Fed Hikes, Dollar Likes

The Fed didn't take quite the gradual, wait-and-see approach that many market watchers envisioned. Only the Australian dollar outperformed the US dollar on the day while the yen was the laggard. Data released in Japan shows the perils of competitive FX devaluation. In Ashraf's Premium Insights, a new EURUSD trade was issued, while the GBPNZD trade was closed with a 385-pip gain. Six trades are now in progress.

After the Hike

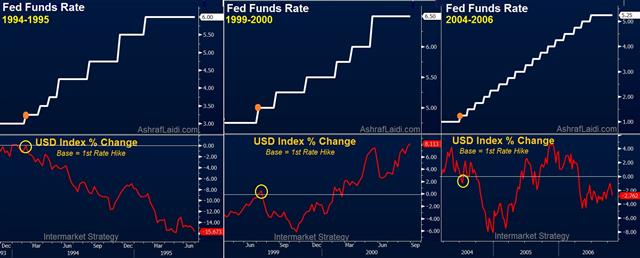

Fed Chair Yellen reverted to a data dependent approach for further hikes but there were signs that officials might be more eager than markets had anticipated. Heading into the meeting, the rates market expected about 2 hikes in 2016. Yellen certainly sounded like she could hike again towards the end of Q1. If growth in the first few months of the year skews higher, possibly due to good weather, the Fed might be lured into prematurely hiking in March and June.The Fed also had the opportunity to tone down hawkish expectations by lowering the dot plot, but the median estimate for 1.375% rates at this time next year – four more hikes-- was held intact. That's what helped to boost the US dollar after the decision and into Asia-Pacific trading.

We warn that dollar longs remain a crowded trade and with year-end looming, a round of profit taking is a high risk.

The other major risk in the day ahead is the implementation of the hike . There are five things to watch. 1) 6:45 am ET on Thursday - The Libor fix 2) 8 am ET - Repo rates will begin to update 3) 9:30 am ET - Rates on commercial paper trade 4) 1:15 pm ET - The NY Fed announces the results of its first overnight reverse repo 5) 8 am ET on Friday - The first post-hike Fed funds effective rate is announced

Dark corners of the internet have long predicted the Fed would struggle on implementation. The Fed should probably be given a few days to smooth out the kinks but markets may have a kneejerk reaction on any signs of stress. We expect the Fed to win out so any overreactions should be faded.

An outlier theme in 2016 might be the inability of countries with weaker currencies to boost exports. Japan reported a smaller trade deficit today but it came on a 10.3% drop in imports. Exports fell 3.3% y/y compared to 1.6% expected. A softer yen might prove not to be the tonic Abe hoped and that may dissuade the BOJ from easing more.

Latest IMTs

-

NFP & CPI Credibility

by Ashraf Laidi | Aug 11, 2025 16:35

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33

-

Recession Metric & Tariff Marsh

by Ashraf Laidi | May 26, 2025 13:47