in the lower panel suggesting further declines towards the 6.0 trendline support, it could argue for $2000 as early as this quarter. And it so appears that we're well on our way of getting ride of that 2013/14 fractal of horror as affirmed last week in here. Let's see what Biden/Powell have to say before buying any gold dips.

Latest IMTs

-

Gold Bear or Correction

by Ashraf Laidi | Oct 23, 2025 9:51

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33