From Eurozone CPI to US PCE

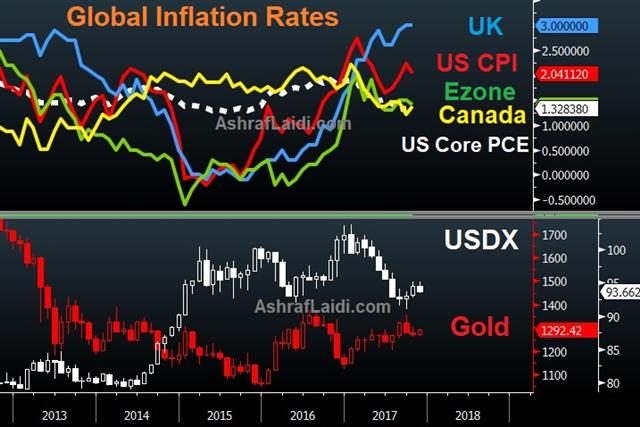

Aside from the news of Bitcoin rocketing to $11,434 before plunging back to $9007, markets are focusing on GBP's prolonged gains, boosted by talk of an pending deal on the Brexit bill and resolution on the Irish border. Markets turn next to US October core PCE index, the Fed's favourite inflation gauge, expected +1.4% from 1.3%. Earlier, Eurozone preliminary Nov CPI rose to 1.5% from 1.4%, undershooting expectations of 1.6%. The Premium Insights service took 150-pip gain in GBPUSD. A new trade will be posted before start of the US opening bell.

Bitcoin was gripped by the FOMO phase over the past month and that led to an incredible run that attracted more and more buying. It continued through $10,000 on Wednesday until a wave of profit taking turned into a 20% correction over the course of a few hours. Later, it rebounded to $10,200 but some exchanges were having difficulty.

The volatility created a massive indecisive candle on the chart and that could be a warning sign. However, all the attention and volatility hasn't been a negative up to this point so it's no reason to expect a drop just yet.

In financial markets, the main story on the day was a rise in global bond yields. German and US 10-year yields rose 5-6 bps and that was a reason to buy yen crosses. USD/JPY rebounded for the second day and hit 112.00. The gains came after some upbeat comments from Fed Chair Yellen. She said growth was becoming more broad based. The second look at Q3 GDP was also revised to +3.3% from +3.2% in part due to strong business investment.

The most-solid trend at the moment in FX is sterling's climb. It's risen in 10 of the past 12 sessions and is trading at the best since Oct 2. Ashraf pointed out in the video that the 7 consecutive daily gains were the longest string of advances since April 2015. Signs of progress on Brexit negotiations continue to mount and that's helping the pound to rebound from depressed levels.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone CPI Flash Estimate (y/y) | |||

| 1.5% | 1.6% | 1.4% | Nov 30 10:00 |

| Prelim GDP (q/q) [P] | |||

| 3.3% | 3.3% | 3.0% | Nov 29 13:30 |

Latest IMTs

-

Gold Enters Week 9

by Ashraf Laidi | Oct 13, 2025 10:39

-

Gold Wave 3 تحديث موجات الذهب

by Ashraf Laidi | Sep 18, 2025 16:19

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jun 18, 2025 10:55

-

Updating GoldBugs تحديث مناجم الذهب

by Ashraf Laidi | Jun 16, 2025 13:58

-

Breaking Debt Ceiling & Forex Brokers

by Ashraf Laidi | Jun 6, 2025 17:33